In the following interview, the President addresses these key issues:

- Business results for fiscal 2013, the first year under

the MTP - Initiatives the motorcycle business is pursuing in

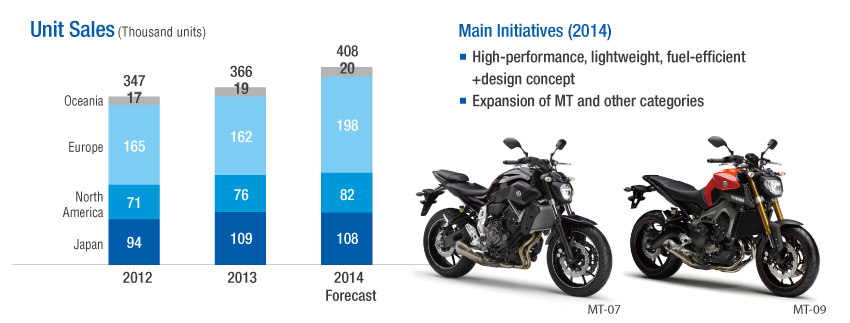

developed markets - Initiatives the motorcycle business is pursuing in

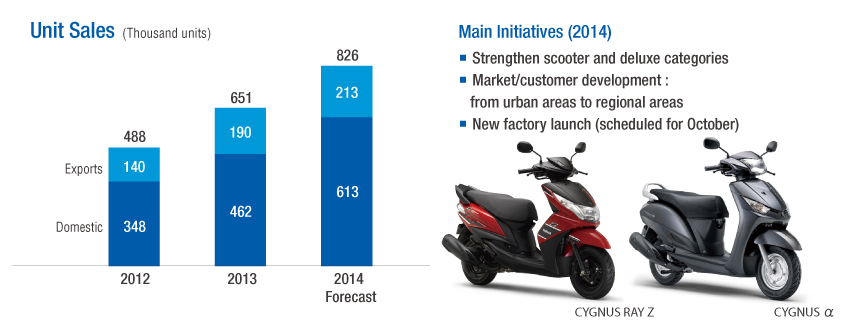

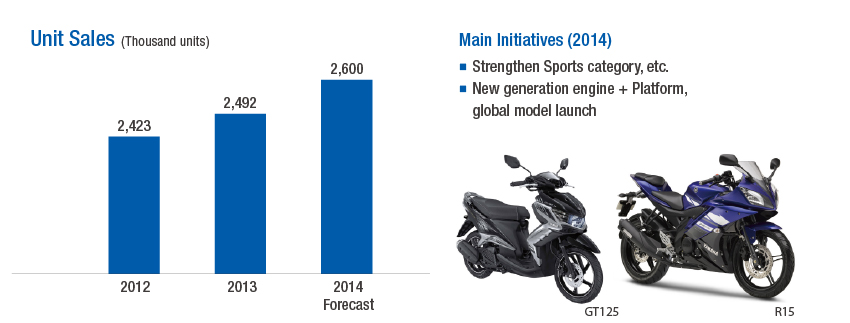

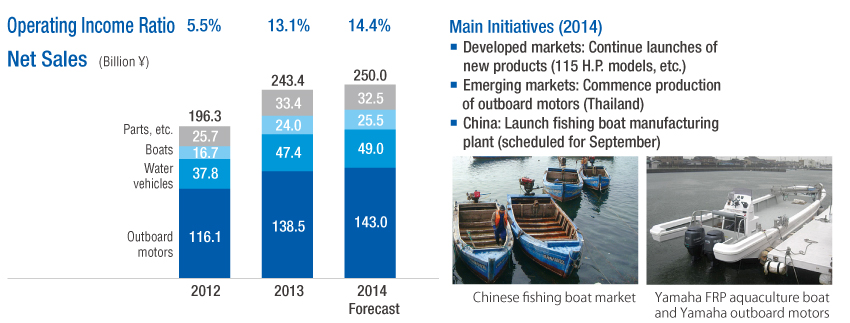

emerging markets - Initiatives being pursued in the marine products

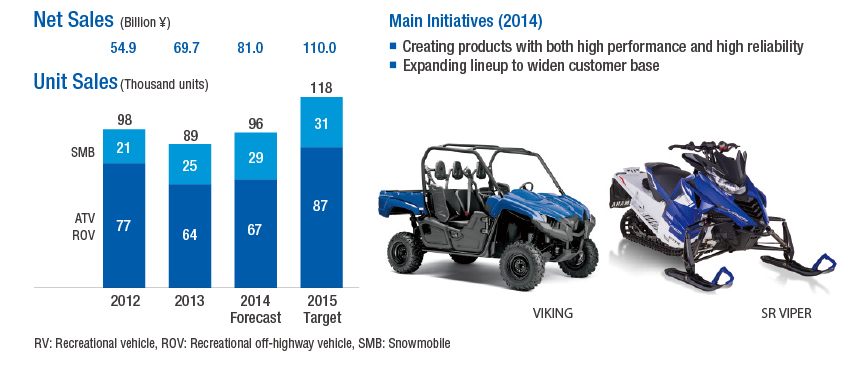

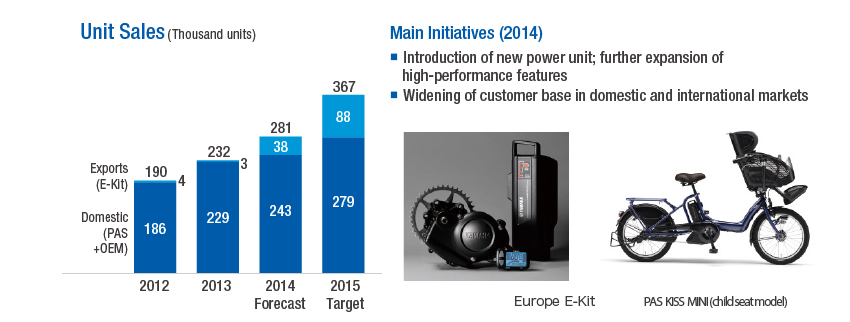

business - Activities in other businesses

- Progress in the area of management reforms

during 2013 - Yamaha Motor’s long-term strategy

- Management targets for fiscal 2014, relative to the

achievement of the MTP - Returns to shareholders

- Message for stakeholders

Please give us an overview of Yamaha Motor’s business results for fiscal 2013,

the first year under the Medium-Term Management Plan.

We achieved sales growth in all businesses.

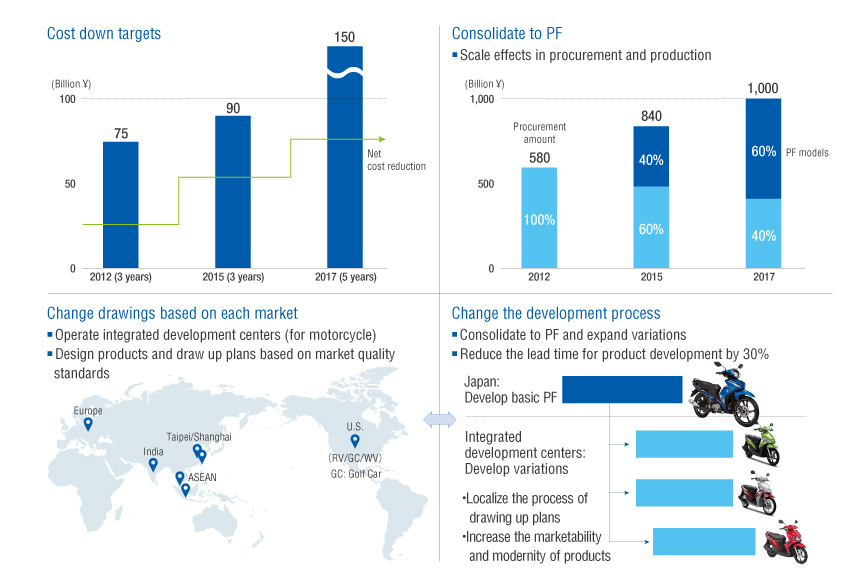

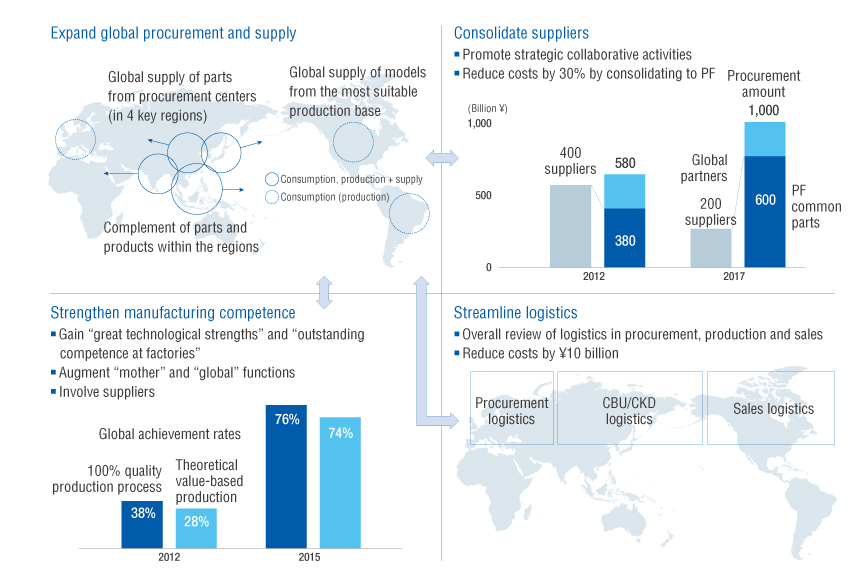

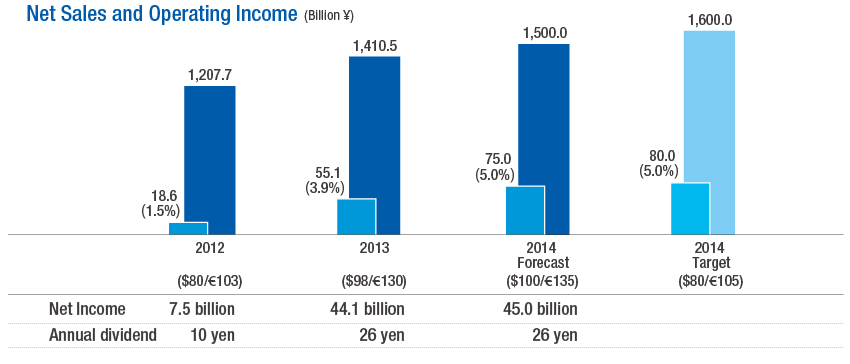

Looking at the global economy in 2013, the United States posted a significant recovery and there were major expectations for a recovery in Japan as well. However, European economies remained sluggish and growth appeared to stall in emerging markets in Asia and Central and South America. Against this backdrop, the Yamaha Motor Group made a comprehensive effort to achieve sustainable growth in terms of business scale, financial strength, and corporate strength as outlined in the Medium-Term Management Plan (MTP), which sets fiscal 2015 Group targets of \1,600.0 billion in net sales and \80.0 billion in operating income (for an operating income margin of 5%).

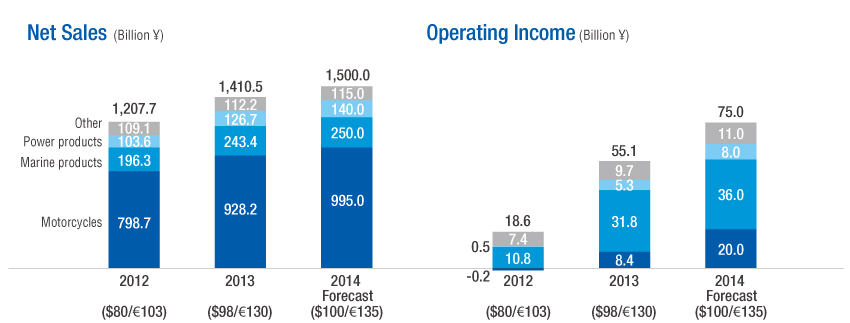

In fiscal 2013, the Group recorded a 16.8% increase in net sales, to \1,410.5 billion. Net sales rose in all business segments, on increased unit sales of motorcycles in Indonesia and India and outboard motors in North America, coupled with the impact of yen depreciation.

Operating income totaled \55.1 billion, a \36.5 billion increase from fiscal 2012. This reflected improved earnings in the marine products business and cost reductions in the motorcycle business in emerging markets, as well as yen depreciation. Ordinary income and net income rose significantly, with a \32.8 billion increase in ordinary income, to \60.1 billion, and a \36.6 billion increase in net income, to \44.1 billion, which included the additional recording of deferred tax assets at overseas subsidiaries.

Our financial position remained stable, with a net debt-equity (D/E) ratio of 0.7 times, unchanged from the end of the previous year, and a 1.5 percentage point improvement in the shareholders’ equity ratio, to 33.5%.

Sales and Operating Income by Business Segment

2013: Operating income: motorcycles bottoming out, large improvements in marine products

2014: Increases in sales and income for all business segments