President Hidaka

Question and

Answer Session

on the Current

Progress

Regarding the

Long-Term Vision

On December 22, 2023, President Hidaka gave an interview to journalists in Japan.

The following are the questions and answers regarding the current progress

of the long-term vision.

* President Hidaka’s remarks were as of the time of the interview on December 22, 2023.

The year 2024 is the final year of the current Medium-Term Management Plan. How well do you expect to achieve your goals? And as president, what will you focus on as you develop the next Medium-Term Management Plan?

We set a guideline of 2.2 trillion yen in sales with 9% in ROS※1 for the current Medium-Term Management Plan, which was already achieved last year. We have published this year’s performance forecast at 2.5 trillion yen in sales, with 250 billion yen or 10% in ROS, which is slightly above the targets. Nevertheless, our goal in the plan is to build a corporate structure that can inherently achieve a certain level of profitability, investment efficiency, ROE※2 and ROA※3. We announced the target of ROE in the 15% range and ROIC※4 of 9% or higher. We achieved these targets last year and expect to exceed them again this year. We want to do even better next year, so I would say that we are likely to achieve the Medium-Term targets.

We will spend the coming year developing the next Medium-Term Management Plan. In the six years since I took this position as president, we have invested quite aggressively in new businesses, as well as in eBikes and robotics as the next pillars of our business growth. However, when I look at this year’s sales of 2.5 trillion yen, more than 80% comes from motorcycles and marine products. So, I keep an eye on how competitive our core businesses are at this point. And as we add electric models to our motorcycle product lineup, I ask myself, “How competitive are they?” I have been telling my teams and colleagues that we should take a fresh look at these products with an open mind and that I want to increase their competitiveness. I want this to be our main theme for the next Mid-Term Plan.

We have made growth investments with an eye to the next core business in 2030 and for the next 50 years. This is not to say we will abandon these new business areas. Still, I see ourselves taking a hard look at our core business and further enhancing its competitiveness during the next medium term.

※1 ROS(Return on Sales)

※2 ROE (Return on Equity)

※3 ROA (Return on Assets)

※4 ROIC (Return On Invested Capital)

Please tell us about your efforts to achieve carbon neutrality and measures for electrification.

First and foremost, we must achieve carbon neutrality. One way to achieve this is through electrification. We are developing EV models in the commuter category as a means of daily transportation. In the area of large-displacement models, our development efforts expand to the aspect of fuels, such as hydrogen combustion. Similarly in outboards, electric models like HARMO are used for rivers, inland lakes, and other bodies of water close to land where only low propulsion power is required. On the other hand, we develop fuel cells for models requiring to go out to and return from the open sea. Our uniqueness lies in a wide range of technological developments. If we take engine sizes alone, the smallest is a 125-cc scooter engine, and the largest is a 5,559-cc V8 outboard. Small motors can maintain a balance between power and range when turning electric. But for larger motors, we must go beyond the current battery technology, considering the overall load capacity of the batteries and the way customers use the products. With this in mind, Yamaha develops a wide range of products, including fuel cells. This approach is distinctly Yamaha.

What are Yamaha Motor’s unique initiatives? What measures, if any, is Yamaha taking toward electrification, and what do you see happening in the future?

It is not that we make batteries with novel technologies. Our strength is our know-how. We do not make our own fuel cells. Rather, we are “borrowing” Toyota’s technology and trying something new with fuel cells. We do not make our own fuels, but we can use any fuel, thanks to our long experience in combustion technologies. Whatever the driving force of motors and products, we have decades of know-how. I believe that our accumulated knowledge becomes effective in creating the final product, including the vehicle body.

This month, Yamaha started a new European company called “ENYRING GmbH.” It’s a subscription solution provider for eBike batteries in Germany. In a nutshell, we want to build a “Gachaco”※5 for eBikes. The Japan Automobile Manufacturers Association (JAMA) first created a Japanese standard for interchangeable batteries. The aim is to make it easier to subscribe to a battery-swapping service, facilitate subsequent reuse and recycling of batteries, and consequently accelerate the electrification of scooters. Following this, ENEOS and four motorcycle companies joined forces to create Gachaco. We need a similar solution for eBikes.

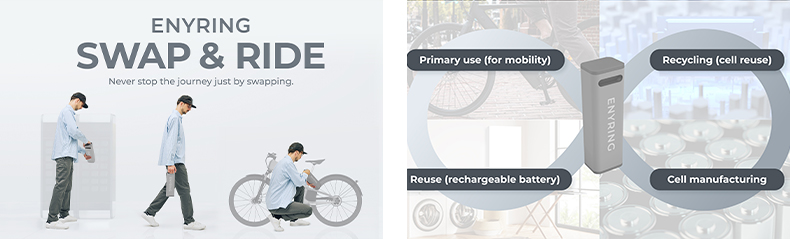

(left) Image of ENYRING’s subscription service for swappable batteries for compact electric vehicles

(right) Image of the closed loop that ENYRING aims for

(above) Image of ENYRING’s subscription service for swappable batteries for compact electric vehicles

(below) Image of the closed loop that ENYRING aims for

With the market for eBikes already at over 5 million units per year in Europe and 800,000 to 900,000 units in Japan, the question of what to do with the batteries is bound to arise. In Europe, the battery recycling law will take effect in the future. We are now exporting “e-Kit” to Europe, and the annual number of units exported may exceed 500,000. When I think about this, I can’t help but wonder what will eventually happen to these batteries. After all, our customers who buy the end products are supposed to collect used batteries and send them for recycling. Now, there are so many bicycle manufacturers in Europe, from large to small, and small companies cannot recycle batteries on their own. However, the number of companies selling the “e-Kit” is much smaller and limited to Bosch, Yamaha, Shimano, and a few other companies.

This prompted us to think that Yamaha should consider battery recycling. So, we talked with several cities in Germany and the Netherlands, as well as with local governments familiar with eBike rental and subscription services. We have met with companies that reuse batteries for home use and shared a vision for the direction of battery reuse. We went even further and had dialogues with European companies that recycle lithium-ion batteries. If someone has to do it, why shouldn’t it be Yamaha Motor? It should be Yamaha Motor because we have been selling a certain number of batteries in Europe. That’s how we decided to take the first step and set up a company in Berlin, Germany, to do just that.

※5 Gachaco Inc. was established by five companies (ENEOS Holdings, Inc., Honda Motor Co., Ltd., Kawasaki Motors, Ltd., Suzuki Motor Corporation, and Yamaha Motor Co., Ltd.) to provide the standardized eBike battery sharing service and develop its infrastructure.

Your robotics business will start the operation of a new plant next year. How do you plan to turn things around in this area?

The robotics market has been rather stagnant this year, and the business has remained at a low level. So, I am hoping that the market will return in the second half of next year. Of course, this is only one man’s wish. The Robotics Division forecasts that the market will return in the second half of next year, so I am very hopeful. The new factory will double our supply capacity. After the new factory starts operations in early 2024, we will first increase and stabilize the capacity utilization rate and productivity, preparing for a recovery in demand during the second half of the year.

At the same time, we plan to acquire a semiconductor back-end processes company. In the past, customers bought the machines they needed and assembled them into a full semiconductor production line. There are also system integrators that propose and provide the entire production line, including back-end processes. By acquiring the company, we want Yamaha to become an equipment manufacturer that can also serve as a system integrator. We are now working on establishing a sales framework by preparing new offerings. Let me give you a more specific picture. We can use our factory automation (FA) products, such as SCARA and Cartesian coordinate robots, to connect between equipment from the back-end process to the mounter. So, we can provide customers with a complete production line by integrating, for example, a feeder to the mounter using our robotic products. I would like customers to trust us with complete production solutions. This will increase our strength.