Yamaha Motor: Revision of Directors' Remuneration Amounts and Introduction of Shares with Restriction on Transfer Remuneration System

February 12, 2019

IWATA, February 12, 2019—Yamaha Motor Co., Ltd. (Tokyo: 7272) hereby announces that, at the Board of Directors meeting held on February 12, 2019, a resolution was passed to revise the directors' remuneration system and remuneration amounts, to introduce a system of remuneration of shares with restriction on transfer, and to place a resolution regarding the new directors' remuneration system on the agenda of the 84th Ordinary General Meeting of Shareholders (hereafter, "the General Meeting") scheduled for March 27, 2019.

1. Objectives of the revision of the directors' remuneration system

With the overarching aim of further promotion of sharing value with all shareholders, Yamaha Motor Co., Ltd. has revised the directors' remuneration system to further clarify the responsibility to deliver the newly-formulated long-term vision and New Medium-Term Management Plan as well as to achieve short-term performance targets, in addition to providing incentives for sustainable growth in corporate value.

2. Composition and proportions of directors' remuneration

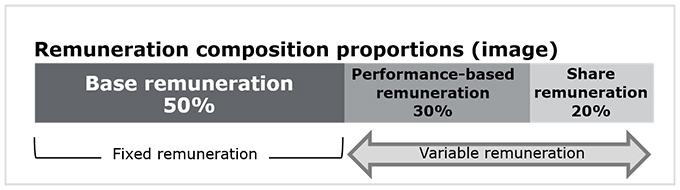

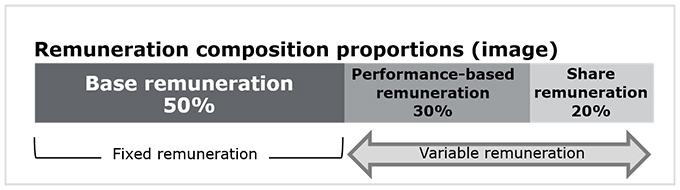

The new remuneration system is to be comprised of base remuneration (fixed remuneration), performance-based remuneration, and share remuneration. The proportions of base remuneration: performance-based remuneration: share remuneration for the President and Representative Director is to be set at roughly 50%:30%:20% of the reference amount. For other directors, the amounts are to be determined bearing in mind their duties and remuneration level etc., with reference to the President and Representative Director.

Performance-based remuneration is to be made up of a whole-company performance-based bonus (equivalent to the previous directors' bonuses), which reflects whole-company consolidated business results over the fiscal year, and an individual performance-based bonus (equivalent to the previous individual performance-based remuneration), linked to the performance of each individual director. As previously, the Representative Director is to only be paid the whole-company performance-based bonus component of the performance-based remuneration.

(Please refer to the subsequent "Reference: New Yamaha Motor Co., Ltd. Executive Remuneration System" for an overview of the new remuneration system.)

3. Revision of remuneration amounts

Currently, Yamaha Motor Co., Ltd. directors' remuneration comprises base remuneration, directors' bonuses reflecting whole-company short-term consolidated business results, individual performance-based remuneration linked to each director's performance, and a share remuneration plan reflecting whole-company consolidated business results over the medium- to long-term term.

Among the above directors' remuneration amounts, the directors' remuneration amounts excluding directors' bonuses (the previous base remuneration, individual performance-based remuneration, and share remuneration plan) were approved at the 73rd Ordinary General Meeting of Shareholders held on March 26, 2008 up to an annual amount of 540 million yen (of which, the portion for outside directors is an annual amount of up to 50 million yen). In addition, the total (annual) amounts of directors' bonuses were approved at the 79th Ordinary General Meeting of Shareholders held on March 25, 2014 as payable up to 0.5% of the net income attributed to owners of parents of the previous consolidated fiscal year.

As part of the revision of the remuneration system, the Company has taken into account the broadening of the diversity and specializations etc. of directors, with the aim of improving corporate governance. The Company plans to place a resolution revising base remuneration (fixed remuneration) to an annual amount of up to 500 million yen (of which, the portion for outside directors is an annual amount of up to 100 million yen) and individual performance-based bonuses (equivalent to the previous individual performance-based remuneration) to an annual amount of up to 100 million yen on the agenda of the General Meeting. In addition, as per 4. "Introduction of a system of remuneration of shares with restriction on transfer" below, a new system of remuneration of shares with restriction on transfer is to be introduced as replacement for the previous share remuneration plan. The Company plans to place a resolution regarding payment of share options worth up to an annual amount of 200 million yen on the agenda of the General Meeting.

Moreover, the total amount of the whole-company performance-based bonus (equivalent to the previous directors' bonuses) is to be, as previously, payable up to 0.5% of the net income attributed to owners of parents of the previous consolidated fiscal year. In addition, the above remuneration amounts are not to include the employee salary amounts of those directors who work both as an employee and a director.

4. Introduction of a system of remuneration of shares with restriction on transfer

In order to further promote sharing value with Yamaha Motor Co., Ltd. directors and all shareholders as well as to increase the medium- to long-term corporate value of Yamaha Motor Co., Ltd., Yamaha Motor Co., Ltd. is to implement a new remuneration system allocating shares with restriction on transfer (hereafter "the Share Remuneration System") for directors excluding outside directors (hereafter "Applicable Director") as replacement for the previous share remuneration plan.

The Share Remuneration System is to pay the Applicable Directors share options as remuneration in order to impart shares with restriction on transfer. Separate to the amounts of remuneration in 3. "Revision of remuneration amounts" above, the Company plans to ask all shareholders for their approval of payment of share options worth up to a total annual amount of 200 million yen (however, this amount is not to include the employee salary amounts of those directors who work both as an employee and a director) with the aim of imparting shares with restriction on transfer at the General Meeting.

The overview of the Share Remuneration System is as follows.

(1) Allocation of and payment for shares with restriction on transfer

Based on the resolution of the Yamaha Motor Co., Ltd. Board of Directors, Yamaha Motor Co., Ltd. is to pay the Applicable Directors share options worth up to annual amounts as listed above as remuneration relating to shares with restriction on transfer. The various Applicable Directors are to be paid with property contributed in kind for all of the share options concerned, and are to receive issue or disposal of ordinary shares in Yamaha Motor Co., Ltd.

The specific payment timing and distribution to each Applicable Director shall be determined by the Board of Directors after discussion and reporting by the Executive Personnel Committee.

The payment amount per share is to be determined by the Yamaha Motor Co., Ltd. Board of Directors based on the closing price of ordinary shares in Yamaha Motor Co., Ltd. on the first section of the Tokyo Stock Exchange the business day before each Board of Directors resolution (if no transactions are made on that day, the closing price on the most recent trading date) etc., within a scope which is not a particularly advantageous price for the Applicable Directors receiving the shares with restriction on transfer concerned.

(2)Total number of shares with restriction on transfer

The total number of ordinary shares which Yamaha Motor Co., Ltd. may newly issue or dispose of with regard to the Applicable Directors under the Share Remuneration System is to be up to 200,000 shares per year. However, when adjustment of the total number of shares with restriction on transfer allocated is necessary based on in the case of division, share merger, or similar of ordinary shares in Yamaha Motor Co., Ltd. (including gratis allocation of ordinary shares in Yamaha Motor Co., Ltd.) with an effective date after the date of resolution at the General Meeting, the total number concerned is to be adjusted within a reasonable scope as necessary based on the ratio of division or merger etc.

(3)Conclusion and content of contracts regarding shares with restriction on transfer allocation

With regard to the issue or disposal of ordinary shares in Yamaha Motor Co., Ltd. under the Share Remuneration System, a contract for the allocation of shares with restriction on transfer (hereafter "the Allocation Contract") is to be concluded between Yamaha Motor Co., Ltd. and the Applicable Director scheduled to receive payment by remuneration of shares with restriction on transfer. The Allocation Contracts are to include the following.

i. Period of restriction on transfer

With regard to ordinary shares in Yamaha Motor Co., Ltd. received by Applicable Directors via allocation under the Allocation Contracts (hereafter "the Allocated Shares"), transfer, establishment of security interests, or other disposal (hereafter "the Restrictions on Transfer") are to not be permitted for a period of 30 years (hereafter "the Period of Restriction on Transfer") from the date of receiving allocation under the Allocation Contracts.

ii. Cancellation of restriction on transfer

On the condition that Applicable Directors continue to be Directors, Audit & Supervisory Board Members, Executives, Executive Officers, Fellows, or hold status of other similar employees of Yamaha Motor Co., Ltd. during the Period of Restriction on Transfer, Yamaha Motor Co., Ltd. is to cancel the Restrictions on Transfer of all of the Allocated Shares at the point when the Period of Restriction on Transfer expires.

However, if an Applicable Director retires from or relinquishes whatever their position as set forth above even during the Period of Restriction on Transfer due to the expiration of term, reaching mandatory retirement age, death, or other legitimate reason, the number of the Allocated Shares for which the Restrictions on Transfer are to be canceled and the timing thereof are to be reasonably adjusted as necessary.

iii. Gratis acquisition of shares with restriction on transfer

In the case that an Applicable Director retires from or relinquishes whatever their position as Director, Audit & Supervisory Board Member, Executive, Executive Officer, Fellow, or status as other similar employee of Yamaha Motor Co., Ltd. before the expiration of the Period of Restriction on Transfer, and excluding cases of the expiration of term, reaching mandatory retirement age, death, or other legitimate reason, Yamaha Motor Co., Ltd. is to naturally acquire for gratis all of the Allocated Shares. The same is to apply to the Allocated Shares for which restriction on transfer has not been canceled based on the provisions listed in ii. above at the point when the Period of Restriction on Transfer expires.

In addition, if the Board of Directors of Yamaha Motor Co., Ltd. deems that an Applicable Director has violated laws and ordinances, Yamaha Motor Co., Ltd. internal regulations, or important points of the Allocation Contract during the Period of Restriction on Transfer, Yamaha Motor Co., Ltd. is to acquire for gratis all of the Allocated Shares held by the Applicable Director concerned.

iv. Handling in the event of organizational restructuring

If, during the Period of Restriction on Transfer, a merger contract in which Yamaha Motor Co., Ltd. is the defunct company, a share exchange contract in which Yamaha Motor Co., Ltd. becomes a wholly-owned subsidiary, a share transfer plan, or other item relating to organizational restructuring etc. is approved by a General Meeting of Shareholders of Yamaha Motor Co., Ltd., (however, when approval of a General Meeting of Shareholders of Yamaha Motor Co., Ltd. is not required regarding the organizational restructuring etc. concerned, [approval of] the Board of Directors of Yamaha Motor Co., Ltd. [shall apply]), the Restrictions on Transfer are to be canceled by a resolution of the Board of Directors of Yamaha Motor Co., Ltd. in advance of the effective date of the organizational restructuring etc. concerned for a reasonably-specified number of the Allocated Shares, bearing in mind the period from the date of commencement of the Period of Restriction on Transfer until the date of approval of the organizational restructuring etc. concerned. In addition, Yamaha Motor Co., Ltd. is to naturally acquire for gratis the Allocated Shares for which restrictions on transfer were not canceled at the point directly after restrictions on transfer were canceled pertaining to the provisions above.

v. Other provisions

Other provisions regarding the Allocation Contract are to be determined by the Board of Directors of Yamaha Motor Co., Ltd.

Reference

On the condition that the above set of resolutions relating to revision of the directors' remuneration system are approved and passed at the General Meeting, Yamaha Motor Co., Ltd. plans to, similarly to the above, allocate shares with restriction on transfer to Executive Officers and Fellows who do not also work as Yamaha Motor Co., Ltd. directors.

Reference: New Yamaha Motor Co., Ltd. Executive Remuneration System

A resolution was passed at the Yamaha Motor Co., Ltd. Board of Directors meeting held on February 12, 2019 to, on the condition that approval is received from shareholders at the General Meeting, implement a new remuneration system for Yamaha Motor Co., Ltd. Directors and Executive Officers (hereafter "Executives"). The overview of the remuneration system is as follows.

Basic Direction

- ・

- Aiming to be a "Kando* Creating Company," Yamaha Motor Co., Ltd. strives to encourage employees to perform their duties in accordance with the Company's Management Principles and Behavioral Guidelines.

- ・

- Yamaha Motor Co., Ltd. has positioned achieving the corporate targets in the Medium-Term Management Plan etc. as strong motivators in working toward realizing the Company's long-term vision.

- ・

- In order to function as sound incentives toward Yamaha Motor Co., Ltd.'s sustainable growth, the proportions of remuneration linked to short-term results and performance of duties etc. (performance-based remuneration) and remuneration linked to medium- to long-term results and corporate value (share remuneration) will be set appropriately.

- ・

- The remuneration is to be at a level which can attract and retain the highly-capable human resources appropriate to the roles and responsibilities to be carried out by Executives of Yamaha Motor Co., Ltd.

*Kando is a Japanese word for the simultaneous feelings of deep satisfaction and intense excitement that we experience when we encounter something of exceptional value.

Remuneration Structure

Remuneration is to be comprised of base remuneration (fixed remuneration), performance-based remuneration, and share remuneration. The proportions of base remuneration: performance-based remuneration: share remuneration for the President and Representative Director is to be set at roughly 50%:30%:20% of the reference amount. For other Executives, the amounts are to be determined bearing in mind their duties and remuneration level etc., with reference to the President and Representative Director.

Performance-based remuneration

- ・

- The Representative Director is to only be paid the whole-company performance-based bonus component of the performance-based remuneration. The performance-based remuneration packages of other Directors and Executive Officers are to be comprised of a whole-company performance-based bonus and an individual performance-based bonus. The ratio of whole-company performance-based bonus: individual performance-based bonus is to be set at around 2:1 of the reference amount for Directors excluding the Representative Director, and around 1:3 of the reference amount for Executive Officers who do not also work as Directors. The individual performance-based bonus is to be comprised of the "financial evaluation-based portion" and the "non-financial evaluation-based portion," with the ratio to be set at 1:1 of the reference amount.

- ・

- The whole-company performance-based bonus will be drawn from a total amount obtained by multiplying a certain proportion of "net income attributed to owners of parents" by evaluation coefficients based on the consolidated total assets operating income ratio (ROA), and distributed to each Executive based on coefficients etc. determined for each position. The evaluation coefficients are to be adjusted after discussion by the Executive Personnel Committee based on the achievement of consolidated net sales and operating income targets, overall degree of progress regarding initiatives in the Medium-Term Management Plan etc. toward realizing the long-term vision, and occurrence of other matters affecting corporate value and brand value.

- ・

- The financial evaluation-based portion component of the individual performance-based bonus will be determined within the scope of 0-2 times the reference amount specified for each position, bearing in mind the extent of target achievement and results compared with the previous fiscal year etc. for financial evaluation indicators set in advance (net sales, operating income, ROA etc. for the responsible division).

- ・

- The non-financial evaluation-based portion component of the individual performance-based bonus will be determined within the scope of 0-2 times the reference amount specified for each position, bearing in mind the degree of progress etc. for non-financial evaluation indicators set in advance (initiatives in the Medium-Term Management Plan etc., development of successor Executives and company management candidates, etc.).

Share remuneration

- ・

- Share remuneration will be provided through issuing shares with restriction on transfer once each year based on the reference amount specified for each position.

Process for determining remuneration

- ・

- In order to ensure the appropriateness as well as the transparency and feasibility of the discussion process regarding items relating to executive remuneration, determination will be made by the Board of Directors after discussion and reporting by the Executive Personnel Committee, which Yamaha Motor Co., Ltd. has established voluntarily and which is composed of a majority of outside directors.

*As the role of outside directors and Audit & Supervisory Board Members is to provide supervision and advice regarding management from an objective and independent perspective, they are only paid fixed base remuneration. The specific amount of base remuneration paid to Audit & Supervisory Board Members is determined through discussion with the Audit & Supervisory Board Members within the total framework amount approved at a General Meeting of Shareholders.