Consolidated Business Results Summary - First Half of Fiscal Year Ending December 31, 2023 -

August 8, 2023

Consolidated Business Results

IWATA, August 8, 2023 - Yamaha Motor Co., Ltd. (Tokyo: 7272) announces its consolidated business results for the first half of fiscal 2023.

From HIDAKA, Yoshihiro

President, Chief Executive Officer and Representative Director

For the second quarter of fiscal 2023, we were able to set new records for net sales and incomes. In our core businesses of motorcycles and marine products, the strong demand that brought higher unit sales was the main factor behind the significant increase in our overall sales and profits.

In terms of the market outlook from here, while we expect outdoor recreation demand to settle down, we see demand for motorcycles in emerging markets and large outboard motor demand to remain strong. Furthermore, expectations are for electrically power-assisted bicycle (eBike) inventory adjustments to continue throughout the year and for the robotics market recovery to stretch into the next fiscal year. In this manner, our projections are for the Company's businesses to experience a mix of strong and weak demand, but Yamaha Motor will continue to keep management efficiency and its break-even-point management style in mind as we strive to further raise profitability.

In this second quarter period, we signed a business transfer agreement for our generators, multi-purpose engines, and other power products, and are currently working on acquiring the required legal and regulatory permits and approvals. Additionally, we announced our eventual withdrawal from the snowmobile and swimming pool businesses. We have also begun considering a possible merger with our consolidated subsidiary, Yamaha Motor Electronics Co., Ltd. We are making progress with the portfolio management initiatives we laid down in the current Medium-Term Management Plan. Going forward, we will direct our management resources not only on our core businesses but also on creating and expanding the new businesses that will be the seeds of our next stages of growth, and strive to further bolster our corporate resilience in order to continue growing even amidst highly unpredictable business environments.

Consolidated Business Results

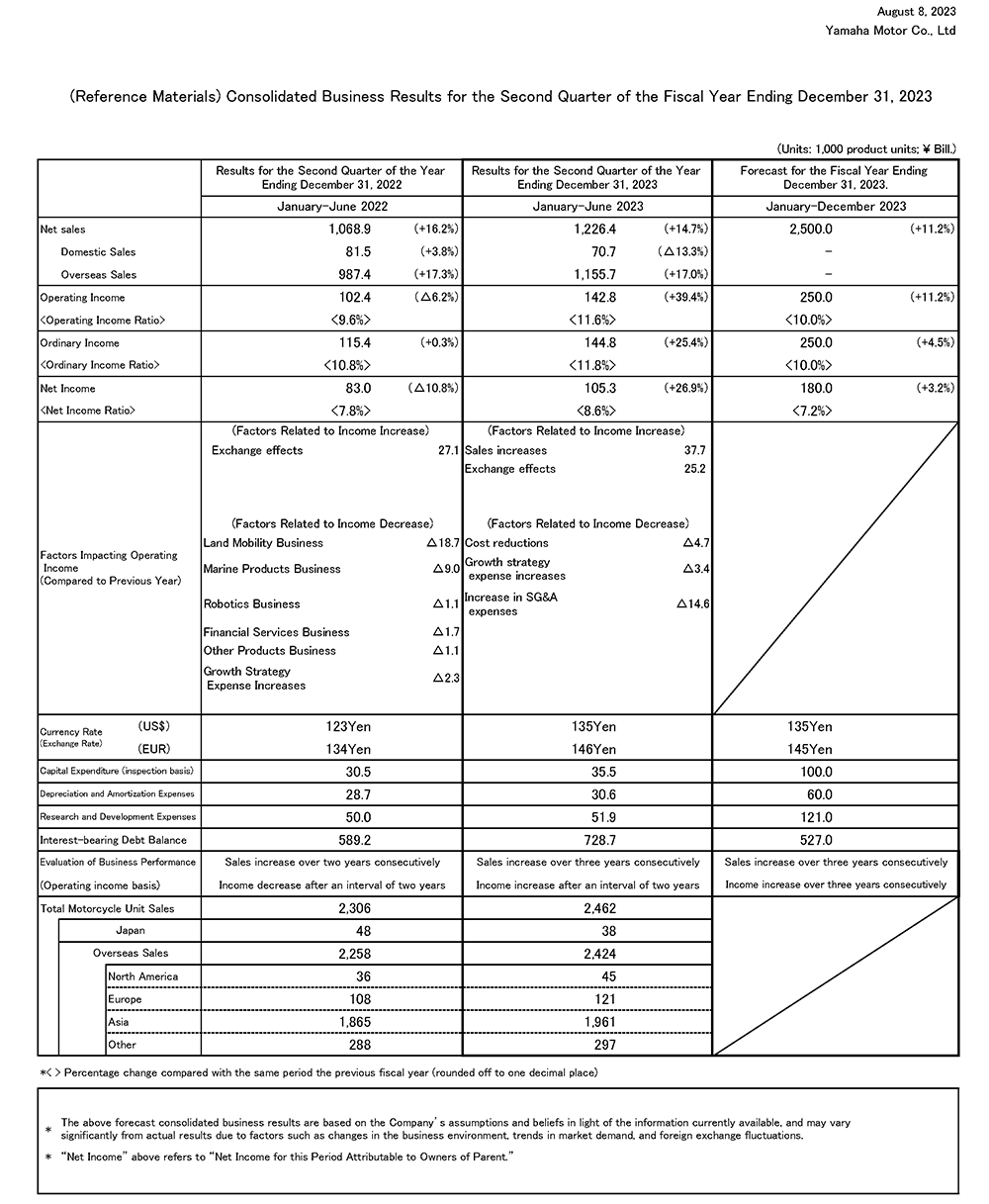

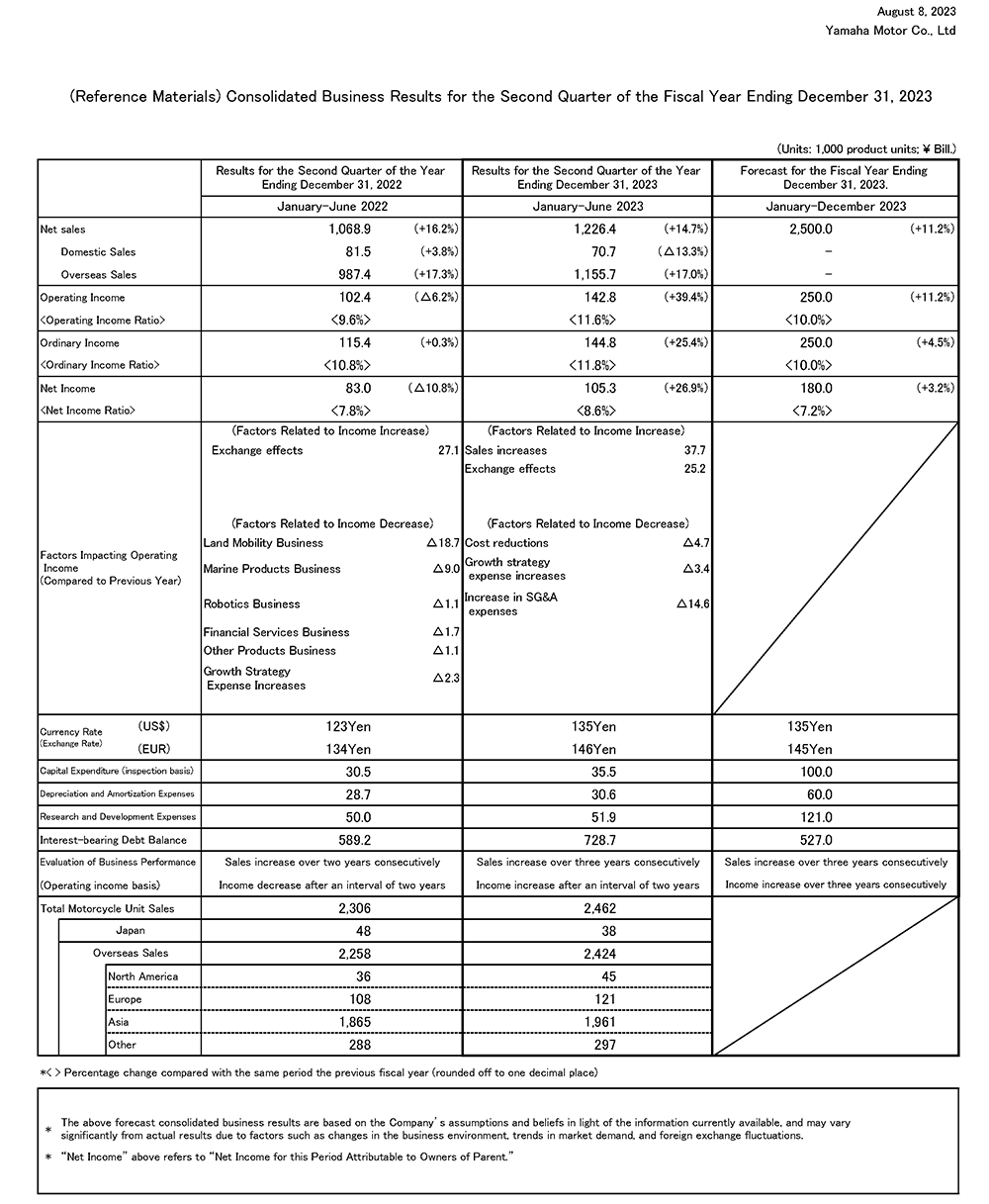

Net sales for the consolidated accounting period for the first six months of the fiscal year ending December 31, 2023 were 1,226.4 billion yen (an increase of 157.5 billion yen or 14.7% compared with the same period of the previous fiscal year) and operating income was 142.8 billion yen (an increase of 40.3 billion yen or 39.4%). Ordinary income was 144.8 billion yen (an increase of 29.4 billion yen or 25.4%) and net income attributable to owners of parent was 105.3 billion yen (an increase of 22.3 billion yen or 26.9%). This is also the first time net income has exceeded 100 billion yen in a second quarter period.

For the first half-year consolidated accounting period, the U.S. dollar traded at 135 yen (a depreciation of 12 yen from the same period of the previous fiscal year) and the euro at 146 yen (a depreciation of 12 yen).

Market conditions during the second quarter were affected by factors that include subsiding outdoor recreation demand and a protracted economic recovery in China, but demand for large outboard motors and motorcycles remained strong. Compared to last year when the Company faced supply chain disruptions, marked improvements were made with product supply volumes and this resulted in higher sales. For operating income, higher unit sales as well as more pronounced effects from passing on costs to offset soaring prices for raw materials generated higher profits. Together with the positives of a weaker yen, led the Company to post record highs for net sales and incomes for a second quarter consolidated accounting period.

Results by Business Segment

Land Mobility Business

Net sales were 795.0 billion yen (an increase of 106.3 billion yen or 15.4% compared with the same period of the previous fiscal year) and operating income was 69.4 billion yen (an increase of 32.7 billion yen or 88.9%).

For the motorcycle business, demand in Europe and North America continued to remain robust, while demand in many emerging markets?primarily in Asia?also grew as economic recoveries progressed. Higher unit sales in Indonesia, Brazil, the Philippines, and other countries resulted in higher net sales for the business. For operating income, in addition to these higher unit sales, the benefits of a weaker yen and greater effects from passing on costs brought in bigger profits.

With recreational vehicles (all-terrain vehicles, ROVs, and snowmobiles), shipments have fallen as the spike in demand stemming from the boom in outdoor recreation has begun to settle down. Conversely, production efficiency at our U.S. factory, which had suffered last year due to higher COVID-19 cases, improved, and together with the added gains from a weaker yen, the business took in higher sales and profits.

For the Smart Power Vehicles (SPV) business, i.e., electric wheelchairs, electrically power-assisted bicycles and their drive units (e-Kits), market inventory adjustments are ongoing and the Company also made adjustments to production. On the other hand, e-Kit unit sales increased compared to last year, which was heavily impacted by the Shanghai lockdown, and this resulted in higher sales and profits overall.

Marine Products Business

Net sales were 299.8 billion yen (an increase of 43.8 billion yen or 17.1% compared with the same period of the previous fiscal year) and operating income was 68.4 billion yen (an increase of 18.8 billion yen or 38.0%).

Demand for small and midrange outboard motor models settled down in Europe and North America, but the strong demand for large outboard motors has continued. In Southeast Asia and China, healthy demand continued thanks to the recovery of the fishing and tourism markets. While sales of large outboard motors rose in North America, they fell in Europe and this lowered outboard motor unit sales overall. For personal watercraft, the strong demand continued, plus improvements with production efficiency at our U.S. factory brought in higher unit sales. The positive effect of the yen's depreciation also contributed to the overall increase in sales and profits for the business.

Robotics Business

Net sales were 46.0 billion yen (a decrease of 11.8 billion yen or 20.4% compared with the same period of the previous fiscal year) and operating income was 0.4 billion yen (a decrease of 7.8 billion yen or 95.3%).

In the surface mounter market, automotive segment and industrial equipment demand in developed markets was strong. The slowing economic recovery in China and declining demand for smartphones, PCs, and other consumer electronics and appliances led to lower sales in China, Taiwan, and South Korea. With the Company's semiconductor back-end processing equipment as well, the same sluggish demand for consumer electronics led to a sales decline. As a result, the Robotics business as a whole posted lower sales and profits.

Financial Services Business

Net sales were 38.5 billion yen (an increase of 10.5 billion yen or 37.4% compared with the same period of the previous fiscal year) and operating income was 4.3 billion yen (a decrease of 5.0 billion yen or 54.2%.

From the rise in unit sales, financial receivables increased in all regions in turn and net sales were higher. On the other hand, the sharp jump in interest rates affected fundraising costs, and in addition, a higher allowance for doubtful accounts accompanying the increase in receivables, and appraised losses derived from interest rate swaps in Brazil and other countries drove down the business' profits overall.

Other Products Business

Net sales were 47.2 billion yen (an increase of 8.7 billion yen or 22.6% compared with the same period of the previous fiscal year) and operating income was 0.3 billion yen (compared to an operating loss of 1.4 billion yen).

Improving production efficiency at our U.S. factory raised golf car unit sales and the business took in both higher sales and profits.

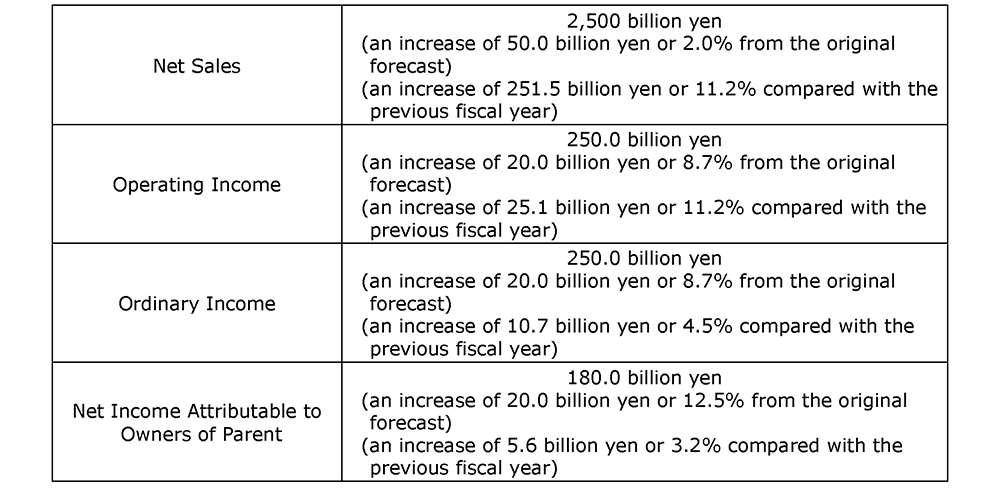

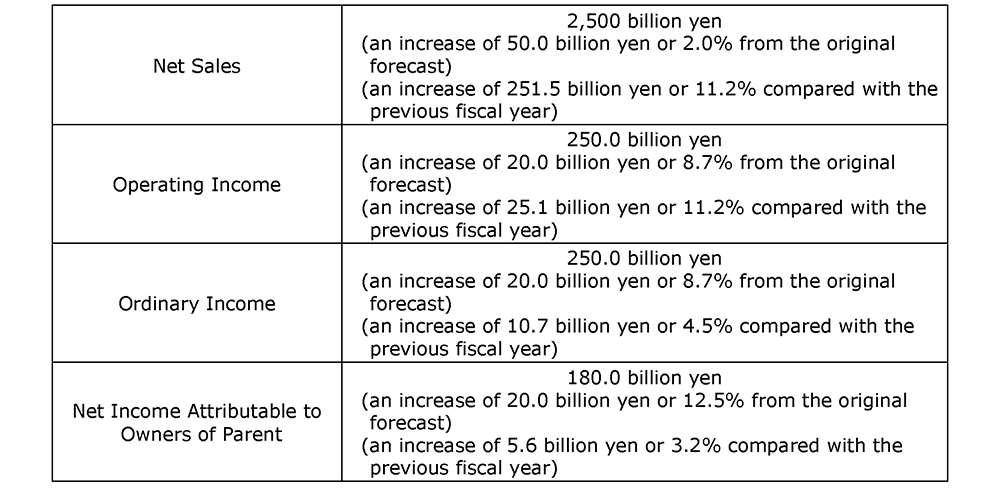

Forecast of Consolidated Business Results

Regarding the forecast for the remainder of the fiscal year ending December 31, 2023, while the market situation is worsening for the robotics and SPV businesses and outdoor recreation demand is showing signs of settling down, the effects from steep raw material prices are expected to taper off.

In light of the depreciating trend of the yen, the Company has revised its forecasts for net sales and various incomes as follows.

These forecast figures are based on the U.S. dollar trading at 135 yen during the fiscal year (a depreciation of 10 yen from the previous forecast and a year-on-year depreciation of 3 yen) and the euro at 145 yen (a depreciation of 10 yen from the previous forecast and a year-on-year depreciation of 7 yen).

Basic Policy Concerning Profit Distribution and Dividends for the Current Fiscal Year

For shareholder returns, the Company's basic policy is to emphasize making consistent and ongoing dividend payments while taking into consideration the outlook for business performance and investments for future growth, distributing returns to shareholders in a flexible way based on the scale of our cash flows with the total payout ratio set at the 40% range for the cumulative total of the Medium-Term Management Plan's three-year period.

Based on the revised business results forecast, the Company has decided to change the forecast for this fiscal year's annual dividend to 145 yen (an increase of 15 yen from the original forecast and an increase of 20 yen from the previous fiscal year), with an interim dividend of 72.5 yen (an increase of 7.5 yen from the original forecast and an increase of 15 yen from the previous fiscal year).

■Contact us from the Press

Corporate Communication Division, PR group: +81-538-32-1145

■News Center: https://global.yamaha-motor.com/news/

IWATA, August 8, 2023 - Yamaha Motor Co., Ltd. (Tokyo: 7272) announces its consolidated business results for the first half of fiscal 2023.

From HIDAKA, Yoshihiro

President, Chief Executive Officer and Representative Director

For the second quarter of fiscal 2023, we were able to set new records for net sales and incomes. In our core businesses of motorcycles and marine products, the strong demand that brought higher unit sales was the main factor behind the significant increase in our overall sales and profits.

In terms of the market outlook from here, while we expect outdoor recreation demand to settle down, we see demand for motorcycles in emerging markets and large outboard motor demand to remain strong. Furthermore, expectations are for electrically power-assisted bicycle (eBike) inventory adjustments to continue throughout the year and for the robotics market recovery to stretch into the next fiscal year. In this manner, our projections are for the Company's businesses to experience a mix of strong and weak demand, but Yamaha Motor will continue to keep management efficiency and its break-even-point management style in mind as we strive to further raise profitability.

In this second quarter period, we signed a business transfer agreement for our generators, multi-purpose engines, and other power products, and are currently working on acquiring the required legal and regulatory permits and approvals. Additionally, we announced our eventual withdrawal from the snowmobile and swimming pool businesses. We have also begun considering a possible merger with our consolidated subsidiary, Yamaha Motor Electronics Co., Ltd. We are making progress with the portfolio management initiatives we laid down in the current Medium-Term Management Plan. Going forward, we will direct our management resources not only on our core businesses but also on creating and expanding the new businesses that will be the seeds of our next stages of growth, and strive to further bolster our corporate resilience in order to continue growing even amidst highly unpredictable business environments.

Consolidated Business Results

Net sales for the consolidated accounting period for the first six months of the fiscal year ending December 31, 2023 were 1,226.4 billion yen (an increase of 157.5 billion yen or 14.7% compared with the same period of the previous fiscal year) and operating income was 142.8 billion yen (an increase of 40.3 billion yen or 39.4%). Ordinary income was 144.8 billion yen (an increase of 29.4 billion yen or 25.4%) and net income attributable to owners of parent was 105.3 billion yen (an increase of 22.3 billion yen or 26.9%). This is also the first time net income has exceeded 100 billion yen in a second quarter period.

For the first half-year consolidated accounting period, the U.S. dollar traded at 135 yen (a depreciation of 12 yen from the same period of the previous fiscal year) and the euro at 146 yen (a depreciation of 12 yen).

Market conditions during the second quarter were affected by factors that include subsiding outdoor recreation demand and a protracted economic recovery in China, but demand for large outboard motors and motorcycles remained strong. Compared to last year when the Company faced supply chain disruptions, marked improvements were made with product supply volumes and this resulted in higher sales. For operating income, higher unit sales as well as more pronounced effects from passing on costs to offset soaring prices for raw materials generated higher profits. Together with the positives of a weaker yen, led the Company to post record highs for net sales and incomes for a second quarter consolidated accounting period.

Results by Business Segment

Land Mobility Business

Net sales were 795.0 billion yen (an increase of 106.3 billion yen or 15.4% compared with the same period of the previous fiscal year) and operating income was 69.4 billion yen (an increase of 32.7 billion yen or 88.9%).

For the motorcycle business, demand in Europe and North America continued to remain robust, while demand in many emerging markets?primarily in Asia?also grew as economic recoveries progressed. Higher unit sales in Indonesia, Brazil, the Philippines, and other countries resulted in higher net sales for the business. For operating income, in addition to these higher unit sales, the benefits of a weaker yen and greater effects from passing on costs brought in bigger profits.

With recreational vehicles (all-terrain vehicles, ROVs, and snowmobiles), shipments have fallen as the spike in demand stemming from the boom in outdoor recreation has begun to settle down. Conversely, production efficiency at our U.S. factory, which had suffered last year due to higher COVID-19 cases, improved, and together with the added gains from a weaker yen, the business took in higher sales and profits.

For the Smart Power Vehicles (SPV) business, i.e., electric wheelchairs, electrically power-assisted bicycles and their drive units (e-Kits), market inventory adjustments are ongoing and the Company also made adjustments to production. On the other hand, e-Kit unit sales increased compared to last year, which was heavily impacted by the Shanghai lockdown, and this resulted in higher sales and profits overall.

Marine Products Business

Net sales were 299.8 billion yen (an increase of 43.8 billion yen or 17.1% compared with the same period of the previous fiscal year) and operating income was 68.4 billion yen (an increase of 18.8 billion yen or 38.0%).

Demand for small and midrange outboard motor models settled down in Europe and North America, but the strong demand for large outboard motors has continued. In Southeast Asia and China, healthy demand continued thanks to the recovery of the fishing and tourism markets. While sales of large outboard motors rose in North America, they fell in Europe and this lowered outboard motor unit sales overall. For personal watercraft, the strong demand continued, plus improvements with production efficiency at our U.S. factory brought in higher unit sales. The positive effect of the yen's depreciation also contributed to the overall increase in sales and profits for the business.

Robotics Business

Net sales were 46.0 billion yen (a decrease of 11.8 billion yen or 20.4% compared with the same period of the previous fiscal year) and operating income was 0.4 billion yen (a decrease of 7.8 billion yen or 95.3%).

In the surface mounter market, automotive segment and industrial equipment demand in developed markets was strong. The slowing economic recovery in China and declining demand for smartphones, PCs, and other consumer electronics and appliances led to lower sales in China, Taiwan, and South Korea. With the Company's semiconductor back-end processing equipment as well, the same sluggish demand for consumer electronics led to a sales decline. As a result, the Robotics business as a whole posted lower sales and profits.

Financial Services Business

Net sales were 38.5 billion yen (an increase of 10.5 billion yen or 37.4% compared with the same period of the previous fiscal year) and operating income was 4.3 billion yen (a decrease of 5.0 billion yen or 54.2%.

From the rise in unit sales, financial receivables increased in all regions in turn and net sales were higher. On the other hand, the sharp jump in interest rates affected fundraising costs, and in addition, a higher allowance for doubtful accounts accompanying the increase in receivables, and appraised losses derived from interest rate swaps in Brazil and other countries drove down the business' profits overall.

Other Products Business

Net sales were 47.2 billion yen (an increase of 8.7 billion yen or 22.6% compared with the same period of the previous fiscal year) and operating income was 0.3 billion yen (compared to an operating loss of 1.4 billion yen).

Improving production efficiency at our U.S. factory raised golf car unit sales and the business took in both higher sales and profits.

Forecast of Consolidated Business Results

Regarding the forecast for the remainder of the fiscal year ending December 31, 2023, while the market situation is worsening for the robotics and SPV businesses and outdoor recreation demand is showing signs of settling down, the effects from steep raw material prices are expected to taper off.

In light of the depreciating trend of the yen, the Company has revised its forecasts for net sales and various incomes as follows.

These forecast figures are based on the U.S. dollar trading at 135 yen during the fiscal year (a depreciation of 10 yen from the previous forecast and a year-on-year depreciation of 3 yen) and the euro at 145 yen (a depreciation of 10 yen from the previous forecast and a year-on-year depreciation of 7 yen).

Basic Policy Concerning Profit Distribution and Dividends for the Current Fiscal Year

For shareholder returns, the Company's basic policy is to emphasize making consistent and ongoing dividend payments while taking into consideration the outlook for business performance and investments for future growth, distributing returns to shareholders in a flexible way based on the scale of our cash flows with the total payout ratio set at the 40% range for the cumulative total of the Medium-Term Management Plan's three-year period.

Based on the revised business results forecast, the Company has decided to change the forecast for this fiscal year's annual dividend to 145 yen (an increase of 15 yen from the original forecast and an increase of 20 yen from the previous fiscal year), with an interim dividend of 72.5 yen (an increase of 7.5 yen from the original forecast and an increase of 15 yen from the previous fiscal year).

< >

>

>

>■Contact us from the Press

Corporate Communication Division, PR group: +81-538-32-1145

■News Center: https://global.yamaha-motor.com/news/