The Yamaha Motor Group launched its new Medium-Term Management Plan in January 2016. Building on the recovery in level of performance and earnings power achieved under the previous Medium-Term Management Plan, the new Medium-Term Management Plan charts a course for new growth with the aim of being a unique company that continues to achieve dynamic milestones and lives up to our “Revs your Heart” slogan.

Hiroyuki Yanagi

President, Chief Executive Officer and Representative Director,

Yamaha Motor Co., Ltd.

In the following interview, the President addresses these key issues:

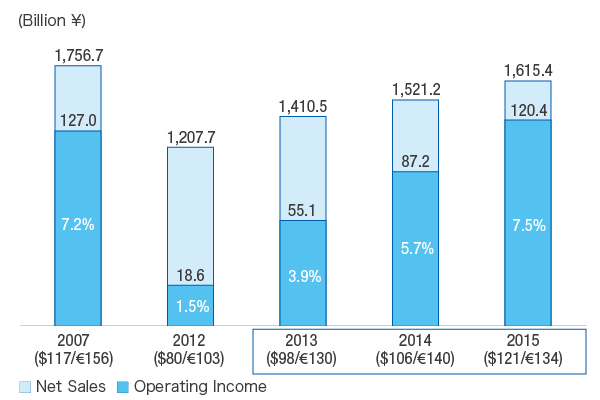

The previous MTP (2013?2015) set management targets of \1,600.0 billion in net sales with operating income of \80.0 billion (for an operating income ratio of 5%). Working toward these targets, we strengthened Yamaha’s product competitiveness, incorporated changes to our Monozukuri,* carried out structural reforms, implemented growth strategies to reinforce our profit structure and achieved cost reductions.

As a result of these efforts, in the fiscal year ended December 31, 2015, the final year under the plan, we achieved net sales of \1,615.4 billion with operating income of \120.4 billion, marking the third consecutive year of revenue and profit growth. Although production volume for key products declined by roughly 600,000 units over the three-year period, sales rose on solid results in developed markets and the introduction of higher-priced models in emerging markets. In addition, the market share grew for our motorcycle business in markets except the Association of Southeast Asian Nations (ASEAN) region and our recreational off-highway vehicles (ROVs) business, and the market share of large outboard motors increased for our marine products business. The 5% operating income ratio target was achieved one year early, in 2014, and rose to 7.5% in 2015. Our financial position remained stable, with return on equity (ROE) at 12.6% (16.7% excluding the effect of the APA**), a shareholders’ equity ratio of 37.6% (a 2.5 percentage-point improvement from the previous fiscal year-end), net income per share of \171.88 (\232.59 excluding the effect of the APA**), and market capitalization over \1 trillion.

In terms of both level of performance and earnings power, we are returning to the levels of 2007 when the Group recorded record high profit. Going forward, we will pursue the next round of management reforms with the aim of further dynamic growth.

*An approach to engineering, manufacturing and marketing products that emphasizes craftsmanship and excellence

**Advance Pricing Agreement ? prior approval related to taxation on transfer pricing

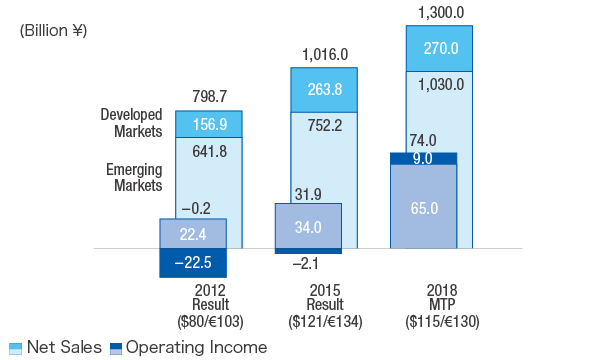

During the three years under the previous MTP, developed markets remained solid but there was a sense of weakening in emerging markets, and by successfully recalibrating the relative positions of the developing and emerging market businesses, results recovered to the levels recorded prior to the 2008 global financial crisis, and we were able to build a stable financial foundation to support continuous growth.

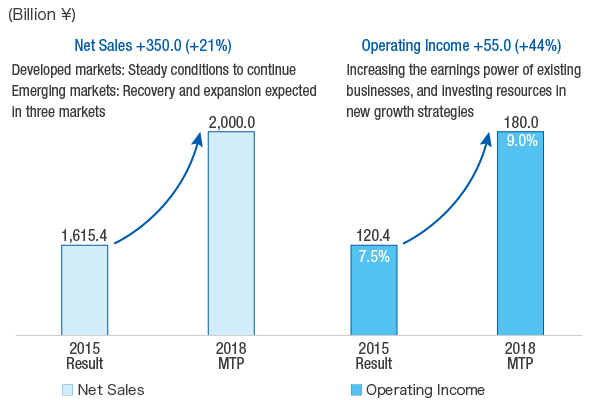

For the next three years under the new MTP (2016-2018), we expect economic conditions to remain solid in developed markets and to recover in some emerging markets. Based on these assumptions, we are positioning 2018, the final year of the new MTP, as the year for having laid the groundwork for new growth to realize the next milestone, with net sales of \2 trillion and \180.0 billion in operating income (for a 10% operating income ratio).

To achieve this, over the next three years we will work to enhance the earnings power of existing businesses even further, by maintaining the strength of the motorcycle, marine products, and recreational vehicles (RVs) businesses in developed markets, and increasing earnings in emerging markets with a focus on Indonesia, India, and Vietnam. While continuing to reduce costs and implement structural reforms to maintain and strengthen our stable financial foundation, we will use the stable earnings generated by existing businesses to invest in new growth strategies.

While further strengthening earnings power, using a stable financial foundation as a foothold for proactive investment in resources for new growth strategies.

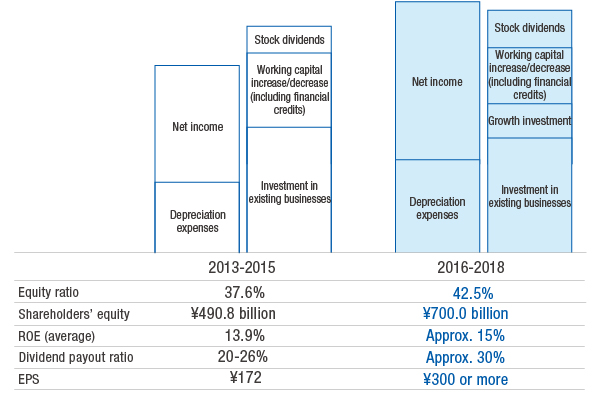

The fundamental financial strategy of the new MTP is to enhance the earnings power of existing businesses, and use this stable financial foundation as a source of new investments for growth and increased returns to shareholders. The plan sets financial targets for 2018 of a shareholders’ equity ratio of 42.5%, an average ROE of 15% over the three-year period, a dividend payout ratio of 30%, and earnings per share (EPS) of at least \300. It also stresses management’s awareness of marginal profit, investment efficiency, and business efficiency.

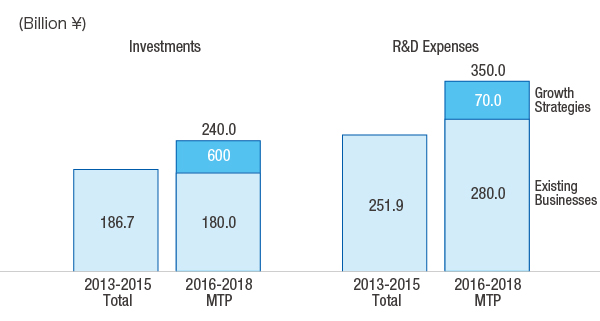

To realize these growth strategies, the new MTP is to keep investment in existing businesses at the same level as the previous plan, and calls for proactive investment in strategies for new growth totaling \130.0 billion.

Capital expenditure in existing businesses is to be held to \180.0 billion, the same level as under the previous plan, with an additional \60.0 billion for investment in new growth strategies bringing the total to \240.0 billion. The plan for R&D expenses is for a total of \350.0 billion, broken down as \280.0 billion for existing businesses and \70.0 billion for new growth strategies, to bring about strategic growth that will lead to the next milestone.

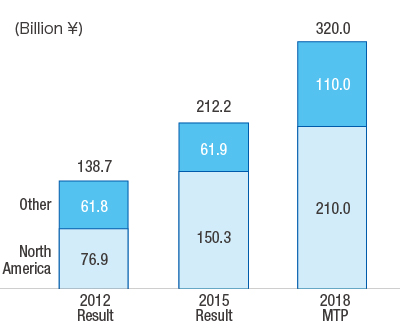

The Yamaha Motor Group has sales finance companies in the United States and Canada, and we have begun full-fledged finance operations to support existing businesses. We are strengthening our operational foundation focusing on North America, and intend to grow the business to have a receivables balance of \300.0 billion.

I believe the most important issues for increasing the earnings power of existing businesses are to strengthen our product competitiveness by using the unique style of Yamaha Monozukuri while raising the quality of products and work, and increasing brand power and earnings power. Under the previous plan, we released 250 new models during the three years to 2015. For the new plan, we intend to bring 270 models to market. Yamaha’s emphasis on Monozukuri, which consists of the five key themes GEN, Play & Sure, S-EX-Y, and Ties, enables us to deliver new products that embody the unique style of Yamaha to markets around the world.

The Yamaha Motor Group is a global company with overseas sales accounting for roughly 90% of both total sales volume and production volume for key products. In terms of globalizing development, our target is to have 35% of development in the motorcycle business, including vehicle bodies and engines, carried out locally in three years. For the power products business, our goal is for 70% local development for recreational vehicle (RV) bodies, and we aim to raise the share of local development of hulls for watercraft (WV) and sports boats (SB) to 80% in the marine products business.

We will also transfer management functions overseas and are implementing training programs to cultivate local leaders, as well as promoting diversity in human resources management by hiring and appointing non-Japanese staff and women to management positions.

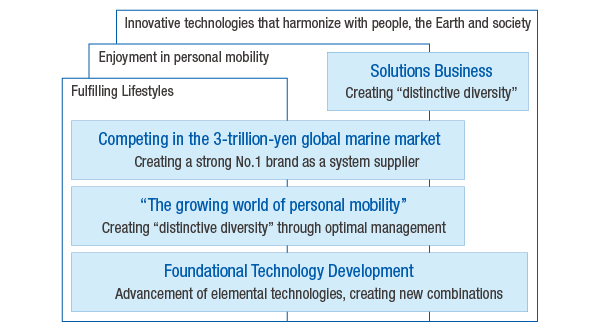

The new MTP designates the following four strategic themes for growth that will guide our efforts for the foreseeable future in the three business areas of “fulfilling lifestyles,” “enjoyment in personal mobility,” and “innovative technologies that harmonize with people, the Earth and society.”

Yamaha Motor has expanded the world of personal mobility, from the development of PAS electrically power-assisted bicycles in 1993 to the release of the industry’s first electric motorcycle in 2002 and the creation of the commuter vehicle (CV) market in 2004, as well as the development of unique motorcycles. Under the new MTP, we will pursue the growing world of personal mobility by continuing the development of products in the “third-vehicle category” which incorporate our leaning multi-wheel (LMW) technology used in the TRICITY line announced in 2014, to fully achieve a pure sports ROV. As part of this pursuit, we will also adapt motorcycle technologies to compact four-wheeled vehicles (C4W) to expand their application.

The marine products business will move from being an engine supplier that provides highly reliable, lightweight, fuel-efficient engines to establishing a solid No. 1 brand as a system supplier that approaches all areas of marine life, providing comprehensive marine life value to everyone who comes into contact with Yamaha Motor.

The intelligent machinery (IM) business will expand the scope of its operations to include the general industrial and general lifestyle segments, and the unmanned systems (UMS) business will widen the use of industrial-use unmanned helicopters beyond agriculture to include monitoring and infrastructure applications. We will also attempt to use our technologies in new segments as we work to develop Yamaha's “distinctive diversity.”

Along with further refining Yamaha’s proprietary engine and smart power technologies, we will work to develop new foundational technologies in areas including robotics, intelligent capabilities, and information technology, as we pursue innovation through the advancement of elemental technologies and through new combinations.

The motorcycle business will pursue highly efficient business management to achieve its final-year, 2018 target of net sales of \1,300.0 billion with operating income of \74.0 billion. This will involve highly efficient product development and cost reductions with an emphasis on high management efficiency and product competitiveness regardless of unit volume to create a business that increases earnings power to secure stable earnings.

Under the new MTP, we will make maximum use of platform models to consolidate the number of engines and bodies while expanding the model lineup to meet diversifying customer needs with unique new products delivered promptly, quickly, and with freshness.

By pursuing cost reductions in procurement, manufacturing, and logistics, we aim to reduce costs by a total of \60.0 billion, equivalent to 5% of material purchase costs. We will work to reduce costs of platform models and consolidate the global supplier network to 350 suppliers from the current 650. We also aim to reduce logistics costs by applying the concept of Yamaha’s unique theoretical-value-based production to logistics.

We will develop a sales and marketing network that puts us even closer to customers. In terms of sales, we will divide the network in Europe into three blocks according to customer needs ? Feel, Move, and Race ? and position stores in line with these needs. To capture market growth, we will collaborate with Yamaha Music Foundation and provide venues where our products can be enjoyed.

Implementing growth strategies tailored to each business, we are on our way toward becoming a unique company that continues to achieve dynamic milestones.

We will look closely at market trends to determine the markets in which we will pursue sales volume and those in which we will give priority to stable earnings, to deliver distinctive new products that optimally incorporate Yamaha’s distinctive originality, technology, and design in each key region.

We are positioning ASEAN, India, Brazil/China, and developed markets, which account for the majority of our sales, as key regions.

We will step up the introduction of platform models in the three ASEAN countries in which we operate. In particular, under the new MTP, we expect to recover market share and improve earnings in the Indonesian market, and we will roll out highly detailed area marketing to increase sales volume. Specifically, we will further strengthen the sports category and increase product marketability through platform variations, and engage in marketing that strengthens our contact points with customers.

We are targeting high growth in the Indian market, and aim to increase volume scale by expanding the product lineup focusing on the mass-market segment. Specifically, we will launch strategic models for emerging markets, and work to strengthen our contact points with customers by building up our sales network both quantitatively and qualitatively, focusing on rural regions.

Demand is declining in these markets, and given various factors of uncertainty including exchange rates, the economy, and the political situation, we will manage the businesses to lower the break-even point to secure stable profits.

We will proactively launch distinctive new products that convey Yamaha’s strong brand power and pursue further structural reforms to maintain a stable profit structure.

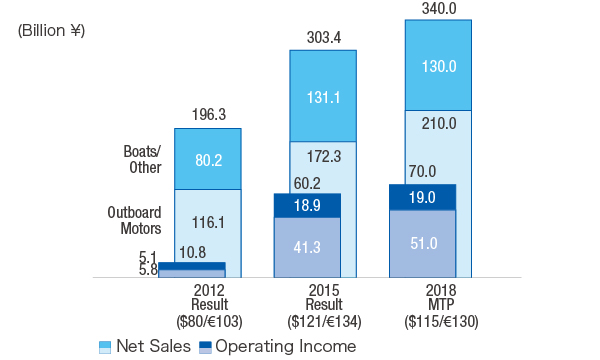

The Yamaha Motor Group boasts strong brand power in markets around the world based on its overall business strength, reliability, and network strength. The marine products business has grown to generate net sales of \300.0 billion with a 20% operating income ratio in 2015. In particular, as the North American market shifts toward larger models, Yamaha’s F200 outboard motor, with superior product technology, has gained the overwhelming support of purchasers for its reliability.

The new MTP targets a business model for further growth beyond being an engine supplier, enhancing its potential to become a system supplier that offers a broad range of value in addition to engines, including hulls and peripheral equipment. Our aim is to establish a solid position as the No. 1 global brand that satisfies professionals, that upper- and mid-tier customers cannot live without, and that first-time customers regularly come back to.

Achieving this requires us to enhance our three strengths: our overall business strength derived from a wide range of business fields and our product lineup; our reliability as a business partner in addition to the reliability of our products and systems; and our global network through which we conduct sales and provide services that are closely tailored to each market.

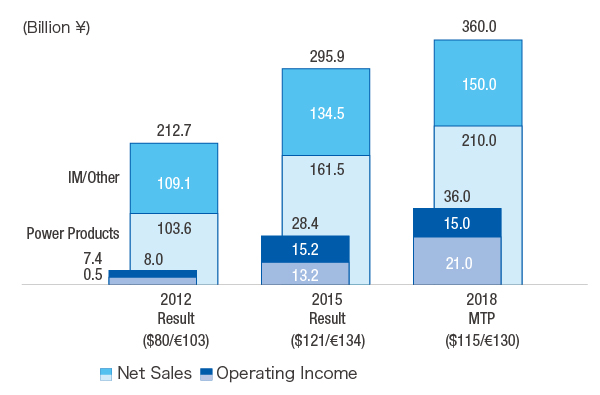

The main goal of the power products and other businesses is to create a unique business model. By developing this unique model, we will strive for further growth beyond the businesses’ current total net sales of \350.0 billion and 10% operating income ratio.

The power products business has positioned RVs as the third core business after motorcycles and marine products, and is accelerating the development of products that thoroughly increase differentiation and added value, with a 2018 target of net sales of \200.0 billion and a 10% operating income ratio.

The market for the RV business’s core product, recreational off-highway vehicles (ROVs), is growing, reflecting people’s high preference for leisure and a shift from all-terrain vehicles (ATVs) in North America. Under the new MTP, the business will incorporate Yamaha’s expertise as a motorcycle manufacturer to develop products that only we can. While the sports category will be the main product area, we will also emphasize product differentiation in the category of recreation to increase our market share in both categories, with the aim of being the No. 1 brand in the sports category. We will work to increase our presence in the North American market by increasing our share there from the current 7% to 12% by 2018.

The IM business is creating a high-profitability business model targeting net sales of \60.0 billion with a 20% operating income ratio. This will involve the use of Yamaha’s strength in timely management that integrates development, manufacturing, and sales, making maximum use of the absorption of Hitachi High-Technologies’ business division and its extensive customer base, and the expansion of sales channels to the automotive, home appliances and LED, mobile, and electronics manufacturing services (EMS) fields.

The industrial unmanned helicopter business is creating a business model for net sales of \10.0 billion, and pursuing global growth. Along with developing product technologies for business growth, we are working to reposition the business beyond the agricultural segment to become a solutions business that also encompasses monitoring and infrastructure. With the launch of a crop dusting business in the United States, we are also developing a global market.

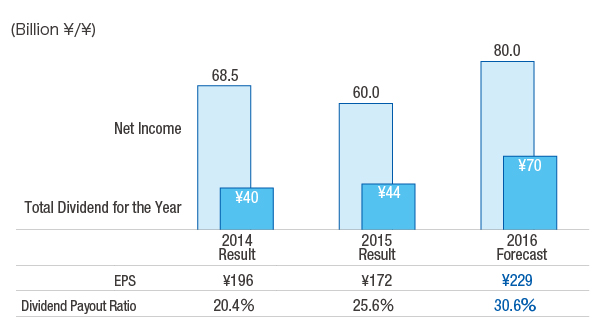

The new MTP uses a dividend payout ratio of 30% for returns to shareholders.

Under the previous MTP, we maintained an (average) ROE of 13.9%, achieved net income per share of \172 (\233 excluding the effect of the APA**), and maintained the dividend payout ratio at the 20-26% level. In terms of returns to shareholders, in 2015 we paid a total dividend for the year (including the interim dividend) of \44 per share. Based on the steady earnings we are forecasting for all businesses in 2016, this year we intend to pay a total dividend for the year of \70 per share.

The Yamaha Motor Group’s spirit of challenge means that we have belief in our potential and set high goals, and put all of our effort into achieving those goals, with activities like our participation in MotoGP and the YAMAHA JUBILO RUGBY FOOTBALL CLUB providing excitement to people around the world. Having wholeheartedly applied this spirit under the previous MTP, we are returning to the Group’s former level of performance and earnings power.

To ensure that this growth takes hold, the new MTP calls for each and every Group employee to embrace a spirit of challenge to make the Yamaha Motor Group a unique company that achieves dynamic milestones. In the spirit of our “Revs your Heart” brand slogan, I hope to share exceptional value and experiences that enrich the lives of all stakeholders.

I ask for your continued support.