In the following interview, the President addresses these key issues:

In 2014, global economic conditions remained uncertain, although signs of a rally were visible in developed markets, as stagnation endured in emerging markets.

In the United States, improvements in the employment situation and personal income levels continued to support a gradual revival. In contrast, Europe’s recovery stumbled, as Greece’s debt crisis reignited and currency instability persisted in Russia. In Japan, consumer spending fell, despite further yen depreciation and persistently high share prices, as a consequence of a hike in the country’s consumption tax. Overall conditions in emerging markets reflected a lull in growth in the Association of Southeast Asian Nations (ASEAN) region, China and South America, although India’s economy remained on the road to recovery.

In this environment, we promoted a variety of efforts in line with our MTP, formulated to guide our efforts from 2013 through 2015, with a focus on such considerations as greater product competitiveness, changes to Monozukuri*, structural reforms and growth strategies. All business segments reported increases in net sales and operating income in fiscal 2014, the second year of the plan, as we achieved our operating income target for 2015?¥80.0 billion?a year ahead of schedule.

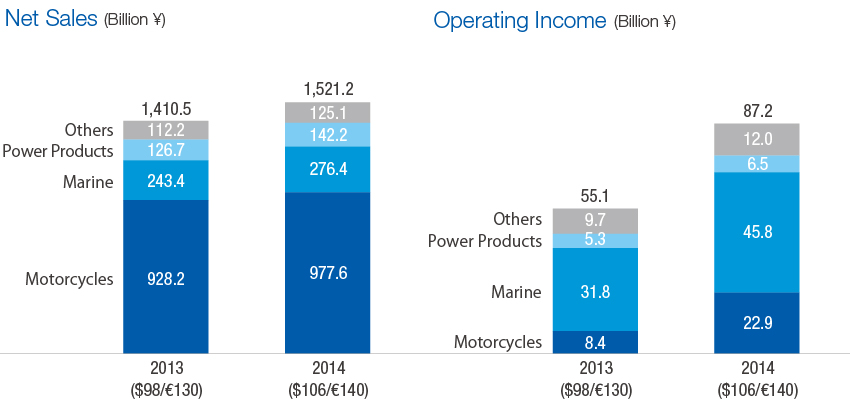

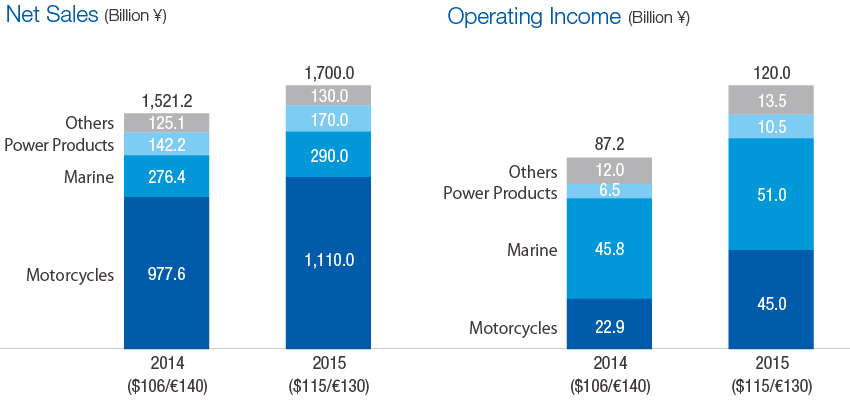

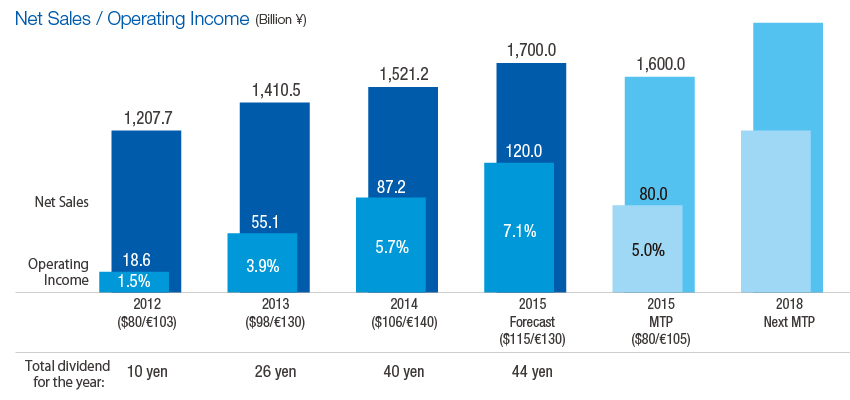

Net sales in 2014 rose 7.9%, or ¥110.7 billion, to ¥1,521.2 billion, bolstered by the expansion of our product lineup, increased sales of high-priced products and the declining value of the yen against the currencies of other developed markets. In addition to higher sales, the positive impact of yen depreciation surpassed the negative impact of elevated research and development (R&D) expenses, among others, in developed markets. In emerging markets, the favorable influence of cost reductions exceeded the detrimental influence of increases in procurement costs, among others, attributable to weak local currencies. Operating income climbed 58.2%, or ¥32.1 billion, to ¥87.2 billion, and ordinary income soared 61.9%, or ¥37.2 billion, to ¥97.3 billion. Net income, at ¥68.5 billion, was up 55.4%, or ¥24.4 billion.

As of December 31, 2014, our net debt-to-equity (D/E) ratio improved to 0.6 times, from 0.7 times at the same point a year earlier. The shareholders’ equity ratio was also stable, slipping 1.6 percentage points to 35.1% from the end of 2013.

* An approach to engineering, manufacturing and marketing products that emphasizes craftsmanship and excellence

Details of Net Sales and Operating Income by Business (FY2014)

Achieve increases in sales and income in all business segments.

One target of our current MTP is to launch 250 new products incorporating creativity, technologies and design excellence that embody the unique style of Yamaha in markets around the world. Our progress rate as of the end of 2014 was 63.0%, and we are confident that we will meet this target in 2015.

Customer reception of these new products has been favorable, enabling us to enhance our presence in crucial markets.

With efforts to develop products using a new approach that centers on engine, frame, functional component and exterior component platforms progressing, we began to bring new platform products to market. We also began to launch products planned and developed with the goal of expanding our focus beyond the ASEAN region to the global market.

Concurrently, we took steps to create a business foundation that will balance product appeal and cost considerations, as well as to trim purchasing costs through platform development and production and logistics costs through theoretical-value-based production.

We entered the final stage of an ongoing initiative intended to realign our domestic production configuration from 12 factories and 25 units at the end of 2009 to six factories and 13 units at the end of 2015. We also proceeded with efforts to restructure our operations in Europe from the current “One Company” format, under which organizational and operational functions are integrated into independent companies, to a “One Entity” format, wherein all functions are combined into a single entity.

We continued to implement strategies directed at securing future growth. These included establishing new companies and preparing for the construction of plants with the aim of expanding our motorcycle business into Pakistan and Nigeria, augmenting our financing business in North America and developing new businesses.

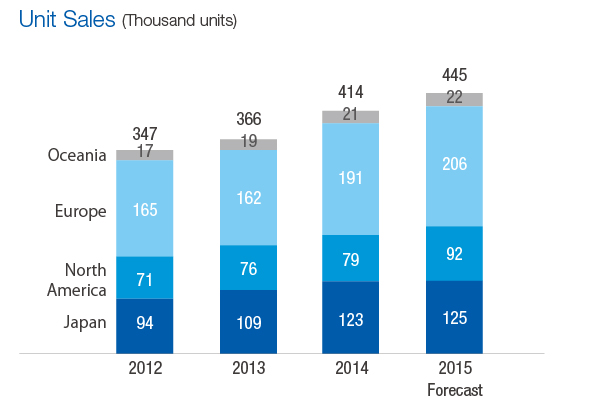

In 2014, total demand for motorcycles in developed markets bottomed out after having fallen steadily since the global financial crisis. Against this backdrop, our shipments of motorcycles in developed markets rose 13.0%, to 414,000 units.

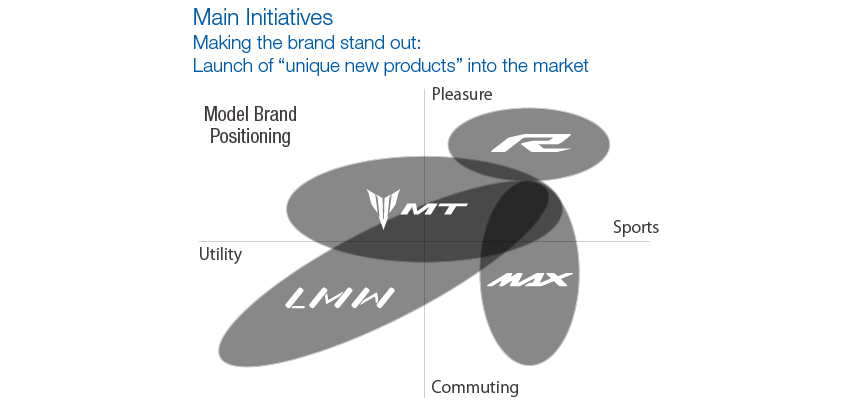

In the MT series, which has created a market segment unique to Yamaha, the MT-07 and MT-09 continued to garner rave reviews from customers worldwide. We also launched the next generation of our flagship R1 superbike, a vehicle that overwhelms with outstanding performance features, cutting-edge technologies and a stunning new design. Our exceptional MAX series of sports commuters, which includes the TMAX, XMAX and SMAX models, also continued to earn high marks in key markets.

With total demand expected to recover further in 2015, we forecast an increase in shipments in developed markets to 445,000 units. We will press ahead with efforts to launch unique new models with the aim of making the Yamaha brand even more attractive. We will also proceed with decisive structural reforms intended to restore the profitability of our motorcycle business in developed markets.

Motorcycle Business: Developed Markets

We will work to balance product appeal and cost considerations, while at the same time expanding our motorcycle lineup and introducing unique models with the goal of making the Yamaha brand even more attractive.

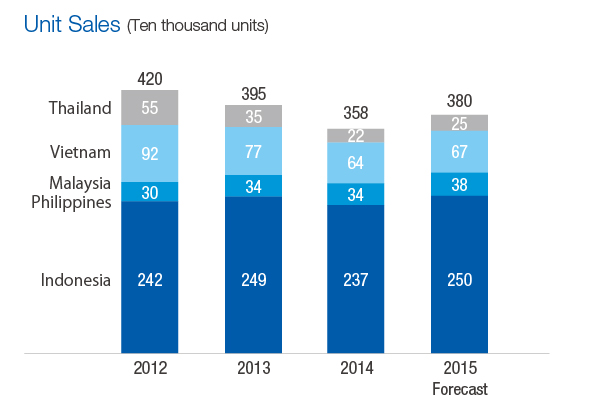

Flagging economic conditions led to a 3.0% dip in total demand in the ASEAN region in fiscal 2014. For this reason, and because the first half of the year was devoted to preparations for new product launches, our shipments for the year declined 9.0%. Beginning in summer, we launched the Nozza Grande, Grand Filano and Mio 125 ASEAN-region commuter bikes, the first models based on the BLUE CORE next-generation engine platform, all three of which are mounted with 125cc air-cooled engines. The BLUE CORE engine, which delivers both fuel efficiency and riding enjoyment, facilitates a 50% reduction in fuel consumption compared with 2008 scooter engines, leading the industry.

In 2015, we will release the NMAX, an ASEAN-region sports commuter featuring a 155cc liquid-cooled BLUE CORE engine, in global markets. We will also take steps to increase brand power and achieve a recovery in regional sales and profitability levels.

Motorcycle Business: ASEAN Market

Total demand in India rose 12.0% in 2014. Thanks to the introduction of new models and the expansion of our sales network, our shipments were up 23.0%. Domestic sales and exports together totaled 740,000 units. In the high-growth scooter category, we introduced the CYGNUS α, while in the brand-driving sports category we launched the FZS F1.

In Chennai, in the south of India, we pressed ahead with construction of a new factory complex that will combine parts manufacturing, assembly and R&D facilities, as well as a “vendor park” housing production facilities of main external parts suppliers, in a single location. We also proceeded with construction of a new sales base. Both the new complex and the sales base are scheduled to begin operating in early 2015. Having thus established a new production configuration in India, we will promote efforts in 2015 to broaden our local product lineup and further reduce costs. We will also conduct promotional activities aimed at building strong relationships with local customers and capturing demand in provincial markets.

Motorcycle Business: Indian Market

To enhance our presence, we will introduce products that provide new value, as well as promote efforts to cultivate new market segments and expand our customer base.

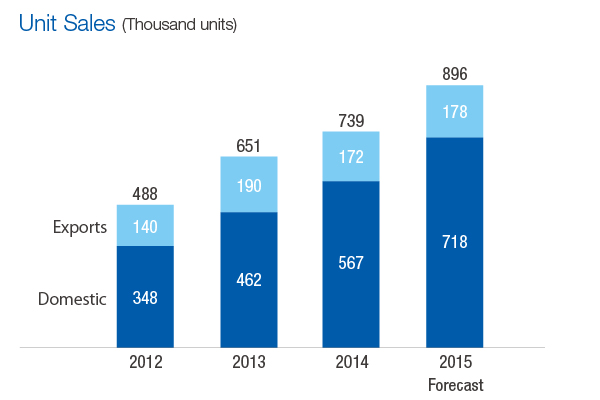

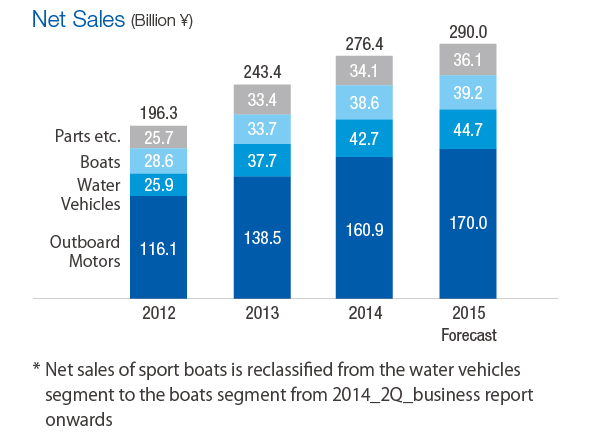

Excellent overall business capabilities, reliability and network have enabled us to build exceptional brand power in this area. In 2014, we reported a significant increase in sales of large marine engines in North America, bolstered by a recovery in total demand in the markets for marine engines for lake, river and ocean craft and a steady shift in the focus of our product portfolio from inboard to outboard motors.

Key new product launches included the large F175 and the medium-sized F115 engines; the F4, F5 and F6 small engines, which are manufactured in Thailand; and the FX and FZS high output marine engines, featuring the Reverse with intuitive Deceleration Electronics (RiDE) system, which employs an innovative dual throttle technology.

In 2015, we will endeavor to further expand our customer base by providing new value. Through these and other efforts, we will continue to create a business model capable of sustaining annual net sales of ¥300.0 billion and an operating income margin of around 20.0%.

Marine Products Business

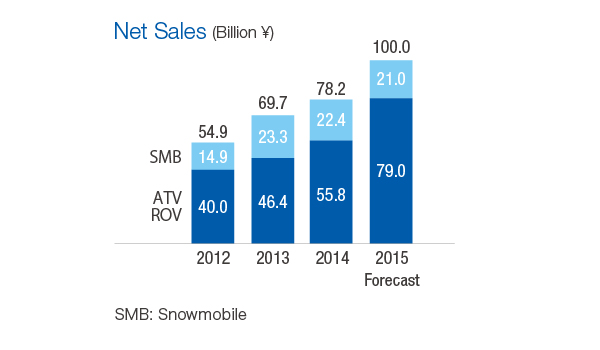

We strengthened our lineup of recreational off-highway vehicles (ROVs) in fiscal 2014 with new launches including the six-person VIKING VI and the SR Viper snowmobile.

In 2015, we will further expand our ROV lineup by introducing new products in the sports category, including an eagerly awaited two-person edition of the Wolverine. In snowmobiles, we will promote a strategy aimed at building our share in North American markets. We will also work to restore the ability of our recreational vehicles business to attain annual net sales in the area of ¥100.0 billion and contribute to overall growth and profitability.

A recovery in capital investment and the introduction of new medium- and high-speed surface units supported increased sales of surface mounters in China and other Asian markets, as well as in Europe. We also formulated a strategy to steer our full-scale entry into the market for high-speed mounters and concluded an agreement for the transfer of certain related assets previously owned by the Hitachi High-Tech Group. Having established a new development, production and sales configuration, in 2015 we will promote efforts to attract customers and cultivate new markets.

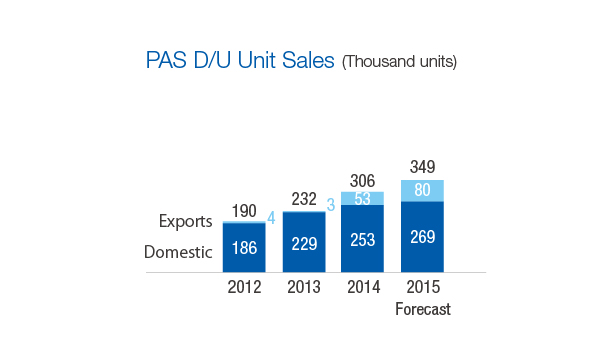

Sales rose in the domestic market in 2014, bolstered by the launch of new models of electrically power assisted bicycles (E-bikes) equipped with the PAS triple sensor. Despite concerns regarding the impact of Japan’s April 2014 consumption tax hike, sales remained favorable throughout the year. We also commenced full-scale exports of the E-kit E-bike system kit to Europe.

In 2015, we will introduce new PAS models mounted with our new GREEN CORE next-generation smart power drive unit. We will also expand our smart power business in Japan by launching the new E-VINO electric scooter, which offers both superb performance and low cost.

RV Business

IM Business

SPV Business

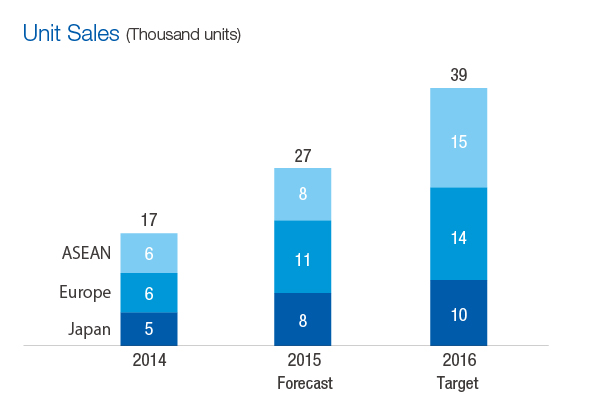

We have identified the creation of a “growing world of personal mobility” as a key strategic focus that will direct our efforts to expand the application of two-wheel vehicle technologies to three- and four-wheeled vehicles and to broaden our customer base. One emphasis of this was the development of a “third-vehicle category” that incorporates our Leaning Multi-Wheel (LMW) technology.

We launched our first such vehicle, the TRICITY, in Japan, Europe and the ASEAN region. Thanks to solid support from target customers in developed markets, sales of the TRICITY for the year exceeded our original forecast by 21.0%.

Recently, we announced the 01GEN, a new multi-wheel crossover concept model that represents a new direction in multi-wheeled vehicle design. Inspired by our “refined dynamism” design philosophy, the 01GEN is the first model that embodies our GEN design concept and the new value it promises customers.

Introduction of “LMW?the Third-Vehicle Category” to the Market

We will maximize the results of initiatives undertaken under our current MTP and make preparations for the start of our next plan.

In 2015, we will maximize the results of initiatives undertaken under our current MTP and make preparations for the start of our next plan, which will guide our efforts from 2016 through 2018.

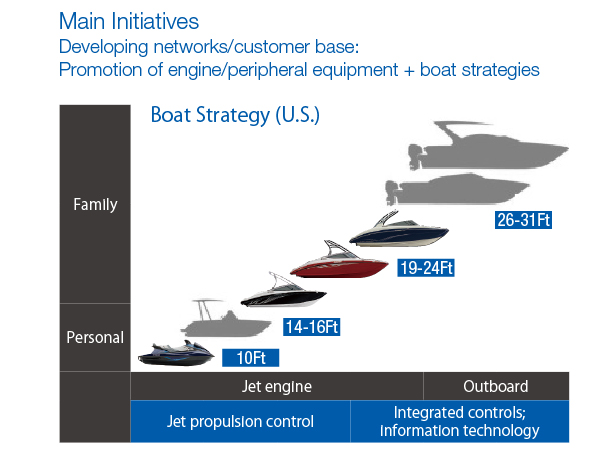

Committed to once again realizing increases in net sales and operating income in all business segments, we have set clear objectives for each in the year ahead. In the motorcycle business, we will aim for net sales in excess of ¥1,000.0 billion and an operating income margin in the area of 5% by pressing ahead with efforts to restore profitability in developed markets and to achieve a recovery in regional sales and profitability levels in emerging markets, thereby transforming this business into one capable of stable net sales and operating income. In the marine products business, we will endeavor to create a business model capable of sustaining annual net sales of ¥300.0 billion and an operating income margin of around 20% by promoting a growth strategy centered on expanding key components of this business, namely, a combination of hull/engine strategy and peripheral equipment. In the power products business, we will expand our selection of ROVs and other products with the goal of achieving net sales of ¥170.0 billion and shifting from stable to high profitability.

Details of Net Sales and Operating Income by Business (FY2015 Forecast)

Continue to achieve increases in sales and income in all business segments.

Having recognized enhancing the distribution of profits to stakeholders as one of management’s highest priorities, we work continuously to maintain a sound financial position by weighing the need for investments in future growth against the need to maintain stable profits and returns to shareholders. Accordingly, we view return on equity (ROE) and return on assets (ROA) as key performance indicators.

At present, we forecast total shareholders’ equity in excess of ¥500.0 billion, net income per share of more than ¥200.00 and ROE in the area of 15% in 2015.

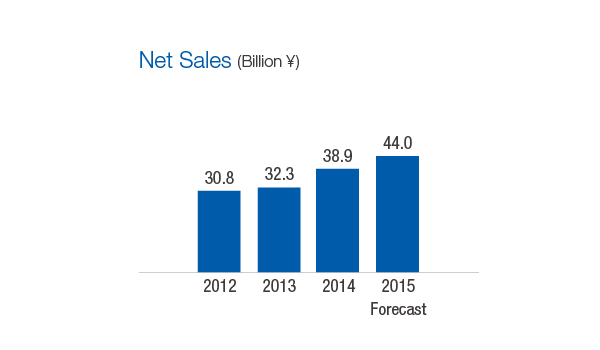

We will determine dividends after giving comprehensive consideration to the business environment, including our performance, retained earnings, and the need to balance forward-looking growth investments with returns to shareholders and loan repayments, while maintaining a minimum dividend payout ratio of 20% of consolidated net income. In 2014, our annual dividend?which included an interim dividend?was ¥40.00 per share. Based on our operating results forecasts for sales and income in 2015, we currently anticipate paying an annual dividend of ¥44.00 per share in 2015.

Management Objectives/Dividends

Achieve results under the current MTP and step up to the next MTP:

Total dividend for the year: (2014) 40 yen, (2015) 44 yen forecast

We have set forth three growth objectives that will guide our efforts for the foreseeable future: “fulfilling lifestyles,” “enjoyment in personal mobility,” and “innovative technologies that harmonize with people, society and the Earth.”

Under these objectives, we have set forth four key strategies. The first is to “create a growing world of personal mobility,” in line with which we are expanding the application of two-wheel vehicle technologies to three- and four-wheeled vehicles. The second is to “compete in the ¥3 trillion global marine market.” In particular, we are endeavoring to expand the scope of our businesses through a combination of hull/engine strategy and peripheral equipment. Our third objective is to “commit to unique versatility.” To this end, we will work to create new business models and expand our customer base. Fourth, we will “advance innovation,” that is, the development of new fundamental technologies, in such areas as robotics, Humax and engines.

In terms of strategic direction, our next MTP will focus on guiding our evolution as a unique company that continues to achieve dynamic milestones while at the same time taking corporate value to the next level. The plan also articulates three priority tasks: “implement our growth strategies,” “pursue the unique style of Yamaha through Monozukuri (and break out of our current norms),” and “implement further fundamental reforms to increase management resource efficiency.”

Announced in 2013, our global brand message, “Revs your Heart,” has been disseminated across the Yamaha Group and is firmly established as a concept among employees worldwide. This slogan represents our strong desire to create exceptional value and experiences that enrich the lives of our customers and everyone involved with Yamaha, and surpass their expectations. To transform this desire into reality, we will work tirelessly to communicate, consider and challenge our perceptions of the unique style of Yamaha in all aspects of our operations, including planning, development, production and sales.

As we press ahead with efforts to evolve as a unique company that continues to achieve dynamic milestones, we pledge to continue providing products and services that enable you, our stakeholders, to truly feel the spirit of “Revs your Heart.” In these and all our endeavors, I look forward to your ongoing support.