Overview of Operations: Power Products and Other Products - Annual Report 2016

Evolution of Yamaha Motor's industrial-use unmmaned helicopters

Overview of Operations

Power Products and Other Products

Aiming to expand our uniquely Yamaha robotics business

Toshizumi Kato

Director and Managing Executive Officer

Chief General Manager of Vehicle & Solution Business Operations

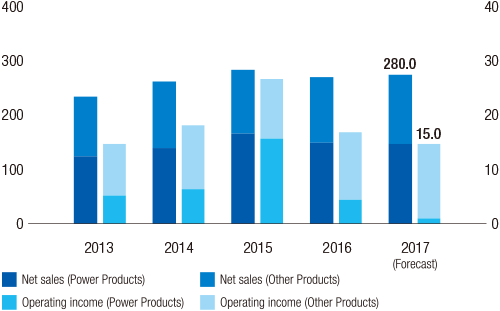

Net sales and operating income

(Billion \)(Billion \)

Operating environment and areas of focus under the Medium-Term Management Plan

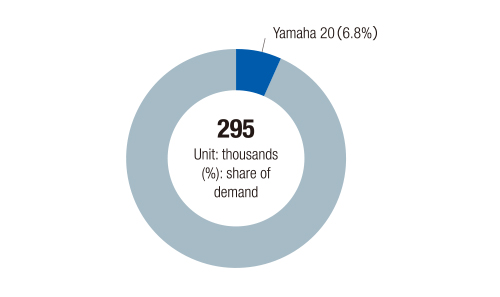

The ROV market is expanding beyond its commercial uses of agriculture and dairy farming to encompass a wide range of applications and terrains, including leisure use in mountain forests, deserts, and rugged mountains. In 2017, we are forecasting a decline in retail sales as we work to trim inventories of existing models and shift to new platform models, with the aim of restoring to normal operations from 2018. In the IM business, our aim is to strengthen our profit structure even further on the back of increasing sales of high-value-added products including high-speed, multi-function surface mounters and integrated control robot systems. The PAS business will work to broaden its customer base globally through increased exports of E-kits (drive units for electrically power assisted bicycles) to Europe.

| 2016 Result | 2017 Forecast | |

|---|---|---|

| Net sales | \275.5 billion | \280.0 billion |

| Operating income | \17.2 billion | \15.0 billion |

FY2016 North American demand and Yamaha Motor unit sales of ROVs

Note: Yamaha Motor surveys

Appraisal of 2016 results

The power products and other businesses progressed toward their goal of creating a unique business model. Net sales declined \13.8 billion (4.8%) from the previous year, to \275.5 billion, and operating income decreased \10.0 billion (36.6%), to \17.2 billion. Both net sales and the operating income margin rose in the IM and PAS businesses, but higher expenses as a result of production adjustments in the ROV business, and the impact of the exchange rate led to a decline in sales and profit in the business as a whole.

For long-term growth

The power products and other businesses are developing uniquely Yamaha robotics businesses that operate on land, in the sea, and in the air. The robotics industry is expected to grow significantly. Currently, the majority of the industry operates in the factory automation sector, but going forward, growth is expected in outdoor sectors such as unmanned operations in agriculture and other industries and self-driving vehicles, as well as in indoor sectors such as nursing care and home automation.

Yamaha Motor’s strengths lie in its modes of mobility, including industrial-use unmanned helicopters, recreational vehicles, and golf cars, and we believe that we can become a pioneer in terms of robotics in these areas.

During 2017, we will work to grow our surface mounters for the existing factory automation field, while also stepping up our efforts in areas including the crop dusting business for vineyards in California using industrial-use unmanned helicopters, and self-driving testing for golf cars. In addition, we will lay the path for future growth by accelerating our development of motor and battery technologies, our development of software, applications, and business models for automated controls, collaboration with outside parties, and our efforts to identify, retain, and cultivate top-tier engineers.