Consolidated Business Results Summary - First Three Months of Fiscal Year Ending December 31, 2023 -

May 15, 2023

IWATA, May 15, 2023 - Yamaha Motor Co., Ltd. (Tokyo: 7272) announces its consolidated business results for the first three months of fiscal 2023.

From HIDAKA, Yoshihiro

President, Chief Executive Officer and Representative Director

For the first quarter of fiscal 2023, we set new records for net sales, operating income, and operating income ratio. In our core businesses of motorcycles and marine products, the strong demand in each market that brought higher unit sales and the progress made in our efforts to raise cost efficiency were the main factors behind the significant increase in sales, profits, and our profit margin.

In terms of the market outlook from here, while we expect the boom in outdoor recreation to settle down, we see demand for motorcycles in emerging markets and large outboard motor demand to remain strong. Furthermore, we believe the electrically power-assisted bicycle market is expected to grow moderately, while the robotics market sees a recovery in demand from the second half of the fiscal year. Based on these projections of the business environment, Yamaha Motor will continue to keep management efficiency and its break-even-point management style in mind as we strive to further raise profitability.

We have made "transformation" and "speed" key words for 2023, and launched four high-priority Companywide projects, such as the Motorcycle Electrification Project and the New Mobility Project. We will bring various divisions together through these projects--from production and sales to procurement and technology--into unified entities working to resolve issues. In doing so, we will foster an environment that encourages innovation and connect that to achieving greater growth as a company.

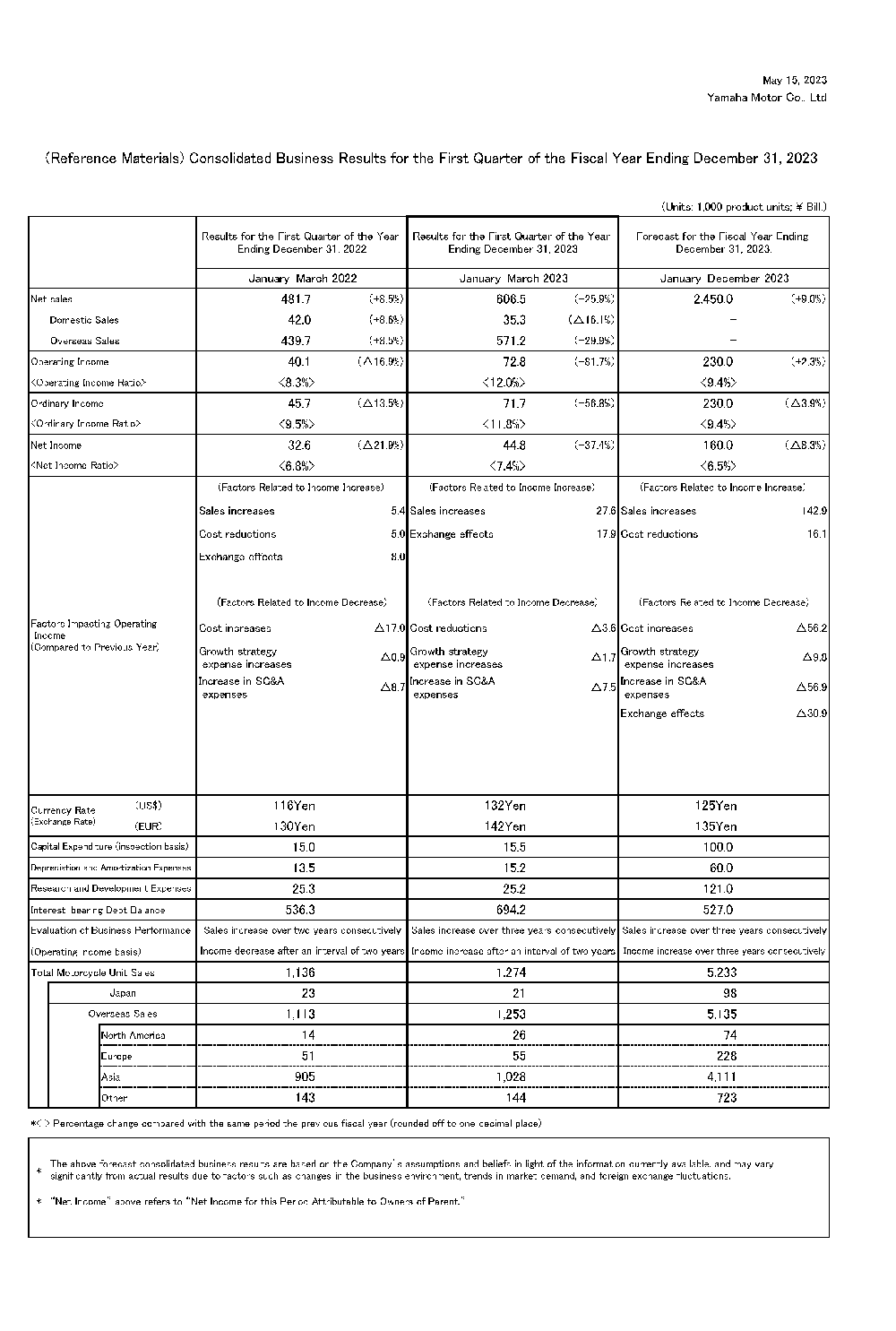

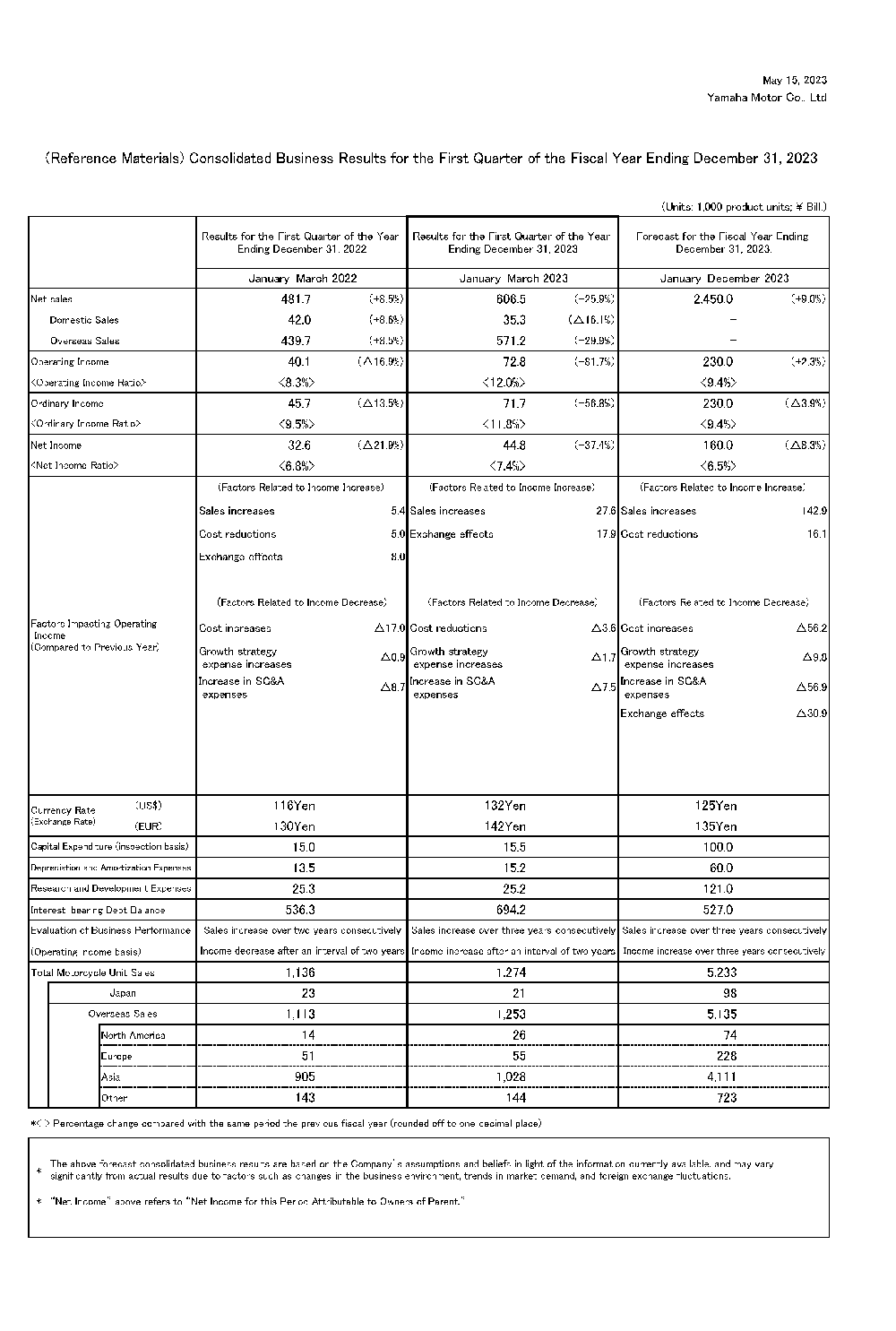

Consolidated Business Results

Net sales for the period were 606.5 billion yen (an increase of 124.7 billion yen or 25.9% compared with the same period of the previous fiscal year) and operating income was 72.8 billion yen (an increase of 32.7 billion yen or 81.7%). Ordinary income was 71.7 billion yen (an increase of 26.0 billion yen or 56.8%) and net income attributable to owners of parent was 44.8 billion yen (an increase of 12.2 billion yen or 37.4%).

For this first quarter consolidated accounting period, the U.S. dollar traded at 132 yen (a depreciation of 16 yen from the same period of the previous fiscal year) and the euro at 142 yen (a depreciation of 12 yen).

Demand for motorcycles and large outboard motors has remained strong, and progress with improvements to address issues with parts procurement, logistics, production, and other areas brought higher product supply volumes that drove up the Company's net sales figures. For operating income, in addition to higher unit sales, the positives of a weaker yen and more pronounced effects from passing on costs to offset soaring prices for raw materials and more led to higher profits for the period.

Results by Business Segment

Land Mobility Business

Net sales were 400.6 billion yen (an increase of 85.1 billion yen or 27.0% compared with the same period of the previous fiscal year) and operating income was 33.7 billion yen (an increase of 21.6 billion yen or 177.4%).

For the motorcycle business, demand in developed markets remained robust, while demand in many emerging markets also grew as economic recoveries progressed. Improvements targeting parts procurement difficulties and to solve logistics issues concerning U.S.-bound items yielded higher unit sales in all regions, resulting in higher net sales for the business. For operating income, in addition to higher unit sales, the benefits of a weaker yen and greater effects from passing on costs brought in higher profits.

With recreational vehicles (all-terrain vehicles, ROVs, and snowmobiles), although demand has begun to settle down, the Company has continued shipments in order to restock inventories. In the U.S., higher ROV unit sales improved the model mix. Although costs rose for raw materials, labor, and other expenses, solving the production issues our U.S. factory was facing upped production efficiency, and together with the added gains from a weaker yen, the business took in higher sales and profits.

For electrically power-assisted bicycles, supply chain disruptions are on the way back to normal. This raised production volumes and the Company was able to greatly improve its supply of e-Kits, resulting in both higher sales and profits. However, the market has taken a sudden turn and inventory has become somewhat overstocked, so the plan is to adjust production plans accordingly going forward.

Marine Products Business

Net sales were 146.1 billion yen (an increase of 37.4 billion yen or 34.4% compared with the same period of the previous fiscal year) and operating income was 38.0 billion yen (an increase of 17.6 billion yen or 86.5%).

In developed markets, the strong demand for large outboard motors has continued. The Company was able to fix issues with overseas shipping to U.S. shores as well as with U.S. domestic shipping. This increased product shipments overall and resulted in higher unit sales. For personal watercraft, the solving of production issues at our U.S. factory brought in higher unit sales. The positives of a weaker yen contributed further to business performance, resulting in higher sales and profits for the Marine Products business overall.

Robotics Business

Net sales were 19.8 billion yen (a decrease of 6.5 billion yen or 24.7% compared with the same period of the previous fiscal year) and an operating loss of 0.5 billion yen (down from an operating income of 3.7 billion yen). In the surface mounter market, automotive segment demand was still strong, but U.S.-China trade friction and settling of the atypical high demand triggered by domestic consumption during the pandemic lowered sales primarily in China, Taiwan, and South Korea. With our semiconductor back-end processing equipment, sales declined due to sluggish demand for smartphones and PCs. As a result, the Robotics business as a whole posted lower sales and profits.

Financial Services Business

Net sales were 17.9 billion yen (an increase of 5.1 billion yen or 40.3% compared with the same period of the previous fiscal year) and operating income was 1.6 billion yen (a decrease of 2.8 billion yen or 63.2%).

From the rise in unit sales, financial receivables increased in all regions in turn and net sales were higher. On the other hand, the sharp jump in interest rates since last year has negatively affected fundraising costs, and with the increase in allowance for doubtful accounts accompanying the increase in receivables, the business recorded lower profits overall.

Other Products Business

Net sales were 22.2 billion yen (an increase of 3.5 billion yen or 18.9% compared with the same period of the previous fiscal year) with an operating loss of 10 million yen (up from an operating loss of 600 million yen). Addressing the production issues at our U.S. factory raised golf car unit sales and the business took in both higher sales and profits.

Forecast of Consolidated Business Results

Regarding the forecast consolidated business results for the fiscal year ending December 31, 2023, no changes have been made to the forecast made on February 13 when announcing the Company's fiscal 2022 results:

Net Sales: 2,450.0 billion yen

Operating Income: 230.0 billion yen

Ordinary Income: 230.0 billion yen

Net Income Attributable to Owners of Parent: 160.0 billion yen

No changes were made to the forecast exchange rates either, and the above figures are based on the U.S. dollar trading at 125 yen during the fiscal year (an appreciation of 7 yen from FY2022) and the euro at 135 yen (an appreciation of 3 yen).

From HIDAKA, Yoshihiro

President, Chief Executive Officer and Representative Director

For the first quarter of fiscal 2023, we set new records for net sales, operating income, and operating income ratio. In our core businesses of motorcycles and marine products, the strong demand in each market that brought higher unit sales and the progress made in our efforts to raise cost efficiency were the main factors behind the significant increase in sales, profits, and our profit margin.

In terms of the market outlook from here, while we expect the boom in outdoor recreation to settle down, we see demand for motorcycles in emerging markets and large outboard motor demand to remain strong. Furthermore, we believe the electrically power-assisted bicycle market is expected to grow moderately, while the robotics market sees a recovery in demand from the second half of the fiscal year. Based on these projections of the business environment, Yamaha Motor will continue to keep management efficiency and its break-even-point management style in mind as we strive to further raise profitability.

We have made "transformation" and "speed" key words for 2023, and launched four high-priority Companywide projects, such as the Motorcycle Electrification Project and the New Mobility Project. We will bring various divisions together through these projects--from production and sales to procurement and technology--into unified entities working to resolve issues. In doing so, we will foster an environment that encourages innovation and connect that to achieving greater growth as a company.

Consolidated Business Results

Net sales for the period were 606.5 billion yen (an increase of 124.7 billion yen or 25.9% compared with the same period of the previous fiscal year) and operating income was 72.8 billion yen (an increase of 32.7 billion yen or 81.7%). Ordinary income was 71.7 billion yen (an increase of 26.0 billion yen or 56.8%) and net income attributable to owners of parent was 44.8 billion yen (an increase of 12.2 billion yen or 37.4%).

For this first quarter consolidated accounting period, the U.S. dollar traded at 132 yen (a depreciation of 16 yen from the same period of the previous fiscal year) and the euro at 142 yen (a depreciation of 12 yen).

Demand for motorcycles and large outboard motors has remained strong, and progress with improvements to address issues with parts procurement, logistics, production, and other areas brought higher product supply volumes that drove up the Company's net sales figures. For operating income, in addition to higher unit sales, the positives of a weaker yen and more pronounced effects from passing on costs to offset soaring prices for raw materials and more led to higher profits for the period.

Results by Business Segment

Land Mobility Business

Net sales were 400.6 billion yen (an increase of 85.1 billion yen or 27.0% compared with the same period of the previous fiscal year) and operating income was 33.7 billion yen (an increase of 21.6 billion yen or 177.4%).

For the motorcycle business, demand in developed markets remained robust, while demand in many emerging markets also grew as economic recoveries progressed. Improvements targeting parts procurement difficulties and to solve logistics issues concerning U.S.-bound items yielded higher unit sales in all regions, resulting in higher net sales for the business. For operating income, in addition to higher unit sales, the benefits of a weaker yen and greater effects from passing on costs brought in higher profits.

With recreational vehicles (all-terrain vehicles, ROVs, and snowmobiles), although demand has begun to settle down, the Company has continued shipments in order to restock inventories. In the U.S., higher ROV unit sales improved the model mix. Although costs rose for raw materials, labor, and other expenses, solving the production issues our U.S. factory was facing upped production efficiency, and together with the added gains from a weaker yen, the business took in higher sales and profits.

For electrically power-assisted bicycles, supply chain disruptions are on the way back to normal. This raised production volumes and the Company was able to greatly improve its supply of e-Kits, resulting in both higher sales and profits. However, the market has taken a sudden turn and inventory has become somewhat overstocked, so the plan is to adjust production plans accordingly going forward.

Marine Products Business

Net sales were 146.1 billion yen (an increase of 37.4 billion yen or 34.4% compared with the same period of the previous fiscal year) and operating income was 38.0 billion yen (an increase of 17.6 billion yen or 86.5%).

In developed markets, the strong demand for large outboard motors has continued. The Company was able to fix issues with overseas shipping to U.S. shores as well as with U.S. domestic shipping. This increased product shipments overall and resulted in higher unit sales. For personal watercraft, the solving of production issues at our U.S. factory brought in higher unit sales. The positives of a weaker yen contributed further to business performance, resulting in higher sales and profits for the Marine Products business overall.

Robotics Business

Net sales were 19.8 billion yen (a decrease of 6.5 billion yen or 24.7% compared with the same period of the previous fiscal year) and an operating loss of 0.5 billion yen (down from an operating income of 3.7 billion yen). In the surface mounter market, automotive segment demand was still strong, but U.S.-China trade friction and settling of the atypical high demand triggered by domestic consumption during the pandemic lowered sales primarily in China, Taiwan, and South Korea. With our semiconductor back-end processing equipment, sales declined due to sluggish demand for smartphones and PCs. As a result, the Robotics business as a whole posted lower sales and profits.

Financial Services Business

Net sales were 17.9 billion yen (an increase of 5.1 billion yen or 40.3% compared with the same period of the previous fiscal year) and operating income was 1.6 billion yen (a decrease of 2.8 billion yen or 63.2%).

From the rise in unit sales, financial receivables increased in all regions in turn and net sales were higher. On the other hand, the sharp jump in interest rates since last year has negatively affected fundraising costs, and with the increase in allowance for doubtful accounts accompanying the increase in receivables, the business recorded lower profits overall.

Other Products Business

Net sales were 22.2 billion yen (an increase of 3.5 billion yen or 18.9% compared with the same period of the previous fiscal year) with an operating loss of 10 million yen (up from an operating loss of 600 million yen). Addressing the production issues at our U.S. factory raised golf car unit sales and the business took in both higher sales and profits.

Forecast of Consolidated Business Results

Regarding the forecast consolidated business results for the fiscal year ending December 31, 2023, no changes have been made to the forecast made on February 13 when announcing the Company's fiscal 2022 results:

Net Sales: 2,450.0 billion yen

Operating Income: 230.0 billion yen

Ordinary Income: 230.0 billion yen

Net Income Attributable to Owners of Parent: 160.0 billion yen

No changes were made to the forecast exchange rates either, and the above figures are based on the U.S. dollar trading at 125 yen during the fiscal year (an appreciation of 7 yen from FY2022) and the euro at 135 yen (an appreciation of 3 yen).

■Contact us from the Press

Corporate Communication Division, PR group: +81-538-32-1145

■News Center: https://global.yamaha-motor.com/news/

Corporate Communication Division, PR group: +81-538-32-1145

■News Center: https://global.yamaha-motor.com/news/