Interview with the president - Annual Report 2016

President Yanagi's analysis of fiscal 2016 and beyond

A Unique Company That Continues to Achieve Dynamic Milestones

The Yamaha Motor Group has been operating under its new Medium-Term Management Plan since 2016. This plan charts a course for new growth with the aim of being a unique company that continues to achieve dynamic milestones and lives up to our “Revs your Heart” slogan.

Hiroyuki Yanagi

President, Chief Executive Officer and Representative Director,

Yamaha Motor Co., Ltd.

Q1Please give us an overview of business results for fiscal 2016.

We maintained stable profits despite the impact of the exchange rate.

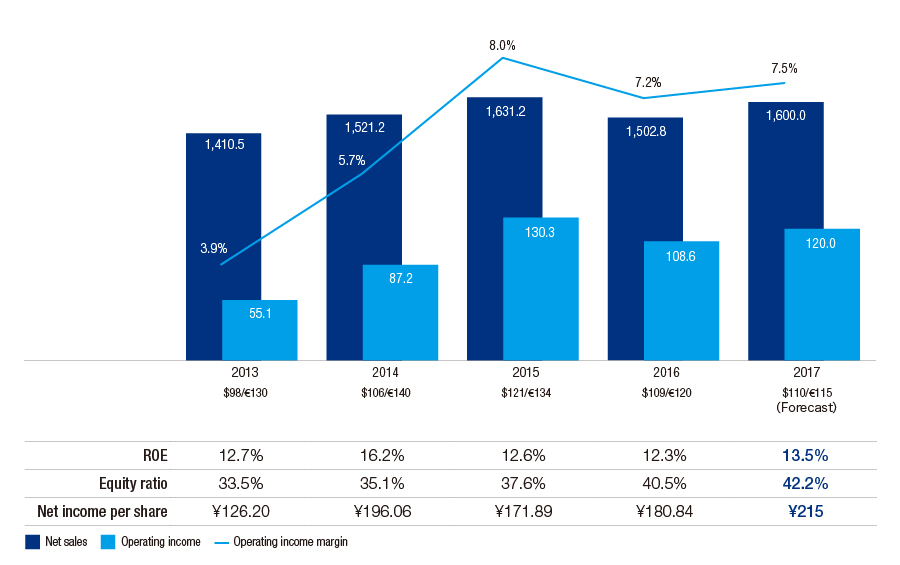

Net sales for the fiscal year ended December 31, 2016, declined ¥128.3 billion, or 7.9%, from the previous year, to ¥1,502.8 billion, and operating income was ¥21.7 billion, or 16.7%, lower at ¥108.6 billion. Excluding the impact of the exchange rate,* net sales rose ¥29.3 billion, or 1.8%, and operating income increased ¥22.1 billion, or 16.9%. Increased sales of higher-priced products, and cost reductions from the development of platform models and global models, and from production methods such as theoretical-value-based production, contributed to improvements in profitability.

*Exchange rates for 2016 were ¥109/USD (a ¥12 appreciation compared with the previous year) and ¥120/euro (a ¥14 appreciation)

Net sales/Operating income/Operating income margin

(Billion ¥)

Q2What progress has been made under the Medium-Term Management Plan?

We have been working to provide new, uniquely Yamaha products, and to build a uniquely Yamaha business model.

The motorcycle business has succeeded in cultivating a new “sports commuter” market in the ASEAN region. The expansion in sales of sports commuter models manufactured in Japan and in ASEAN, and of racing models in Europe and the United States, has made it possible to create a business model with higher profitability while offering new, uniquely Yamaha products to customers around the world.

In 2016, the marine products business embarked on competing in the 3-trillion-yen global marine market. Along with expanding its lineup of boat control systems and other system products, the business is strengthening its alliances with boat builders to move beyond being an engine supplier, to a system supplier.

The power products and other businesses are developing new products that emphasize high added value to differentiate Yamaha’s products, with the aim of creating a unique business model.

We are aiming for ROE of 15% while enhancing

the stability of our financial position.

Q3What is Yamaha Motor’s financial strategy?

We are aiming for ROE of 15% while enhancing the stability of our financial position.

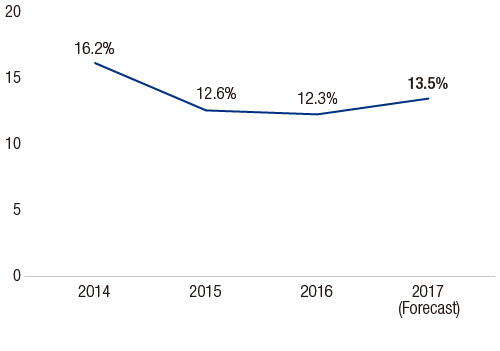

Under the current Medium-Term Management Plan, we are positioning ROE as an important indicator. In 2016, ROE was 12.3%, but we are forecasting a 1.2 percentage-point increase in 2017, to 13.5%. Going forward, we will target an ROE of 15% while enhancing the stability of our financial position.

In terms of cash flow management, during 2016 we implemented various measures contained in the Medium-Term Management Plan, and maintained stable profitability by reducing inventories and other working capital. As a result, we generated

a robust positive cash flow. During 2017, we will continue to maintain stable profitability while flexibly investing for future growth.

Targeting shareholders’ equity of over ¥500 billion and ROE of 15%.

ROE

(%)

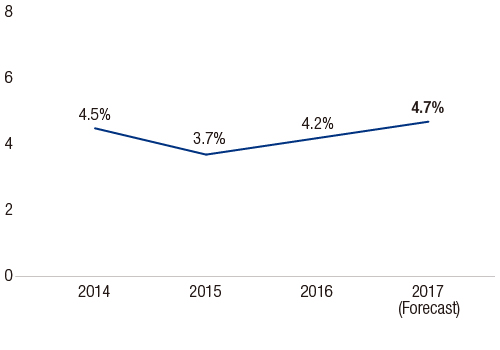

Ratio of profit attributable to owners of parent to net sales

(%)

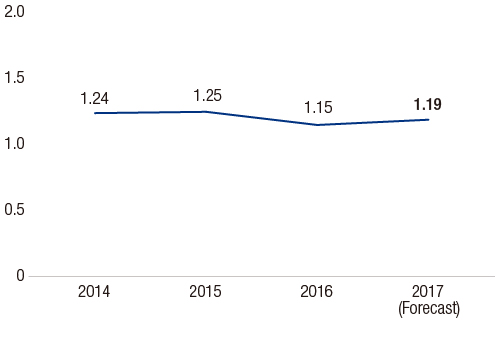

Total asset turnover

(Times)

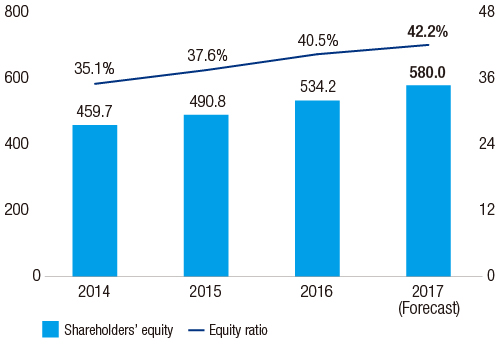

Shareholders’ equity/Equity ratio

(Billion ¥)

Q4Please tell us about Yamaha Motor’s capital expenditures and research and development.

We are proactively investing in equipment and in research and development to realize our growth strategies.

The current Medium-Term Management Plan allocates ¥130.0 billion over three years for flexible investment in new growth strategies.

Under the Plan, capital expenditures for existing businesses is set at ¥180.0 billion, the same level as in the previous Medium-Term Management Plan, and investment for new growth strategies is ¥60.0 billion, for a total of ¥240.0 billion. R&D expenses are set at ¥280.0 billion for existing businesses and ¥70.0 billion for growth strategies, for a total of ¥350.0 billion. We will implement our growth strategies along these lines.

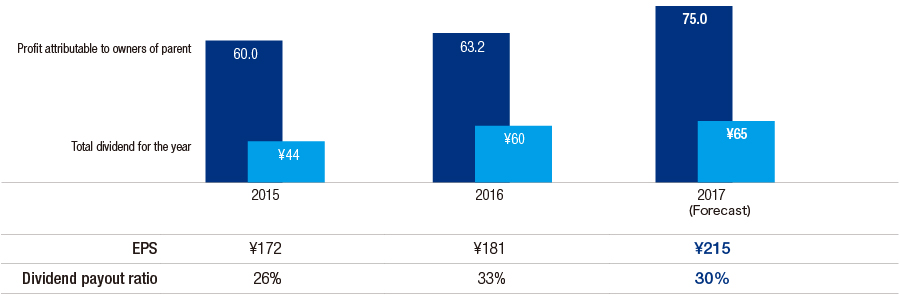

Q5What are your plans and policy for returns to shareholders?

We are targeting a dividend payout ratio of 30%.

Our dividend policy under the Medium-Term Management Plan is for a dividend payout ratio of 30% of profit attributable to owners of parent. Under this policy, we paid a year-end dividend of ¥30 per share for 2016. Combined with the interim dividend of ¥30 per share, this resulted in a full-year dividend of ¥60, for a payout ratio of 33% and a dividend increase for the fourth consecutive year.

Returns to Shareholders

Toward dividend payout ratio of 30% and fifth consecutive year of dividend increases

2016: ¥60 (actual); 2017: ¥65 (forecast)

Profit attributable to owners of parent/Total dividend for the year

(Billion ¥/¥)

I hope to deliver new, uniquely

Yamaha products to people all

over the world and share a

variety of exceptional value

and experiences that enrich

the lives of everyone.

Q6What are your thoughts regarding corporate governance and CSR?

We will fulfill our responsibilities to shareholders, investors, and all stakeholders.

To ensure the steady implementation of our growth strategies for the future, Yamaha Motor’s Board of Directors strives to create an environment that supports management’s appropriate risk-taking and resolute decision-making. At the same time, the Board strives to multilaterally understand and appropriately oversee issues and risks associated with the implementation of management strategies from the viewpoint of fulfilling responsibilities to various stakeholders including shareholders and investors.

In addition, we strive to contribute to the sustainable development of society through our business activities based on our corporate philosophy and to always abide by the letter and spirit of domestic and international laws and regulations. We are dedicated to earning the trust of the global community, and we place great value on communication with all stakeholders.

Q7Do you have a message for our stakeholders?

I hope to share exceptional value and experiences that enrich the lives of all stakeholders.

Yamaha Motor strives to create diverse value through Monozukuri,* with the goal of being a Kando Creating Company that offers new excitement and a more fulfilling life for people all over the world. Every employee of the Yamaha Motor Group is embracing a spirit of challenge in order to achieve the targets set in the Medium-Term Management Plan and for the Group to be a unique company that continues to achieve dynamic milestones. In the spirit of our “Revs your Heart” brand slogan, I hope to share exceptional value and experiences that enrich the lives of all stakeholders. I ask for your continued support.

*An approach to engineering, manufacturing and marketing products that emphasizes craftsmanship and excellence