Consolidated Business Results Summary - First Nine Months of Fiscal Year Ending December 31, 2023 -

November 7, 2023

Consolidated Business Results

IWATA, November 7, 2023 - Yamaha Motor Co., Ltd. (Tokyo: 7272) announces its consolidated business results for the first nine months of fiscal 2023.

From HIDAKA, Yoshihiro

President, Chief Executive Officer and Representative Director

I am happy to share that we set new records for net sales and incomes in the third quarter of fiscal 2023. We had increased shipments of motorcycles and large outboard models in our core motorcycle and Marine Product businesses, but the Robotics business continues to struggle significantly due to the sluggish Chinese economy. As for the market situation at the moment, demand for motorcycles in emerging markets continues to recover-albeit to varying degrees depending on the country-and demand for large outboard motors remains firm. On the other hand, the market inventory adjustments for eBikes in the SPV business will likely be lengthy. The robotics market also seems to have bottomed out. While we carry on our efforts to keep expenses under control with carefully targeted spending, we will make steadfast investments into new technologies and accelerate our growth toward the future. Also, at the Board of Directors meeting held today, the Company resolved to carry out a 3-for-1 stock split of our common stock with a record date of December 31, 2023. By lowering the price per share of Yamaha Motor stock, we intend to create an environment conducive to investment and expand our base of investors.

Consolidated Business Results

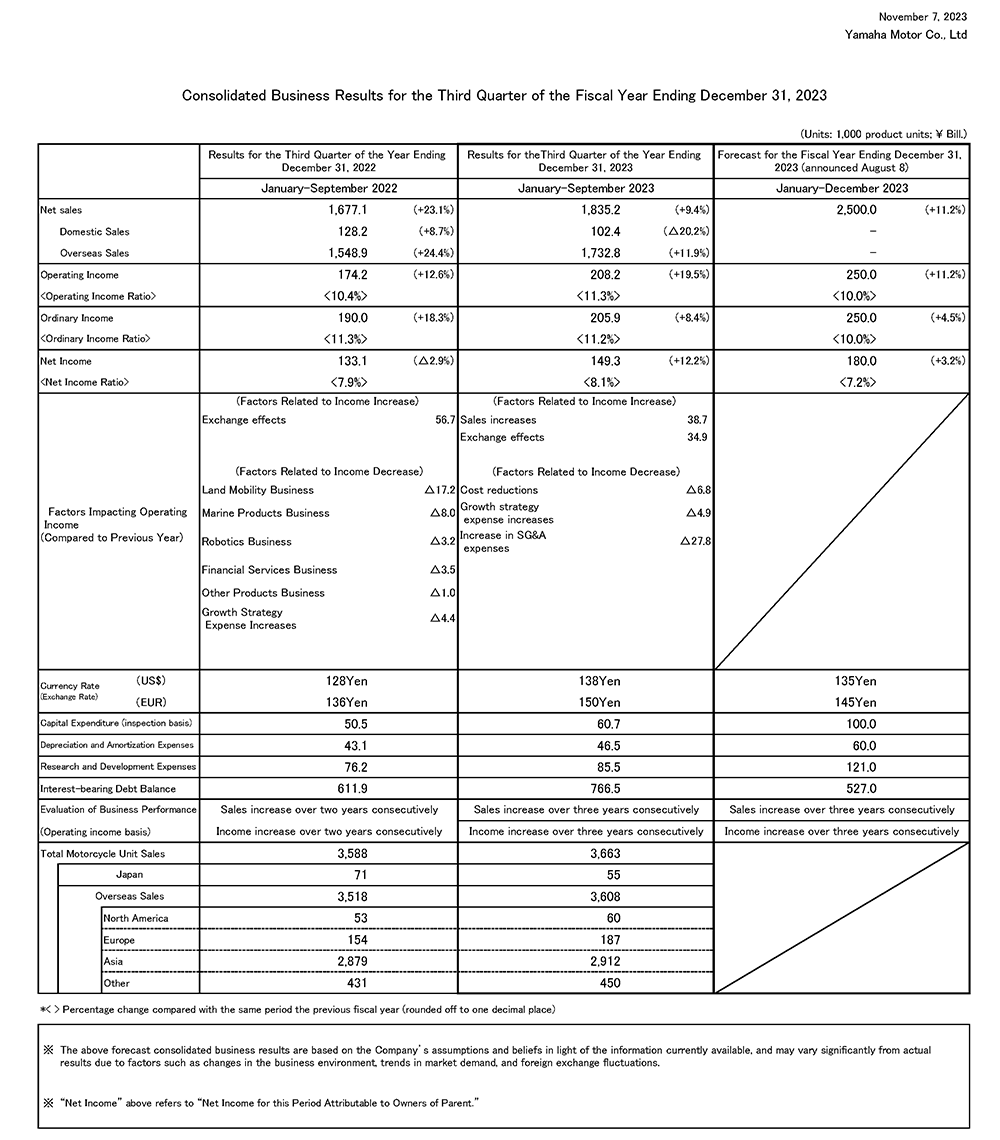

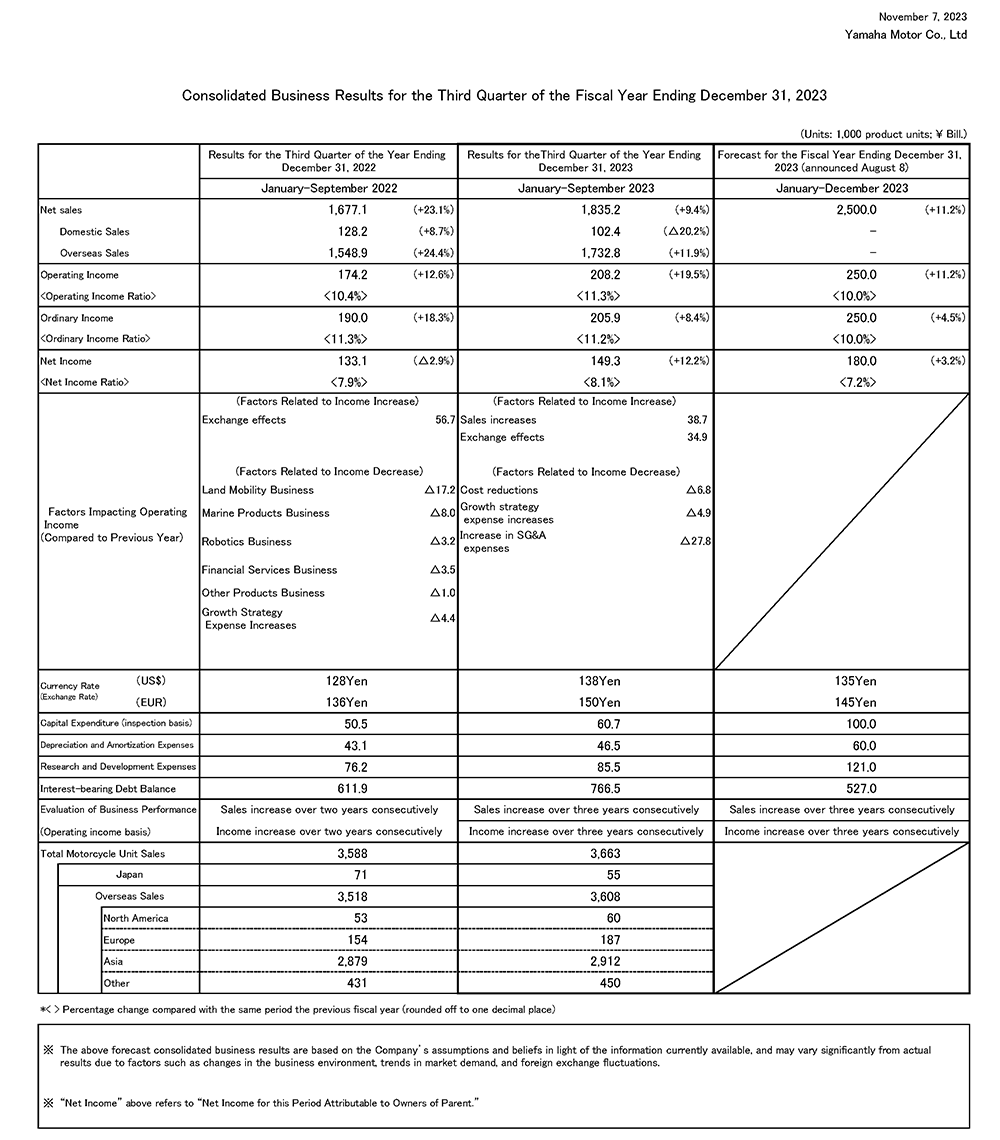

Net sales for the consolidated accounting period for the first nine months of the fiscal year ending December 31, 2023 were 1,835.2 billion yen (an increase of 158.1 billion yen or 9.4% compared with the same period of the previous fiscal year) and operating income was 208.2 billion yen (an increase of 34.1 billion yen or 19.5%). Ordinary income was 205.9 billion yen (an increase of 15.9 billion yen or 8.4%) and net income attributable to owners of parent was 149.3 billion yen (an increase of 16.2 billion yen or 12.2%). This is the first time Yamaha Motor has ever surpassed 200 billion yen in operating and ordinary income for a third quarter consolidated accounting period.

For the period, the U.S. dollar traded at 138 yen (a depreciation of 10 yen from the same period of the previous fiscal year) and the euro at 150 yen (a depreciation of 14 yen).

In addition to firm demand for motorcycles and large outboard motors, supply chains returning to normal operations and improvements made to address issues in logistics, production, and other areas led to an increase in product supply volumes, which raised net sales. For operating income, higher unit sales, more pronounced effects from passing on costs to offset soaring prices for raw materials, plus a depreciating yen generated higher profits. The culminated in the Company posting record highs for net sales and incomes for a third quarter consolidated accounting period.

Results by Business Segment

Land Mobility Business

Net sales were 1,199.9 billion yen (an increase of 114.5 billion yen or 10.6% compared with the same period of the previous fiscal year) and operating income was 106.0 billion yen (an increase of 39.8 billion yen or 60.2%).

For the motorcycle business, demand in Europe and North America was robust and demand in many emerging markets primarily in Asia-with the exception of Vietnam, which is suffering from a prolonged sluggish economy-grew as economic recoveries progressed. Higher unit sales in both developed and emerging markets, namely India and Indonesia, resulted in higher net sales for the business. For operating income, in addition to these higher unit sales, the benefits of a weaker yen and greater effects from passing on costs brought in bigger profits.

With recreational vehicles (all-terrain vehicles, ROVs, and snowmobiles), the boom in outdoor recreation has settled down and the corresponding decline in demand led to fewer shipments. On the other hand, the Company's U.S. factory was also facing issues last year, but production efficiency improvements, together with the added gains from a weaker yen, gave the business higher sales and profits.

For the Smart Power Vehicles business, i.e., electric wheelchairs, electrically power-assisted bicycles and their drive units (e-Kits), market inventory adjustments have been ongoing since the third quarter began. The Company also carried on the production adjustments from the second quarter, but market inventories continue to remain at a high level. As a result, eBike and e-Kit unit sales fell and the business recorded lower sales and profits overall.

Marine Products Business

Net sales were 431.4 billion yen (an increase of 32.7 billion yen or 8.2% compared with the same period of the previous fiscal year) and operating income was 94.4 billion yen (an increase of 10.2 billion yen or 12.1%).

Demand for small and midrange outboard motor models declined in Europe and North America due to concerns of an economic recession, but demand for large 200+ horsepower outboard motors was strong. In Southeast Asia and China, healthy demand continued thanks to the recovery of the fishing and tourism markets. While unit sales rose in emerging markets, they fell in developed markets and this lowered outboard motor unit sales overall. For personal watercraft, in addition to favorable demand, improvements to production efficiency at the Company's U.S. factory brought in higher unit sales. The positive effect of the yen's depreciation also contributed to the overall increase in sales and profits for the business.

Robotics Business

Net sales were 70.6 billion yen (a decrease of 17.2 billion yen or 19.6% compared with the same period of the previous fiscal year) with an operating loss of 1.3 billion yen (down from an operating income of 10.9 billion yen).

In the surface mounter market, automotive segment and industrial equipment demand was strong.

The economic recovery in China has been slow and the declining demand for smartphones, PCs, and other consumer electronics and appliances led to lower sales in China, Taiwan, South Korea, and other markets. With our semiconductor manufacturing equipment as well, despite movements that feel like the market has bottomed out, the prolonged sluggish demand for consumer electronics led to a sales decline. As a result, the Robotics business as a whole posted lower sales and profits.

Financial Services Business

Net sales were 61.4 billion yen (an increase of 16.8 billion yen or 37.6% compared with the same period of the previous fiscal year) and operating income was 10.1 billion yen (a decrease of 3.4 billion yen or 25.4%).

From the rise in unit sales, financial receivables increased in all regions in turn and net sales were higher. Interest rates have continued to be high and while the Company has been passing on costs via customer rates, fundraising costs still went up. In addition, a higher allowance for doubtful accounts accompanying the increase in receivables, and appraised losses derived from interest rate swaps in Brazil and other developments drove down the business' profits overall.

Other Products Business

Net sales were 72.0 billion yen (an increase of 11.4 billion yen or 18.8% compared with the same period of the previous fiscal year) with an operating loss of 1.0 billion yen (compared to an operating loss of 0.7 billion yen).

Improving production efficiency at the U.S. factory raised golf car unit sales and the business took in higher sales, but higher fixed costs and other expenses incurred by other segments of the business overall resulted in lower profits.

Forecast of Consolidated Business Results

Regarding the forecast consolidated business results for the fiscal year ending December 31, 2023, no changes have been made to the forecast made on August 8 when announcing the Company's second quarter results:

Net Sales: 2,500.0 billion yen

Operating Income: 250.0 billion yen

Ordinary Income: 250.0 billion yen

Net Income Attributable to Owners of Parent: 180.0 billion yen

Stock Split and Changes to Shareholder Benefits Program

At the Board of Directors meeting held on November 7, 2023, the Company decided to implement a stock split as well as make partial revisions to the Articles of Incorporation accordingly. The Company's shareholder benefits program will also be changed to align it with the stock split.

■Contact us from the Press

Corporate Communication Division, PR group: +81-538-32-1145

■News Center: https://global.yamaha-motor.com/news/

IWATA, November 7, 2023 - Yamaha Motor Co., Ltd. (Tokyo: 7272) announces its consolidated business results for the first nine months of fiscal 2023.

From HIDAKA, Yoshihiro

President, Chief Executive Officer and Representative Director

I am happy to share that we set new records for net sales and incomes in the third quarter of fiscal 2023. We had increased shipments of motorcycles and large outboard models in our core motorcycle and Marine Product businesses, but the Robotics business continues to struggle significantly due to the sluggish Chinese economy. As for the market situation at the moment, demand for motorcycles in emerging markets continues to recover-albeit to varying degrees depending on the country-and demand for large outboard motors remains firm. On the other hand, the market inventory adjustments for eBikes in the SPV business will likely be lengthy. The robotics market also seems to have bottomed out. While we carry on our efforts to keep expenses under control with carefully targeted spending, we will make steadfast investments into new technologies and accelerate our growth toward the future. Also, at the Board of Directors meeting held today, the Company resolved to carry out a 3-for-1 stock split of our common stock with a record date of December 31, 2023. By lowering the price per share of Yamaha Motor stock, we intend to create an environment conducive to investment and expand our base of investors.

Consolidated Business Results

Net sales for the consolidated accounting period for the first nine months of the fiscal year ending December 31, 2023 were 1,835.2 billion yen (an increase of 158.1 billion yen or 9.4% compared with the same period of the previous fiscal year) and operating income was 208.2 billion yen (an increase of 34.1 billion yen or 19.5%). Ordinary income was 205.9 billion yen (an increase of 15.9 billion yen or 8.4%) and net income attributable to owners of parent was 149.3 billion yen (an increase of 16.2 billion yen or 12.2%). This is the first time Yamaha Motor has ever surpassed 200 billion yen in operating and ordinary income for a third quarter consolidated accounting period.

For the period, the U.S. dollar traded at 138 yen (a depreciation of 10 yen from the same period of the previous fiscal year) and the euro at 150 yen (a depreciation of 14 yen).

In addition to firm demand for motorcycles and large outboard motors, supply chains returning to normal operations and improvements made to address issues in logistics, production, and other areas led to an increase in product supply volumes, which raised net sales. For operating income, higher unit sales, more pronounced effects from passing on costs to offset soaring prices for raw materials, plus a depreciating yen generated higher profits. The culminated in the Company posting record highs for net sales and incomes for a third quarter consolidated accounting period.

Results by Business Segment

Land Mobility Business

Net sales were 1,199.9 billion yen (an increase of 114.5 billion yen or 10.6% compared with the same period of the previous fiscal year) and operating income was 106.0 billion yen (an increase of 39.8 billion yen or 60.2%).

For the motorcycle business, demand in Europe and North America was robust and demand in many emerging markets primarily in Asia-with the exception of Vietnam, which is suffering from a prolonged sluggish economy-grew as economic recoveries progressed. Higher unit sales in both developed and emerging markets, namely India and Indonesia, resulted in higher net sales for the business. For operating income, in addition to these higher unit sales, the benefits of a weaker yen and greater effects from passing on costs brought in bigger profits.

With recreational vehicles (all-terrain vehicles, ROVs, and snowmobiles), the boom in outdoor recreation has settled down and the corresponding decline in demand led to fewer shipments. On the other hand, the Company's U.S. factory was also facing issues last year, but production efficiency improvements, together with the added gains from a weaker yen, gave the business higher sales and profits.

For the Smart Power Vehicles business, i.e., electric wheelchairs, electrically power-assisted bicycles and their drive units (e-Kits), market inventory adjustments have been ongoing since the third quarter began. The Company also carried on the production adjustments from the second quarter, but market inventories continue to remain at a high level. As a result, eBike and e-Kit unit sales fell and the business recorded lower sales and profits overall.

Marine Products Business

Net sales were 431.4 billion yen (an increase of 32.7 billion yen or 8.2% compared with the same period of the previous fiscal year) and operating income was 94.4 billion yen (an increase of 10.2 billion yen or 12.1%).

Demand for small and midrange outboard motor models declined in Europe and North America due to concerns of an economic recession, but demand for large 200+ horsepower outboard motors was strong. In Southeast Asia and China, healthy demand continued thanks to the recovery of the fishing and tourism markets. While unit sales rose in emerging markets, they fell in developed markets and this lowered outboard motor unit sales overall. For personal watercraft, in addition to favorable demand, improvements to production efficiency at the Company's U.S. factory brought in higher unit sales. The positive effect of the yen's depreciation also contributed to the overall increase in sales and profits for the business.

Robotics Business

Net sales were 70.6 billion yen (a decrease of 17.2 billion yen or 19.6% compared with the same period of the previous fiscal year) with an operating loss of 1.3 billion yen (down from an operating income of 10.9 billion yen).

In the surface mounter market, automotive segment and industrial equipment demand was strong.

The economic recovery in China has been slow and the declining demand for smartphones, PCs, and other consumer electronics and appliances led to lower sales in China, Taiwan, South Korea, and other markets. With our semiconductor manufacturing equipment as well, despite movements that feel like the market has bottomed out, the prolonged sluggish demand for consumer electronics led to a sales decline. As a result, the Robotics business as a whole posted lower sales and profits.

Financial Services Business

Net sales were 61.4 billion yen (an increase of 16.8 billion yen or 37.6% compared with the same period of the previous fiscal year) and operating income was 10.1 billion yen (a decrease of 3.4 billion yen or 25.4%).

From the rise in unit sales, financial receivables increased in all regions in turn and net sales were higher. Interest rates have continued to be high and while the Company has been passing on costs via customer rates, fundraising costs still went up. In addition, a higher allowance for doubtful accounts accompanying the increase in receivables, and appraised losses derived from interest rate swaps in Brazil and other developments drove down the business' profits overall.

Other Products Business

Net sales were 72.0 billion yen (an increase of 11.4 billion yen or 18.8% compared with the same period of the previous fiscal year) with an operating loss of 1.0 billion yen (compared to an operating loss of 0.7 billion yen).

Improving production efficiency at the U.S. factory raised golf car unit sales and the business took in higher sales, but higher fixed costs and other expenses incurred by other segments of the business overall resulted in lower profits.

Forecast of Consolidated Business Results

Regarding the forecast consolidated business results for the fiscal year ending December 31, 2023, no changes have been made to the forecast made on August 8 when announcing the Company's second quarter results:

Net Sales: 2,500.0 billion yen

Operating Income: 250.0 billion yen

Ordinary Income: 250.0 billion yen

Net Income Attributable to Owners of Parent: 180.0 billion yen

Stock Split and Changes to Shareholder Benefits Program

At the Board of Directors meeting held on November 7, 2023, the Company decided to implement a stock split as well as make partial revisions to the Articles of Incorporation accordingly. The Company's shareholder benefits program will also be changed to align it with the stock split.

■Contact us from the Press

Corporate Communication Division, PR group: +81-538-32-1145

■News Center: https://global.yamaha-motor.com/news/