Consolidated Business Results Summary -- First Nine Months of Fiscal Year Ending December 31, 2022 --

November 7, 2022

Consolidated Business Results

IWATA, November 7, 2022 - Yamaha Motor Co., Ltd. (Tokyo: 7272) announces its consolidated business results for the first nine months of fiscal 2022.

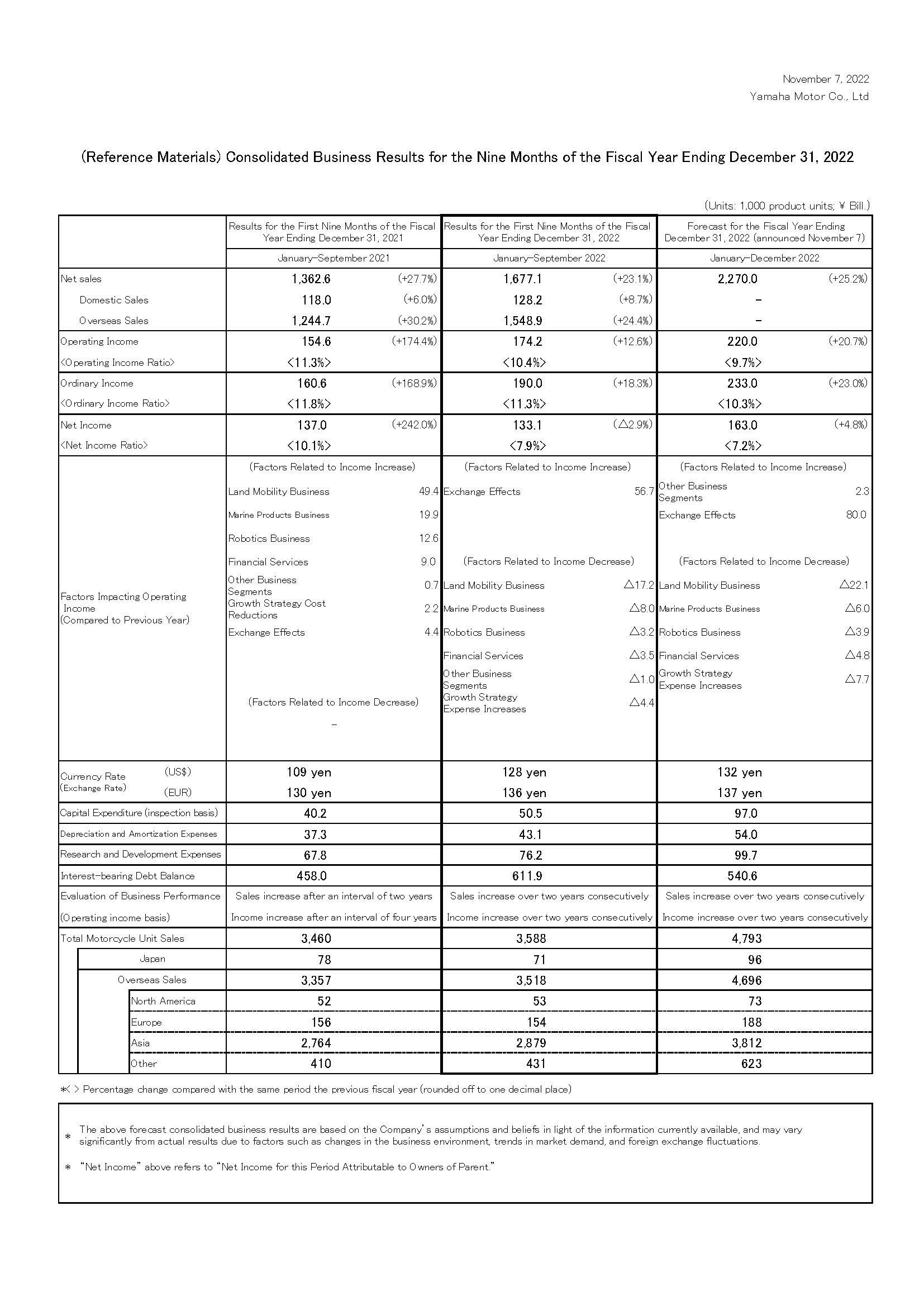

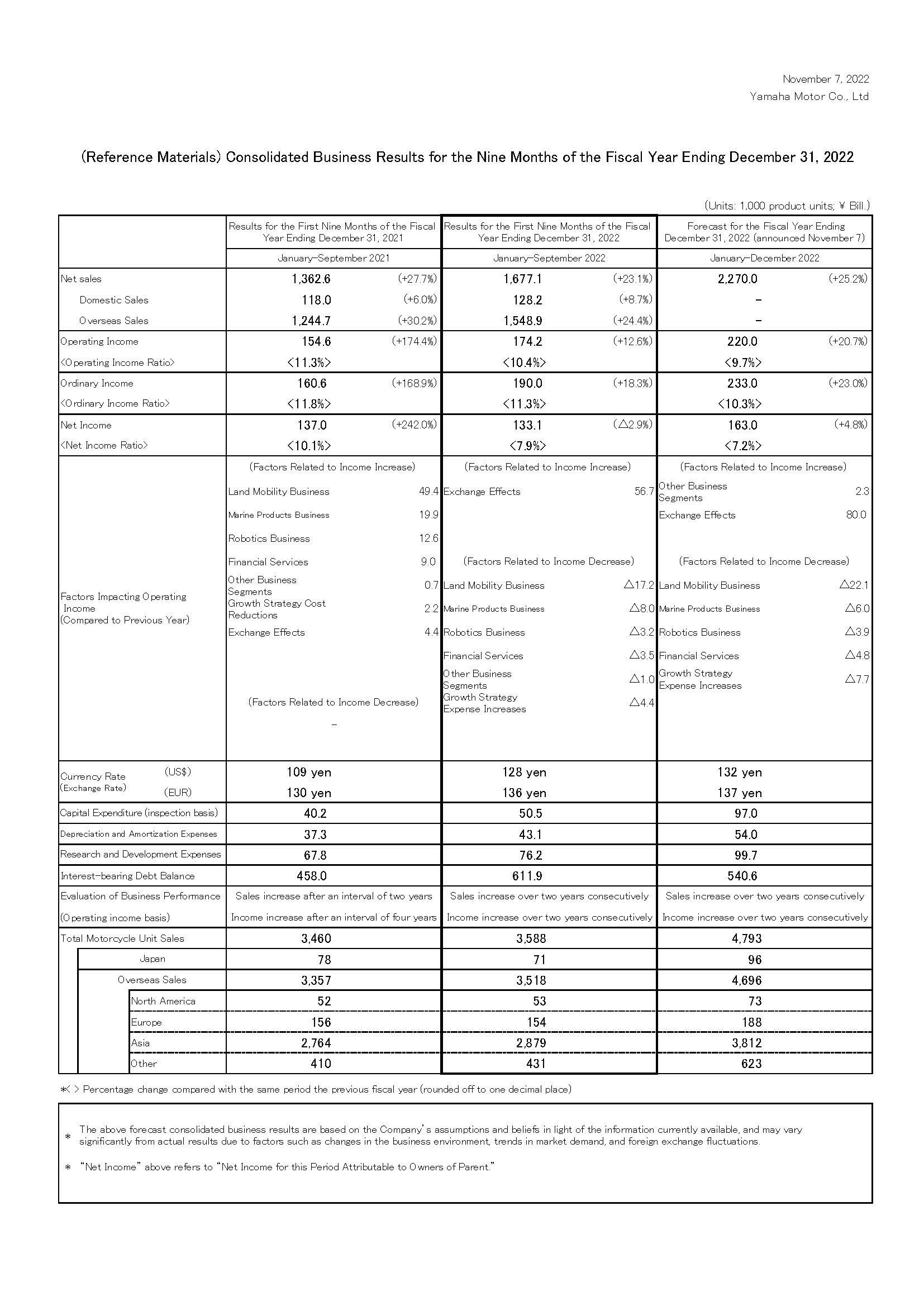

Net sales for the consolidated accounting period for the first nine months of the fiscal year ending December 31, 2022 were 1,667.1 billion yen (an increase of 314.5 billion yen or 23.1% compared with the same period of the previous fiscal year) and an operating income of 174.2 billion yen (an increase of 19.6 billion yen or 12.6%). Ordinary income was 190.0 billion yen (an increase of 29.4 billion yen or 18.3%) and net income attributable to owners of parent was 133.1 billion yen (a decrease of 3.9 billion yen or 2.9%). These represent record-high net sales, operating income and ordinary income for the Company for a third quarter accounting period.

For this third quarter consolidated accounting period, the U.S. dollar traded at 128 yen (a depreciation of 19 yen from the same period of the previous fiscal year) and the euro at 136 yen (a depreciation of 6 yen).

Despite procurement difficulties for semiconductors and other electronic components and facing the effects of lockdowns imposed due to the COVID-19 pandemic, the Company posted an overall increase in net sales thanks to higher outboard motor sales in developed markets driven by the continued demand for marine recreation, and a year-on-year rise in motorcycle sales brought on by the economic recoveries seen in emerging markets. For operating income, the costs of raw materials, logistics, and personnel continue to soar, but by making headway with reducing expenses and passing on costs, plus the added benefits of a weakened yen, the Company recorded higher profits for the period.

Results by Business Segment

Land Mobility Business

Net sales were 1,085.3 billion yen (an increase of 203.3 billion yen or 23.0% compared with the same period of the previous fiscal year) and operating income was 66.2 billion yen (an increase of 5.8 billion yen or 9.6%).

For the motorcycle business, the easing of COVID-19 restrictions and moves for resuming economic activity in each country brought higher demand. Higher unit sales in India, China, Indonesia, and other markets led to higher net sales for the business. For operating income, the soaring costs of raw materials and the insufficient supply of semiconductors and other components have remained, but the Company began the procurement of alternative parts and components, placed priority on the production of high-added-value models, continued the passing on of costs, and the depreciating yen also worked in our favor. As a result, the Company recorded higher profits for the period.

With recreational vehicles (all-terrain vehicles, recreational off-highway vehicles, and snowmobiles), the boom in demand continues, but procuring parts and components remains an ongoing challenge. While unit sales fell overall, sales of the Wolverine RMAX Series - a priority model line for the Company - exceeded those of last year. In addition, the depreciating yen provided a further boost and helped increase net sales. On the other hand, operating income declined due to an increase in costs at U.S. production bases, rising raw material prices, and spiking labor expenses.

For electrically power-assisted bicycles, the Shanghai lockdown led to a shortage of parts and components, which in turn caused production delays that brought down unit sales. While things appear positive for the immediate future and the Company has worked on pass-throughs to counter rising costs, the provisions for product warranties recorded due to a battery recall in the first quarter of the consolidated accounting period meant the business posted lower sales and profits overall.

Marine Products Business

Net sales were 398.7 billion yen (an increase of 96.2 billion yen or 31.8% compared with the same period of the previous fiscal year) and operating income was 84.3 billion yen (an increase of 19.7 billion yen or 30.5%).

The boom for outdoor recreation remains strong and outboard motor demand in developed markets was robust throughout the period. The Company was able to consistently load ships in Japan with products bound for the U.S. and this helped increase unit sales. For personal watercraft, the Company has seen continuously high demand, but also experiencing production delays due to part procurement difficulties and this decreased unit sales. Still, sales and profits both rose for the Marine Products business as a whole due to the price pass-throughs enacted in this third quarter of the consolidated accounting period in addition to the benefits brought by the weaker yen.

Robotics Business

Net sales were 87.8 billion yen (a decrease of 0.7 billion yen or 0.8% compared with the same period of the previous fiscal year) and operating income was 10.9 billion yen (a decrease of 2.9 billion yen or 20.9%).

Demand for surface mounters in China declined due to the Shanghai lockdown as well as the cooling down of domestic demand, but was firm overall in Europe and the U.S. In terms of sales, the Company saw an increase in domestic sales from a recovery in the automotive sector and others, but sales fell overall due to the shortage of semiconductors and other components as well as waning capital investment in China, Taiwan, and South Korea. In the semiconductor equipment market, demand fell for capital investment aimed at manufacturing household appliances and other products meant for general consumers, but demand in the automotive sector remained steady. Yamaha Robotics Holdings Co., Ltd. experienced a drop in sales due in part to making adjustments to align its operations with the current semiconductor market situation, but made progress with profitability improvements and recorded higher profits. As a result, the Robotics business as a whole posted lower net sales and profits due to mounting costs for materials and logistics.

Financial Services Business

Net sales were 44.6 billion yen (an increase of 8.7 billion yen or 24.2% compared with the same period of the previous fiscal year) and operating income was 13.5 billion yen (a decrease of 1.5 billion yen or 10.0%).

Receivables increased in the U.S. and Brazil and this drove up sales, but for operating income, profits fell due to the effects of rising interest rates upping procurement costs and the decrease in the one-time allowance for doubtful accounts the previous year.

Other Products Business

Net sales were 60.6 billion yen (an increase of 7.1 billion yen or 13.2% compared with the same period of the previous fiscal year) with an operating loss of 0.7 billion yen (down from an operating income of 0.9 billion yen). Sales rose thanks to an increase in premium-priced golf car unit sales, but operating income declined partly due to rising raw material costs and fixed costs.

Forecast of Consolidated Business Results

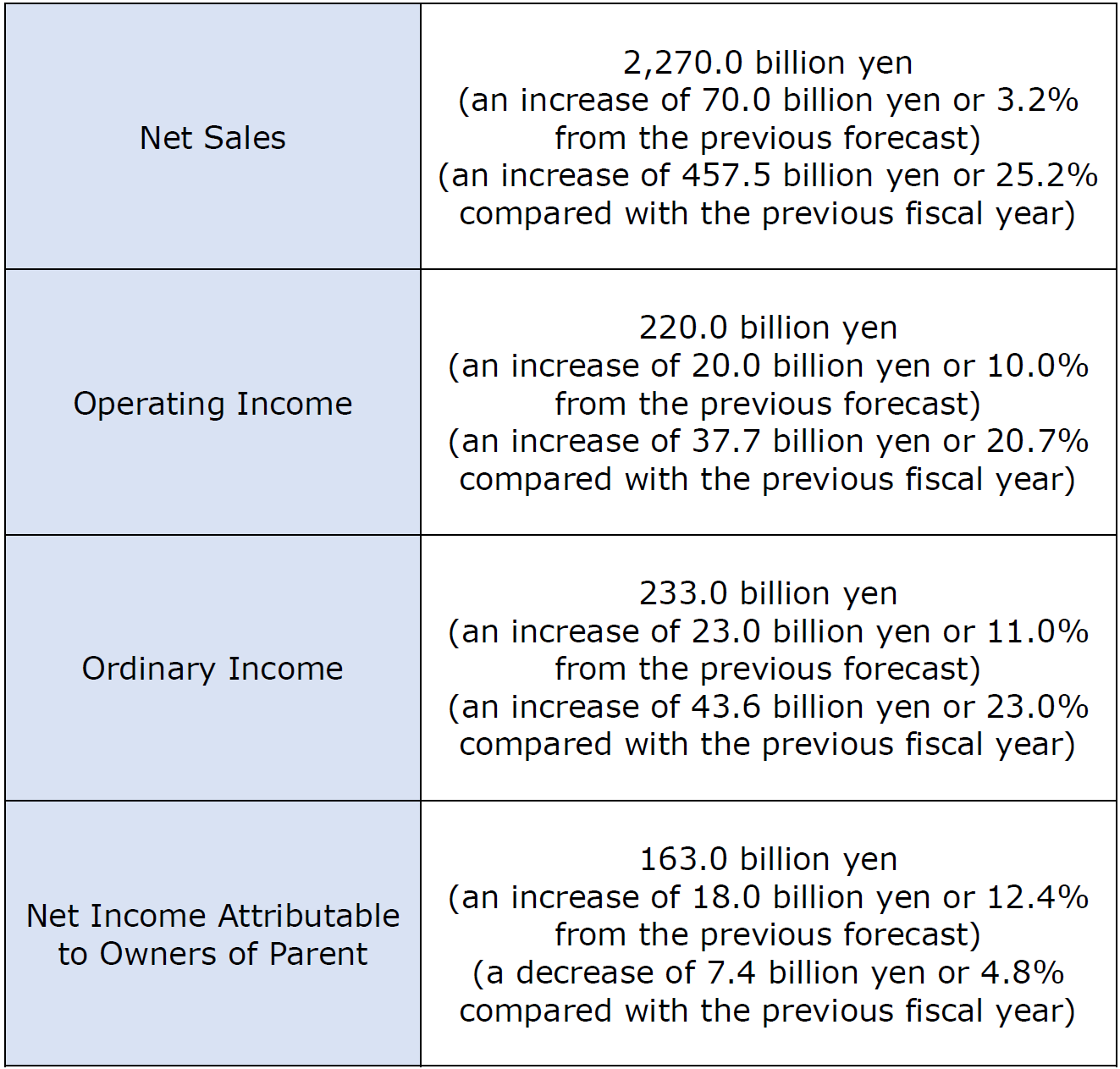

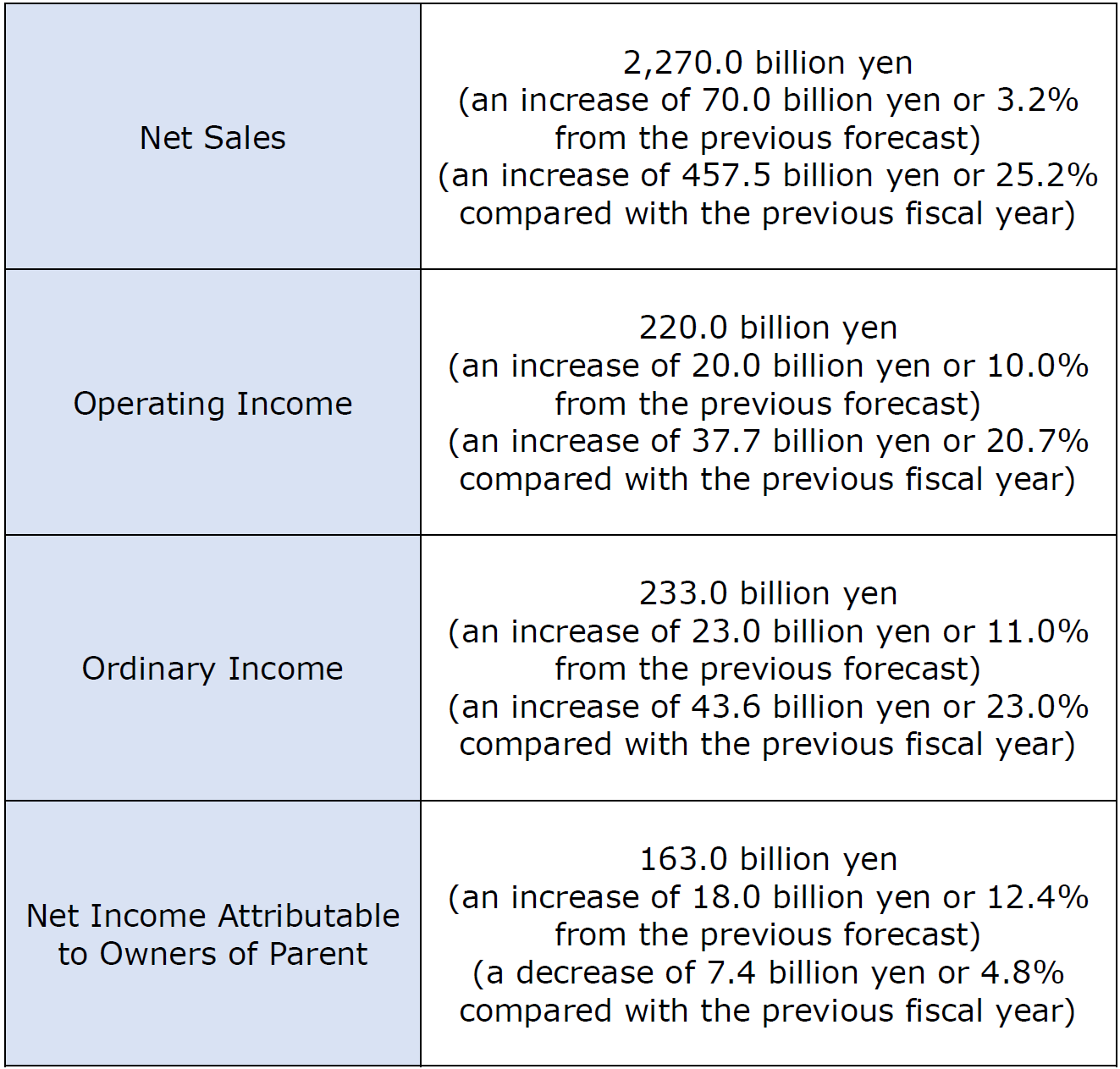

For the remainder of the fiscal year ending December 31, 2022, the Company expects its break-even-point management style will lower expenses more than expected and yield progress with cost reduction efforts, thereby lowering the impact of rising costs. Further, taking into account the changes made to assumed foreign exchange rates, the Company has revised its forecasts for net sales and various incomes as follows.

These forecast figures are based on the U.S. dollar trading at 132 yen during the fiscal year (a depreciation of 5 yen from the previous forecast and a year-on-year depreciation of 22 yen) and the euro at 137 yen (a depreciation of 3 yen from the previous forecast and a year-on-year depreciation of 7 yen).

Basic Policy Concerning Profit Distribution and Dividends for the Current Fiscal Year

For shareholder returns, the Company's basic policy is to emphasize making consistent and ongoing dividend payments while taking into consideration the outlook for business performance and investments for future growth, distributing returns to shareholders in a flexible way based on the scale of our cash flows with the total payout ratio set at the 40% range for the cumulative total of the Medium-Term Management Plan's three-year period.

In terms of dividends for this fiscal year, though the business forecast has been revised, the Company has decided to maintain the full-year dividend forecast of 115 yen per share with an interim dividend of 57.5 yen per share.

■Contact us from the Press

Corporate Communication Division, PR group: +81-3-5220-7211

■News Center: https://global.yamaha-motor.com/news/

IWATA, November 7, 2022 - Yamaha Motor Co., Ltd. (Tokyo: 7272) announces its consolidated business results for the first nine months of fiscal 2022.

Net sales for the consolidated accounting period for the first nine months of the fiscal year ending December 31, 2022 were 1,667.1 billion yen (an increase of 314.5 billion yen or 23.1% compared with the same period of the previous fiscal year) and an operating income of 174.2 billion yen (an increase of 19.6 billion yen or 12.6%). Ordinary income was 190.0 billion yen (an increase of 29.4 billion yen or 18.3%) and net income attributable to owners of parent was 133.1 billion yen (a decrease of 3.9 billion yen or 2.9%). These represent record-high net sales, operating income and ordinary income for the Company for a third quarter accounting period.

For this third quarter consolidated accounting period, the U.S. dollar traded at 128 yen (a depreciation of 19 yen from the same period of the previous fiscal year) and the euro at 136 yen (a depreciation of 6 yen).

Despite procurement difficulties for semiconductors and other electronic components and facing the effects of lockdowns imposed due to the COVID-19 pandemic, the Company posted an overall increase in net sales thanks to higher outboard motor sales in developed markets driven by the continued demand for marine recreation, and a year-on-year rise in motorcycle sales brought on by the economic recoveries seen in emerging markets. For operating income, the costs of raw materials, logistics, and personnel continue to soar, but by making headway with reducing expenses and passing on costs, plus the added benefits of a weakened yen, the Company recorded higher profits for the period.

Results by Business Segment

Land Mobility Business

Net sales were 1,085.3 billion yen (an increase of 203.3 billion yen or 23.0% compared with the same period of the previous fiscal year) and operating income was 66.2 billion yen (an increase of 5.8 billion yen or 9.6%).

For the motorcycle business, the easing of COVID-19 restrictions and moves for resuming economic activity in each country brought higher demand. Higher unit sales in India, China, Indonesia, and other markets led to higher net sales for the business. For operating income, the soaring costs of raw materials and the insufficient supply of semiconductors and other components have remained, but the Company began the procurement of alternative parts and components, placed priority on the production of high-added-value models, continued the passing on of costs, and the depreciating yen also worked in our favor. As a result, the Company recorded higher profits for the period.

With recreational vehicles (all-terrain vehicles, recreational off-highway vehicles, and snowmobiles), the boom in demand continues, but procuring parts and components remains an ongoing challenge. While unit sales fell overall, sales of the Wolverine RMAX Series - a priority model line for the Company - exceeded those of last year. In addition, the depreciating yen provided a further boost and helped increase net sales. On the other hand, operating income declined due to an increase in costs at U.S. production bases, rising raw material prices, and spiking labor expenses.

For electrically power-assisted bicycles, the Shanghai lockdown led to a shortage of parts and components, which in turn caused production delays that brought down unit sales. While things appear positive for the immediate future and the Company has worked on pass-throughs to counter rising costs, the provisions for product warranties recorded due to a battery recall in the first quarter of the consolidated accounting period meant the business posted lower sales and profits overall.

Marine Products Business

Net sales were 398.7 billion yen (an increase of 96.2 billion yen or 31.8% compared with the same period of the previous fiscal year) and operating income was 84.3 billion yen (an increase of 19.7 billion yen or 30.5%).

The boom for outdoor recreation remains strong and outboard motor demand in developed markets was robust throughout the period. The Company was able to consistently load ships in Japan with products bound for the U.S. and this helped increase unit sales. For personal watercraft, the Company has seen continuously high demand, but also experiencing production delays due to part procurement difficulties and this decreased unit sales. Still, sales and profits both rose for the Marine Products business as a whole due to the price pass-throughs enacted in this third quarter of the consolidated accounting period in addition to the benefits brought by the weaker yen.

Robotics Business

Net sales were 87.8 billion yen (a decrease of 0.7 billion yen or 0.8% compared with the same period of the previous fiscal year) and operating income was 10.9 billion yen (a decrease of 2.9 billion yen or 20.9%).

Demand for surface mounters in China declined due to the Shanghai lockdown as well as the cooling down of domestic demand, but was firm overall in Europe and the U.S. In terms of sales, the Company saw an increase in domestic sales from a recovery in the automotive sector and others, but sales fell overall due to the shortage of semiconductors and other components as well as waning capital investment in China, Taiwan, and South Korea. In the semiconductor equipment market, demand fell for capital investment aimed at manufacturing household appliances and other products meant for general consumers, but demand in the automotive sector remained steady. Yamaha Robotics Holdings Co., Ltd. experienced a drop in sales due in part to making adjustments to align its operations with the current semiconductor market situation, but made progress with profitability improvements and recorded higher profits. As a result, the Robotics business as a whole posted lower net sales and profits due to mounting costs for materials and logistics.

Financial Services Business

Net sales were 44.6 billion yen (an increase of 8.7 billion yen or 24.2% compared with the same period of the previous fiscal year) and operating income was 13.5 billion yen (a decrease of 1.5 billion yen or 10.0%).

Receivables increased in the U.S. and Brazil and this drove up sales, but for operating income, profits fell due to the effects of rising interest rates upping procurement costs and the decrease in the one-time allowance for doubtful accounts the previous year.

Other Products Business

Net sales were 60.6 billion yen (an increase of 7.1 billion yen or 13.2% compared with the same period of the previous fiscal year) with an operating loss of 0.7 billion yen (down from an operating income of 0.9 billion yen). Sales rose thanks to an increase in premium-priced golf car unit sales, but operating income declined partly due to rising raw material costs and fixed costs.

Forecast of Consolidated Business Results

For the remainder of the fiscal year ending December 31, 2022, the Company expects its break-even-point management style will lower expenses more than expected and yield progress with cost reduction efforts, thereby lowering the impact of rising costs. Further, taking into account the changes made to assumed foreign exchange rates, the Company has revised its forecasts for net sales and various incomes as follows.

These forecast figures are based on the U.S. dollar trading at 132 yen during the fiscal year (a depreciation of 5 yen from the previous forecast and a year-on-year depreciation of 22 yen) and the euro at 137 yen (a depreciation of 3 yen from the previous forecast and a year-on-year depreciation of 7 yen).

Basic Policy Concerning Profit Distribution and Dividends for the Current Fiscal Year

For shareholder returns, the Company's basic policy is to emphasize making consistent and ongoing dividend payments while taking into consideration the outlook for business performance and investments for future growth, distributing returns to shareholders in a flexible way based on the scale of our cash flows with the total payout ratio set at the 40% range for the cumulative total of the Medium-Term Management Plan's three-year period.

In terms of dividends for this fiscal year, though the business forecast has been revised, the Company has decided to maintain the full-year dividend forecast of 115 yen per share with an interim dividend of 57.5 yen per share.

■Contact us from the Press

Corporate Communication Division, PR group: +81-3-5220-7211

■News Center: https://global.yamaha-motor.com/news/