|

Yamaha Motor Co., Ltd. announced its new medium-term management plan, encompassing management issues, business strategies and numerical targets for the three-year period from 2008 through 2010. |

|

The company will focus on increasing profits, achieving further growth throughout the Yamaha Motor Group and enhancing its brand value by investing 300 billion yen in growth investment in mostly in Asia and Latin America, as well as in new model development, cost reduction, production systems and the Life Science business, while strengthening management quality and leveraging the achievements of the previous medium-term management plan. Yamaha Motor aims to achieve 2.1 trillion yen in net sales and 143 billion yen in operating income on a consolidated basis in the fiscal year ending December 2010, with an operating income margin of 6.8% and an ordinary income of 150 billion yen. |

|

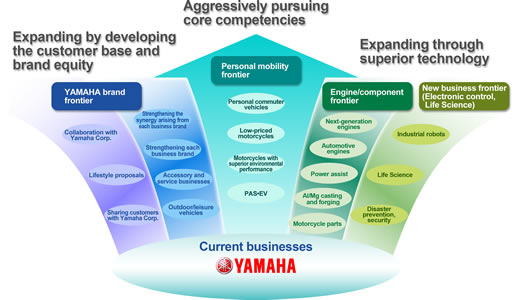

In "Frontier 2020", Yamaha Motor will seek to transform the quality of its growth by the year 2020, evolving into a larger, more unique enterprise, achieving sustainable, high growth and vitalizing its corporate culture. The long-term vision will be based on the "Four Frontiers", focus areas including the "Personal Mobility Frontier", "Yamaha Brand Frontier", "Engine Component Frontier" and "New Business Frontier" that capitalize on the assets, characteristics and competitive advantages of the Yamaha Motor Group, outlining the direction of the company's progress and expansion. |

|

|

|

Review of the Previous Medium-term Management Plan, "NEXT 50-Phase II" |

|

|

The previous medium-term management plan-NEXT50-Phase II-ran from 2005 through 2007. During the period, Yamaha Motor implemented a business strategy designed to balance value, profitability and growth, building on the profitable structure it had developed under the predecessor plan, Next50-Phase I. In its implementation of the NEXT50-Phase II plan, the company aimed to position Yamaha Motor in the mind of customers as the "Only One" brand (Your Only One). |

|

The company achieved concrete results in several specific priority areas spelled out in the NEXT50-Phase II plan. It maximized growth opportunities and secured profits in the ASEAN and Brazilian motorcycle businesses, while creating value that differentiates Yamaha Motor, using strategies such as marketing side-by-side vehicles and launching the Life Science business. Quantitative evaluation indicates solid performance: the company recorded 1,756.7 billion yen in net sales and 127 billion yen in operating income, exceeding the NEXT50-Phase II targets of 1.45 trillion yen and 120 billion yen, respectively.

On the other hand, outstanding issues remain, such as improving profitability in Japan, the North America and Europe, and restructuring the motorcycle business in India. |

|

|

|

Outline of the New Medium-term Management Plan |

|

|

|

Goals |

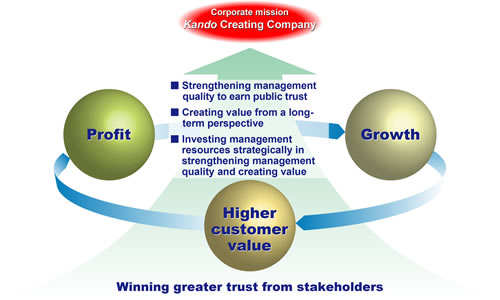

As it implements the new plan, Yamaha Motor will focus on increasing profits, achieving further growth, and creating higher customer value.

To this end, the company is determined to strengthen its management quality and to enhance value from a long-term perspective.

This, in turn, requires investing management resources strategically, another of the company's priorities moving forward.

Ultimately, the company's efforts represent a commitment to realizing its corporate mission ? becoming a Kando*-creating company. |

|

|

* |

Kando is a Japanese word for the simultaneous feelings of deep satisfaction and intense excitement that people experience when they encounter something of exceptional value. |

|

|

|

|

|

Outline of Medium-term Business Strategies |

|

|

1. Motorcycle Business |

Worldwide motorcycle demand is expected to expand 12%, from 46.6 million units in 2007 to 52.3 million units in 2010. ASEAN countries and India will be the major growth engines, with Latin America also forecast to grow substantially. In this environment, Yamaha Motor will work aggressively to maximize growth opportunities in the expanding ASEAN and Latin American markets. Meanwhile, it will continue promoting high-value-added marketing to improve profitability in Japan, the North America and Europe, while enhancing its business foundation in China and India toward establishing a stronger Yamaha presence in these markets. With regard to restructuring the Indian business -- a top management priority -- the company will invest 7 billion rupees (approximately 20 billion yen), toward achieving sales of 650,000 units with break-even profitability. In the ASEAN region, the company will continue proactively introducing new motorcycle models and implementing promotions as in the previous medium term, seeking to increase unit sales in the region's five main nations by approximately 50%, from 2,880,000 units in 2007 to 4,340,000 units in 2010. To this end, the company will expand the production capacity in these nations to 4,700,000 units by establishing a 3-million unit production system in Indonesia and opening a new plant in Vietnam. In Latin America, the company will raise production capacity in Brazil to 600,000, while launching a new assembly plant in Argentina this year.

Overall, the company plans to raise unit sales by 56% from 2007, to 7,780,000 in 2010. |

|

2. Marine Business |

In the mainstay outboard motor business, Yamaha Motor intends to achieve higher profitability by expanding sales worldwide. Specifically, in the North America and Europe, it will further enhance collaboration with boat builders, while extending the product lineup for medium- and large-size models. In developing countries, the company plans to maintain its dominant market position by aggressively introducing four-stroke models. On the manufacturing front, it will move to optimize production by launching the Fukuroi plant in May.

In the personal watercraft segment, the company intends to increase both sales and profit by expanding the product lineup and strengthening the business in sport boats featuring jet pump propulsion systems.

The boat business in Japan is expected to break even in terms of profitability. The company plans to move the segment into the black by enhancing the lineup of large boat models and achieving profitability in the "software" aspect of the business, such as boat licensing and operating the rental boat club "Sea-Style". |

|

3. ATV (all-terrain vehicle) + SSV (side-by-side vehicle) Business |

Yamaha Motor aims to improve profitability in mature ATV markets, while growing the business in the new SSV market segment.

In the ATV segment, the company will focus on maintaining the top position in the sports category. At the same time, the company will strive to increase market share in the utility category.

With regard to SSVs, first introduced in 2003 to develop new demand, the company will increase its model variations, thus differentiating Yamaha Motor from latecomer brands and demonstrating its superiority in the SSV segment to customers. |

|

4. IM (intelligent machinery) Business |

Yamaha Motor aims to improve profitability and expand sales by strengthening product competitiveness.

Specifically, it plans to hone the competitive edge of its products and develop new demand by introducing compact, high-speed modular mounters, and by bringing electric motor-driven feeders to market, and incorporating it in a new product series. Also, it will strengthen the solutions business by expanding the lineup of peripheral products such as printers and testers.

In the "software" aspect of the business, the company will enhance sales and service by establishing sales offices and technical centers worldwide, and stationing staff in major overseas markets.

With these efforts, the company aims to achieve sales of 55 billion yen by 2010. |

|

|

|

Numerical Targets for the New Plan |

|

|

Assuming an exchange rate of 105 yen against the U.S. dollar and 155 yen against the euro, numerical targets for consolidated financial performance in the fiscal year ending December 2010 -- the last of the new medium-term management plan -- are as follows: |

|

Net sales: |

2,100 billion yen (up 19.5% from 2007) |

Operating income: |

143 billion yen (up 12.6% from 2007) |

Operating income margin: |

6.8% |

Ordinary income: |

150 billion yen (up 6.9 from 2007) |

|

|

|

|

Capital Expenditures |

|

|

During the new three-year medium term, Yamaha Motor will make investments of 300 billion yen (an increase of 55 billion yen over the previous medium term) toward realizing its twin objectives of further growth and value creation. In particular, the company intends to focus on growth investment, allotting 109 billion yen -- a 50% increase from the previous medium term -- for the purpose, mostly to expand the motorcycle business in Asia and Latin America.

In terms of improving profitability, the company plans to invest in new model development centering in the North America and Europe, and in cost reduction activities. On the value creation front, it plans investments in the production system for magnesium and other new-material parts, while also investing to expand the Life Science business. |

|

|

|

Payout Ratio |

|

|

In the new plan, Yamaha Motor commits to a payout ratio of at least 20% and aims for approximately 25%, in balance with growth investments. |

|

|

|

Outline of the Long-term Vision "Frontier 2020" |

|

|

|

Goals |

Yamaha Motor has formulated its new long-term vision, "Frontier 2020", based on a thorough review of the assets, characteristics and competitive advantages the Yamaha Motor Group has accumulated through its long experience, as well as the external environment facing the group. The vision suggests a direction for the company's management and business progress toward the year 2020.

In realizing this long-term vision, the company aims to transform the quality of its growth, and to evolve into a larger, more unique enterprise, comprised of multiple core businesses with diverse types of value. In addition to qualitative improvement, it seeks to maintain a high level of growth in quantitative terms, while vitalizing its corporate culture in support of this expansion.

The company will aggressively pursue personal mobility domains, including motorcycles, as these represent its core competencies, and the main direction among its diverse types of value. At the same time, the company intends to expand in other domains by maximizing its customer-oriented approach and branding strategy, and to launch new businesses created by its technological and engineering capabilities. |

|

|

|

|

|

Four Frontiers |

|

|

In its long-term vision, Yamaha Motor has defined the "Four Frontiers" for business expansion, and the direction the company will take in respect to each. |

|

1. Personal Mobility Frontier |

The company will offer optimal mobility solutions from a broader perspective that includes not only its products but also the overall transportation system as well as lifestyle-oriented approaches.

Specifically, this frontier encompasses domains including motorcycles with superior environmental performance, low-priced motorcycles and new concept personal commuter vehicles, in addition to such personal mobility mainstays as PAS electro-hybrid bicycles and electric vehicles. |

|

2. Yamaha Brand Frontier |

In this area, the company offers valuable intangibles -- the so-called "software" aspect of the business -- to customers who enjoy Yamaha Motor products worldwide, thus further enhancing brand value. These include peripheral services and recreational solutions for Yamaha users. |

|

3. Engine Component Frontier |

Based on the expertise it has gained through personal mobility development and manufacturing engineering, the company seeks to grow its business by developing engine components into a core competency.

Specifically, this includes commercializing power sources such as power assist systems, automotive engines, and next-generation engines, in addition to motorcycle components and aluminum and magnesium parts. |

|

4. New Business Frontier |

Here the company seeks to build on its element technologies to achieve further expansion in new applications.

In concrete terms, the company will apply such element technologies as electronic control-acquired in the development of industrial robots and industrial unmanned helicopters-and biotechnology, derived from the Life Science business, to different domains in creating new businesses. |

|

By meeting the developmental challenges presented by each of these "Four Frontiers", Yamaha Motor will transform the quality of its growth, evolving into both a larger and more unique enterprise. |

|

|

|