Consolidated Business Results Summary - Full Fiscal Year Ending December 31, 2022 -

February 13, 2023

Consolidated Business Results

IWATA, February 13, 2023 - Yamaha Motor Co., Ltd. (Tokyo: 7272) announces its consolidated business results for the full 2022 fiscal year.

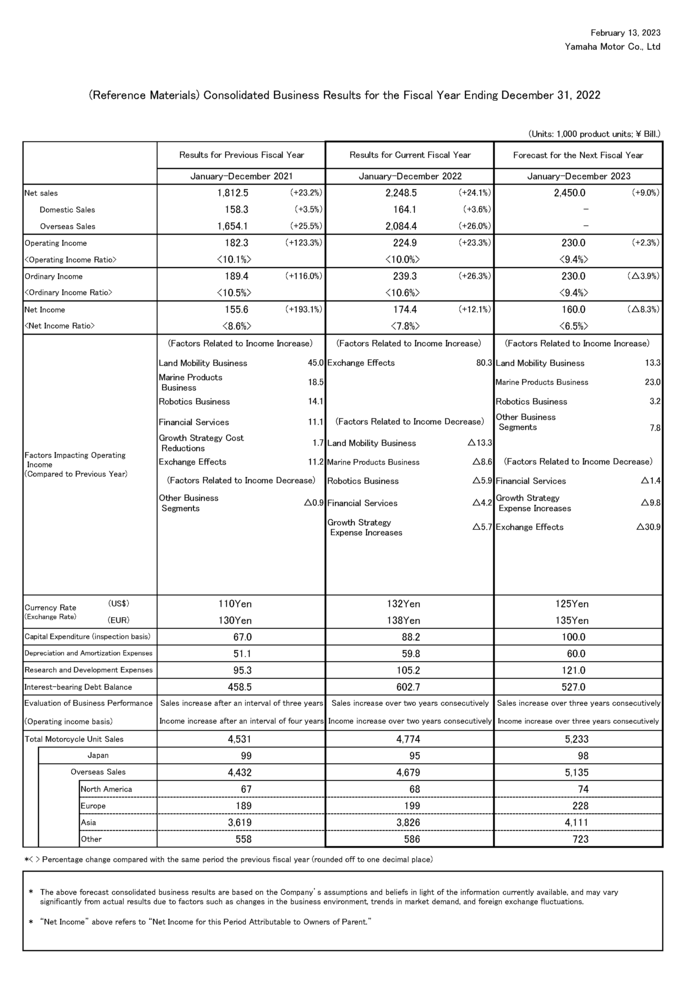

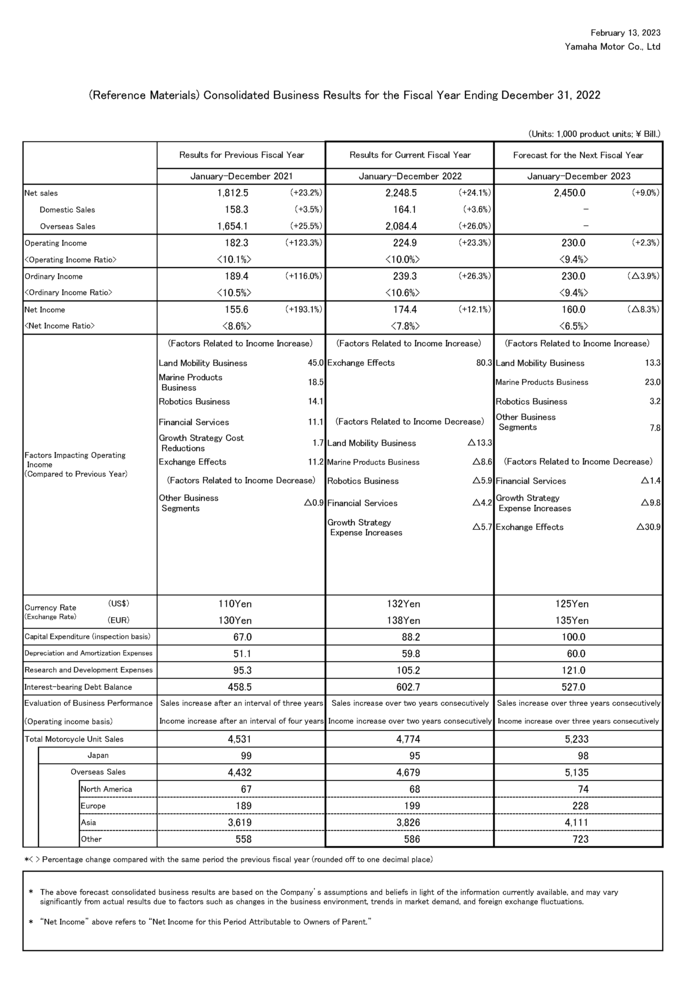

Net sales were 2,248.5 billion yen (an increase of 436.0 billion yen or 24.1% compared with the previous fiscal year) and operating income was 224.9 billion yen (an increase of 42.5 billion yen or 23.3%). Ordinary income was 239.3 billion yen (an increase of 49.9 billion yen or 26.3%) and net income attributable to owners of parent was 174.4 billion yen (an increase of 18.9 billion yen or 12.1%). These figures once again reset the Company's record for net sales and incomes, and this is also the first time Yamaha Motor has ever surpassed 2,000 billion yen in net sales and 200 billion yen in operating and ordinary income. For the full consolidated fiscal year, the U.S. dollar traded at 132 yen (a depreciation of 22 yen from the previous fiscal year) and the euro at 138 yen (a depreciation of 8 yen).

While affected by supply shortages brought on by global supply chain disruptions, net sales still rose due to high demand in developed markets for outboard motors and a recovery in demand for motorcycles in emerging markets. For operating income, there were significant increases in costs for raw materials, logistics, and more, but continued efforts to rein in costs, the effects of passing on costs materializing, and the added benefits of a weak yen led to higher profits for the year.

Results by Business Segment

Land Mobility Business

Net sales were 1,468.2 billion yen (an increase of 288.5 billion yen or 24.5% compared with the previous fiscal year) and operating income was 87.4 billion yen (an increase of 18.7 billion yen or 27.2%).

For the motorcycle business, demand remained firm in developed markets and unit sales rose in Europe and North America. In emerging markets, the resuming of economic activity in each country brought higher demand and unit sales increased accordingly in Indonesia, Vietnam, India, and other countries. The shortage of semiconductors and other parts is carrying on longer than expected, but progress in the procuring of alternative parts and components and meticulous production management efforts have minimized the effects, resulting in higher unit sales as well as higher net sales numbers. For operating income, the soaring production costs brought on by escalating raw material prices and logistics expenses presented challenges, but the passing on of costs and the depreciating yen also worked favorably. As a result, the Company recorded higher profits for the year.

With recreational vehicles (all-terrain vehicles, ROVs, and snowmobiles), the boom in outdoor recreation has continued, but the shortage of parts and components and supply chain disruptions has also continued and limited supply capabilities. While unit sales fell overall, net sales increased from passing on costs and the depreciating yen providing a further boost. Operating income, on the other hand, declined due to lower utilization rates at the Company's main U.S. manufacturing base and spiking production costs.

For electrically power-assisted bicycles, the shortage of parts and components triggered by the Shanghai lockdown in the second quarter and logistics holdups brought on by shipping container shortages led to severe production delays. The situation has since begun improving, but is still far from a complete recovery and unit sales fell. Still, the weak yen worked in the Company's favor and net sales rose slightly overall. In terms of operating income, however, despite working on pass-throughs to counter rising costs, the provisions for product warranties recorded due to a battery recall in the first quarter meant the business posted lower profits overall.

Marine Products Business

Net sales were 517.0 billion yen (an increase of 125.9 billion yen or 32.2% compared with the previous fiscal year) and operating income was 109.2 billion yen (an increase of 32.4 billion yen or 42.2%).

With outboard motors, the boom for outdoor recreation remains strong in developed markets and this was particularly true for large outboard models in the 200+ horsepower category. While container shortages and chaos at U.S. shipping ports impacted the business, the situation gradually improved and unit sales grew. There was also a recovery in tourism sector demand in emerging markets. For personal watercraft, the robust demand continued, but so did supply constraints stemming from part shortages and supply chain disruptions, and this drove down unit sales. Still, sales and profits both rose for the Marine Products business as a whole due to the cost pass-throughs enacted in the third quarter, in addition to the benefits brought by the weaker yen.

Robotics Business

Net sales were 115.9 billion yen (a decrease of 4.4 billion yen or 3.7% compared with the previous fiscal year) and operating income was 11.9 billion yen (a decrease of 5.7 billion yen or 32.6%).

In China, the Shanghai lockdown and a slower economic recovery led to lower capital investment demand there, but automotive sector investments in Europe and the U.S., the China Plus One strategy, and capital investments aimed at shifting to domestic production kept demand strong. With surface mounters, sales from large investments for automotive systems and other sectors primarily in Japan and other developed markets have grown steadily, but a cooling down of demand in China, Taiwan, and South Korea saw overall sales decline. It was a similar story for the Company's industrial robots and semiconductor manufacturing equipment, with sales falling in China, Taiwan, and other markets. As a result, the Robotics business as a whole posted lower net sales and profits also fell due to mounting costs for parts and logistics.

Financial Services Business

Net sales were 62.2 billion yen (an increase of 13.5 billion yen or 27.8% compared with the previous fiscal year) and operating income was 17.5 billion yen (a decrease of 1.6 billion yen or 8.4%).

The significant decrease in market inventories led to a decrease in wholesale receivables, but an increase in retail financing and a decrease in the allowance for doubtful accounts as a one-time factor brought in higher sales and profits.

Other Products

Net sales were 85.1 billion yen (an increase of 12.4 billion yen or 17.1% compared with the previous fiscal year) with an operating loss of 1.2 billion yen (down from an operating income of less than 1 billion yen).

Higher sales of premium-priced golf car models and the cost pass-throughs implemented brought higher sales overall, but operating income declined partly due to soaring raw material costs and the higher fixed costs accompanying supply chain disruptions.

Forecast of Consolidated Business Results for the Fiscal Year Ending December 31, 2023

In 2022, the world experienced continued destabilizing socioeconomic occurrences as well as rising costs for raw materials, logistics, and more. But amidst all that, demand either quickly bounced back or remained strong in almost all segments (except for capital investment demand in China for the Robotics business). In 2023, we expect demand to remain particularly high for large outboard motor models and motorcycles in emerging markets, so we will look to make progress with parts procurement, production, and shipments as we aim to optimize our market inventory levels for products in short supply. Furthermore, the Company expects the effects of the cost pass-throughs implemented in 2022 to manifest even more clearly in 2023, and for ocean freight rates to be lower than the previous year.

However, the risks anticipated include price hikes accompanying a recovery in automobile production for materials like aluminum, precious metals, and steel, as well as further rises in labor and energy costs. Additionally, global economic trends, exchange rate fluctuations, and other factors make the situation quite uncertain.

To address these risks, we will move forward with core structural reforms and measures to reinforce our foundations, such as lowering costs and raising productivity. At the same time, the marketing and technology departments will come together to work on upping the pace of such reforms, create new value for adapting to changes in our business environment, and make headway with initiatives for sustainable growth.

Also, regarding the effects from the ongoing shortage of semiconductors and other components on the Company's immediate production operations, progress has been made with developing alternatives, so we expect things to begin improving in the latter half of 2023.

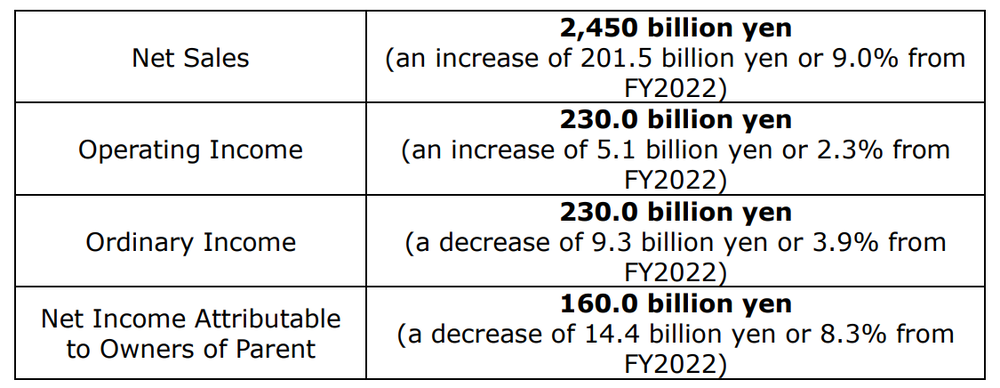

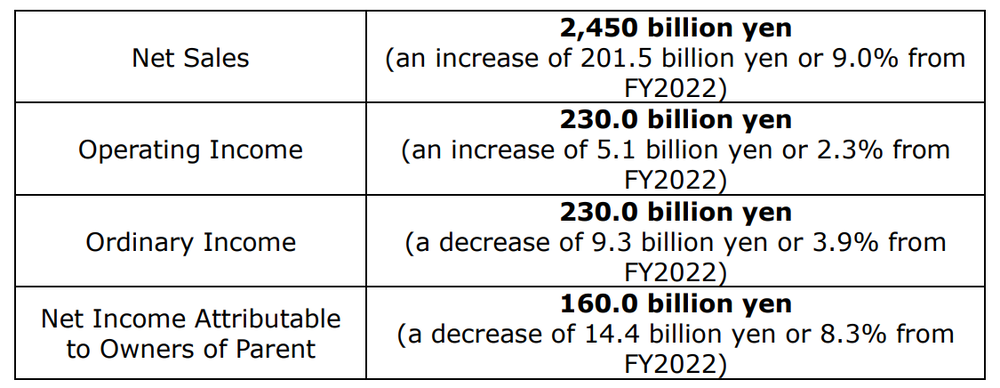

The forecast consolidated business results for FY2023 are as follows.

These forecast figures are based on the U.S. dollar trading at 125 yen during the fiscal year (an appreciation of 7 yen from FY2022) and the euro at 135 yen (an appreciation of 3 yen).

Basic Policy Concerning Profit Distribution and Dividends for the Current and Subsequent Fiscal Years

Recognizing that improvement of shareholder benefits represents one of the Company's highest management priorities, the Company has been striving to meet shareholder expectations by working to maximize its corporate value.

The Company works on the principle of paying an interim dividend and a final dividend. Decisions with regard to the dividends are made by the Board of Directors for the interim dividend, and the Ordinary General Meeting of Shareholders for the final dividend. The dividend record dates are stated in the Articles of Incorporation as June 30 for the interim dividend and December 31 for the final dividend.

Regarding the final dividend for the current fiscal year, a dividend of 67.5 yen per share is planned to be placed on the agenda of the 88th Ordinary General Meeting of Shareholders, scheduled for March 22, 2023. With the interim dividend of 57.5 yen per share, this gives a total dividend for the year of 125 yen per share.

In addition, as specified in the new Medium-Term Management Plan announced in 2022, per our new shareholder returns policy, we will emphasize making consistent and ongoing dividend payments while taking into consideration the outlook for business performance and investments for future growth, and continue distributing returns to shareholders in a flexible way based on the scale of our cash flows with the total payout ratio set at the 40% range for the cumulative total of the plan's period.

With regard to the next fiscal year, a total of 130 yen (interim dividend of 65 yen and final dividend of 65 yen) is planned, as well as a 30.0 billion yen acquisition of treasury stock.

■Contact us from the Press

Corporate Communication Division, PR group: +81-3-5220-7211

■News Center: https://global.yamaha-motor.com/news/

IWATA, February 13, 2023 - Yamaha Motor Co., Ltd. (Tokyo: 7272) announces its consolidated business results for the full 2022 fiscal year.

Net sales were 2,248.5 billion yen (an increase of 436.0 billion yen or 24.1% compared with the previous fiscal year) and operating income was 224.9 billion yen (an increase of 42.5 billion yen or 23.3%). Ordinary income was 239.3 billion yen (an increase of 49.9 billion yen or 26.3%) and net income attributable to owners of parent was 174.4 billion yen (an increase of 18.9 billion yen or 12.1%). These figures once again reset the Company's record for net sales and incomes, and this is also the first time Yamaha Motor has ever surpassed 2,000 billion yen in net sales and 200 billion yen in operating and ordinary income. For the full consolidated fiscal year, the U.S. dollar traded at 132 yen (a depreciation of 22 yen from the previous fiscal year) and the euro at 138 yen (a depreciation of 8 yen).

While affected by supply shortages brought on by global supply chain disruptions, net sales still rose due to high demand in developed markets for outboard motors and a recovery in demand for motorcycles in emerging markets. For operating income, there were significant increases in costs for raw materials, logistics, and more, but continued efforts to rein in costs, the effects of passing on costs materializing, and the added benefits of a weak yen led to higher profits for the year.

Results by Business Segment

Land Mobility Business

Net sales were 1,468.2 billion yen (an increase of 288.5 billion yen or 24.5% compared with the previous fiscal year) and operating income was 87.4 billion yen (an increase of 18.7 billion yen or 27.2%).

For the motorcycle business, demand remained firm in developed markets and unit sales rose in Europe and North America. In emerging markets, the resuming of economic activity in each country brought higher demand and unit sales increased accordingly in Indonesia, Vietnam, India, and other countries. The shortage of semiconductors and other parts is carrying on longer than expected, but progress in the procuring of alternative parts and components and meticulous production management efforts have minimized the effects, resulting in higher unit sales as well as higher net sales numbers. For operating income, the soaring production costs brought on by escalating raw material prices and logistics expenses presented challenges, but the passing on of costs and the depreciating yen also worked favorably. As a result, the Company recorded higher profits for the year.

With recreational vehicles (all-terrain vehicles, ROVs, and snowmobiles), the boom in outdoor recreation has continued, but the shortage of parts and components and supply chain disruptions has also continued and limited supply capabilities. While unit sales fell overall, net sales increased from passing on costs and the depreciating yen providing a further boost. Operating income, on the other hand, declined due to lower utilization rates at the Company's main U.S. manufacturing base and spiking production costs.

For electrically power-assisted bicycles, the shortage of parts and components triggered by the Shanghai lockdown in the second quarter and logistics holdups brought on by shipping container shortages led to severe production delays. The situation has since begun improving, but is still far from a complete recovery and unit sales fell. Still, the weak yen worked in the Company's favor and net sales rose slightly overall. In terms of operating income, however, despite working on pass-throughs to counter rising costs, the provisions for product warranties recorded due to a battery recall in the first quarter meant the business posted lower profits overall.

Marine Products Business

Net sales were 517.0 billion yen (an increase of 125.9 billion yen or 32.2% compared with the previous fiscal year) and operating income was 109.2 billion yen (an increase of 32.4 billion yen or 42.2%).

With outboard motors, the boom for outdoor recreation remains strong in developed markets and this was particularly true for large outboard models in the 200+ horsepower category. While container shortages and chaos at U.S. shipping ports impacted the business, the situation gradually improved and unit sales grew. There was also a recovery in tourism sector demand in emerging markets. For personal watercraft, the robust demand continued, but so did supply constraints stemming from part shortages and supply chain disruptions, and this drove down unit sales. Still, sales and profits both rose for the Marine Products business as a whole due to the cost pass-throughs enacted in the third quarter, in addition to the benefits brought by the weaker yen.

Robotics Business

Net sales were 115.9 billion yen (a decrease of 4.4 billion yen or 3.7% compared with the previous fiscal year) and operating income was 11.9 billion yen (a decrease of 5.7 billion yen or 32.6%).

In China, the Shanghai lockdown and a slower economic recovery led to lower capital investment demand there, but automotive sector investments in Europe and the U.S., the China Plus One strategy, and capital investments aimed at shifting to domestic production kept demand strong. With surface mounters, sales from large investments for automotive systems and other sectors primarily in Japan and other developed markets have grown steadily, but a cooling down of demand in China, Taiwan, and South Korea saw overall sales decline. It was a similar story for the Company's industrial robots and semiconductor manufacturing equipment, with sales falling in China, Taiwan, and other markets. As a result, the Robotics business as a whole posted lower net sales and profits also fell due to mounting costs for parts and logistics.

Financial Services Business

Net sales were 62.2 billion yen (an increase of 13.5 billion yen or 27.8% compared with the previous fiscal year) and operating income was 17.5 billion yen (a decrease of 1.6 billion yen or 8.4%).

The significant decrease in market inventories led to a decrease in wholesale receivables, but an increase in retail financing and a decrease in the allowance for doubtful accounts as a one-time factor brought in higher sales and profits.

Other Products

Net sales were 85.1 billion yen (an increase of 12.4 billion yen or 17.1% compared with the previous fiscal year) with an operating loss of 1.2 billion yen (down from an operating income of less than 1 billion yen).

Higher sales of premium-priced golf car models and the cost pass-throughs implemented brought higher sales overall, but operating income declined partly due to soaring raw material costs and the higher fixed costs accompanying supply chain disruptions.

Forecast of Consolidated Business Results for the Fiscal Year Ending December 31, 2023

In 2022, the world experienced continued destabilizing socioeconomic occurrences as well as rising costs for raw materials, logistics, and more. But amidst all that, demand either quickly bounced back or remained strong in almost all segments (except for capital investment demand in China for the Robotics business). In 2023, we expect demand to remain particularly high for large outboard motor models and motorcycles in emerging markets, so we will look to make progress with parts procurement, production, and shipments as we aim to optimize our market inventory levels for products in short supply. Furthermore, the Company expects the effects of the cost pass-throughs implemented in 2022 to manifest even more clearly in 2023, and for ocean freight rates to be lower than the previous year.

However, the risks anticipated include price hikes accompanying a recovery in automobile production for materials like aluminum, precious metals, and steel, as well as further rises in labor and energy costs. Additionally, global economic trends, exchange rate fluctuations, and other factors make the situation quite uncertain.

To address these risks, we will move forward with core structural reforms and measures to reinforce our foundations, such as lowering costs and raising productivity. At the same time, the marketing and technology departments will come together to work on upping the pace of such reforms, create new value for adapting to changes in our business environment, and make headway with initiatives for sustainable growth.

Also, regarding the effects from the ongoing shortage of semiconductors and other components on the Company's immediate production operations, progress has been made with developing alternatives, so we expect things to begin improving in the latter half of 2023.

The forecast consolidated business results for FY2023 are as follows.

These forecast figures are based on the U.S. dollar trading at 125 yen during the fiscal year (an appreciation of 7 yen from FY2022) and the euro at 135 yen (an appreciation of 3 yen).

Basic Policy Concerning Profit Distribution and Dividends for the Current and Subsequent Fiscal Years

Recognizing that improvement of shareholder benefits represents one of the Company's highest management priorities, the Company has been striving to meet shareholder expectations by working to maximize its corporate value.

The Company works on the principle of paying an interim dividend and a final dividend. Decisions with regard to the dividends are made by the Board of Directors for the interim dividend, and the Ordinary General Meeting of Shareholders for the final dividend. The dividend record dates are stated in the Articles of Incorporation as June 30 for the interim dividend and December 31 for the final dividend.

Regarding the final dividend for the current fiscal year, a dividend of 67.5 yen per share is planned to be placed on the agenda of the 88th Ordinary General Meeting of Shareholders, scheduled for March 22, 2023. With the interim dividend of 57.5 yen per share, this gives a total dividend for the year of 125 yen per share.

In addition, as specified in the new Medium-Term Management Plan announced in 2022, per our new shareholder returns policy, we will emphasize making consistent and ongoing dividend payments while taking into consideration the outlook for business performance and investments for future growth, and continue distributing returns to shareholders in a flexible way based on the scale of our cash flows with the total payout ratio set at the 40% range for the cumulative total of the plan's period.

With regard to the next fiscal year, a total of 130 yen (interim dividend of 65 yen and final dividend of 65 yen) is planned, as well as a 30.0 billion yen acquisition of treasury stock.

■Contact us from the Press

Corporate Communication Division, PR group: +81-3-5220-7211

■News Center: https://global.yamaha-motor.com/news/